Will volatility smooth out as the 2016 cattle market comes into focus?

2016 is shaping up to be a very different year compared with 2014 or 2015.

February 11, 2016

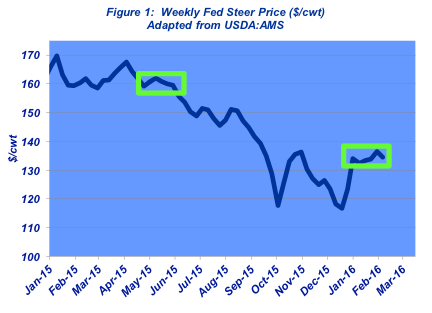

The cash market finally provided some reprieve from the week-to-week volatility (with a lot more down than up) that’s been the norm in recent months. The cash market for fed cattle ended December at $134 per cwt – and averaged about the same during the following four weeks of January. Meanwhile, follow-through as February opened business kept the market mostly at steady money.

It’s been seven months since the market has experienced that type of consistency across multiple weeks. Last spring’s market (mid-April through May) provided a good run of stability; there was a seven-week stretch with steady prices around $160. It was following that period that the market began to turn negative (Figure 1).

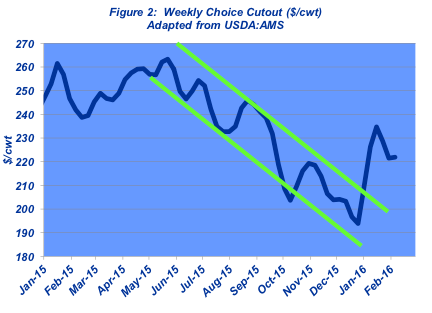

Meanwhile, the same can’t be said about the wholesale beef market. The Choice cutout bottomed at Christmas at $194 per cwt. That’s a price level that represents a slide of approximately $70 per cwt from last May’s peak of $265 just prior to Memorial Day – roughly $600 per head. Following the Christmas low, the cutout surged higher to $235. However, the wholesale market has since tried to find its way while regressing back into the low $220s.

Nevertheless, from a broader perspective, the downward channel in the wholesale market explains much of the decline in the fed market since May (Figure 2). More importantly, until the beef side establishes a consistent trend, the fed market and Live Cattle futures will likely continue to possess potential for extra noise.

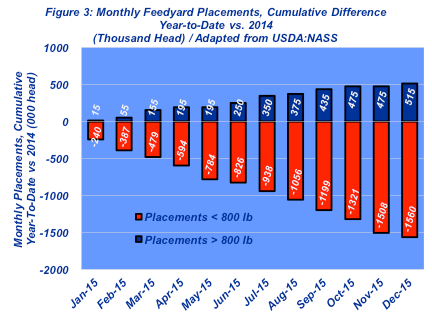

From a supply perspective, the 120-day front end remains stubbornly bigger year-over-year. That’s somewhat counterintuitive, given that placements have trended to the heavy end for the past 12 months (Figure 3). Traditionally, that type of trend would equate to fewer days on feed. However, economic signals and market trends have bucked that trend. As such, cattle are coming in slower and bigger, and subsequently staying longer.

As noted last month: “… the heaviest weight category of placements (800+ pounds) is the only delineation in which arrivals are running ahead of last year’s pace … Cattle are staying out of the feedyard until they have to move … But that pattern sets the sector up for heavy cattle to continue being delivered through spring. The pipeline remains stacked for big weights and little wiggle room when it comes to marketings – heavy in, heavy out.”

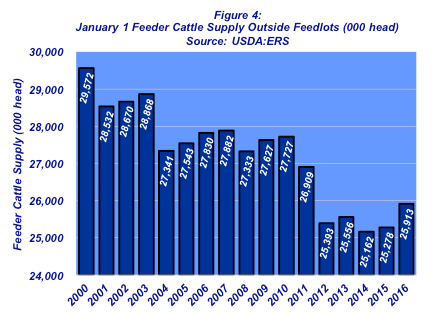

To that end, slower placements during the past year equate to more cattle in the country. USDA’s January 1 reports reveal more feeder cattle outside feedlots versus 2015 (Figure 4). Therefore, from a seller’s perspective, market rallies need to be exploited when they become available.

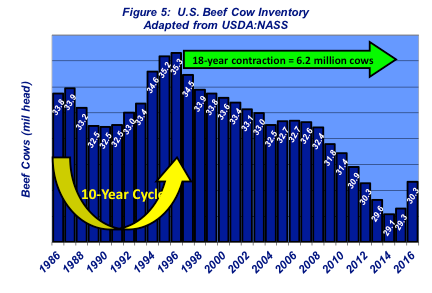

And from a longer-term perspective, USDA’s January 1 inventory reported that herd rebuilding is underway in a robust manner. The beef cow inventory increased by 1 million head to 30.3 million cows (Figure 5). Accordingly, the cowherd is now back to 2012 levels and likely to grow further in the coming years.

Putting all that together, it’s clear that 2016 is shaping up to be a very different year compared with 2014 or 2015. As noted, supply is growing on all fronts. First, there’s the near-term pressure: cattle feeders continue to be front-end loaded, and feeder cattle supply has expanded with feeders subject to arrive at the feedyard heavier than last year. Second, the long-term picture has also changed: the calf crop will be bigger in 2016, meaning more calves to market during this year’s fall run.

That means leverage begins to transition back to buyers with bigger supply pressure on the market going forward. Sellers will need to focus much more closely on managing both cost and margins (more on that next month). In the meantime, though, bigger supply also draws attention to the importance of beef demand.

To that end, since 2009 when cattle prices marked recent lows, beef demand has improved almost 25%; the current 12-month moving average now stands at nearly 93 – the best mark since 1992. Markets are complex (especially from week-to-week). However, available data clearly reveals a positive relationship between the beef demand index and fed cattle prices. With that in mind, imagine what 2015 might have looked like without the commitment to building demand through enhanced quality and consistency coupled with active promotion during the last 25 years. Improvement in beef demand drives stronger spending at the consumer level – and cattle prices follow in a positive direction. (For more on the importance of beef quality, see this week’s Industry At A Glance.)

Lastly, unraveling the lessons of 2015 remains an important process. With that in mind, one observation by Howard Marks from his book, The Most Important Thing, stands out:

“The swing back from the extreme is usually more rapid – and thus takes much less time – than the swing to the extreme. (Or as my partner Sheldon Stone likes to say, ‘The air goes out of the balloon much faster than it went in.’)”

Meanwhile, during the past month I also stumbled across another observation around the stock market that also fittingly applies to the beef complex: “The market can remain irrational longer than you can remain solvent.”

There are renewed challenges for producers looking to market cattle – the market will prove far less forgiving and rewarding price targets may prove more elusive. Therefore, recalling a regularly-repeated observation in this column is useful: “Trying to outguess or outsmart this market is nearly impossible to do and the consequences can be devastating. Given the continued pattern within the market, sharp moves are the primary challenge to be managed – both up and down.”

Markets can be merciless; as such, producers should be, now more than ever, investing time and effort to monitor markets carefully and objectively to ensure successful decision-making.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

You might also like:

Wendy's addresses antibiotic use in beef production

9 new pickups for the ranch in 2016

3 steps for preparing for farm economy downturn

Is production efficiency the answer to falling cattle prices?

What's ahead for the beef industry in 2016? 10 megatrends to watch

15 best winter on the ranch photos

Calving Checklist: Everything you need to know & have before calving

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)