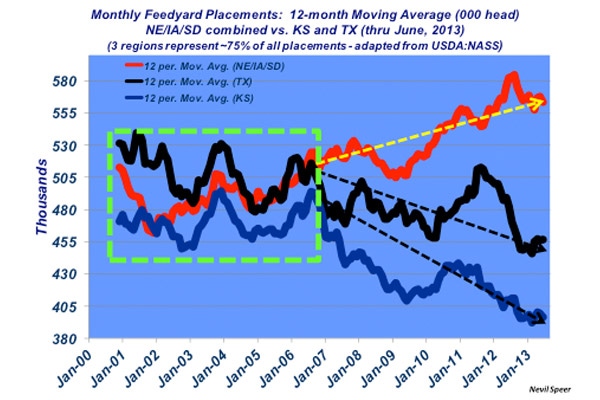

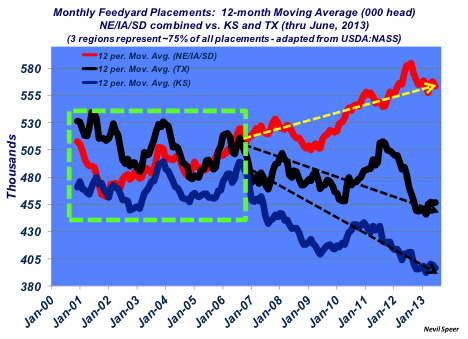

Industry At A Glance: North Attracting More Cattle On Feed

Major shifts began to occur following emergence of the federal ethanol policy as cattle followed the ethanol plants.

August 1, 2013

A recent Industry At A Glance chart discussed the changing market dynamics between the northern and southern tiers. Primarily, there’s been an important shift in regional price differences that began to develop even prior to Cargill’s closure of its Plainview, TX, plant in January. During the past several years, the long-running southern premium has essentially disappeared, with the advantage shifting to the northern market.

Meanwhile, there’s been an even longer pattern with respect to where the nation’s cattle are being fed. Not surprisingly, major shifts began to occur following emergence of the federal ethanol policy – cattle followed the ethanol plants.

Since that time, the three-state region of Nebraska, Iowa and South Dakota continues to pull a greater portion of monthly placements, vs. Texas and Kansas. These three feeding areas account for about 75% of all cattle on feed. Assuming the fed market advantage persists in the north, this trend could potentially intensify over time.

It’s also important to consider that Texas’ beef cow inventory for the start of 2013 was just over 4 million cows (1 million head fewer than just two years before – largely because of drought). That occurs on a land mass of 267,000 square miles. Meanwhile, the beef cow population in the Nebraska, Iowa and South Dakota region is 4.4 million cows – on a land mass of only 211,000 square miles. Those facts counter conventional wisdom: the three-state region has access to a greater number of calves in higher density than those feedyards in Texas.

Is this a permanent trend? How do you foresee the feeding sector changing over time? Leave your thoughts below.

You might also like:

80+ Summer Grazing Scenes From Readers

Calf Marketing Tools Help Smooth Volatility

Wounded Veterans Find Healing On Texas Ranch

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)