Annual feedyard marketings: Heavier placements rule

Cattle feeders’ preference for heavy-weights is clear.

December 12, 2019

The focus of last week’s Industry At A Glance was on the longer-run feedyard placement patterns in the United States. Most important, cattle on the upper end of the placement weight range (greater than 800 pounds) have been and are accounting for a greater percentage of total placements.

The column noted the trend “highlights the priorities within the feeding sector. Increasingly, the sector is not just settling for cattle—even when calves can be purchased at a discount at the time of heaviest supplies (fall run). Rather, cattle feeders are becoming increasingly synchronized in terms of their respective supply management. That means they’re ultimately placing a greater portion of heavier cattle into the feedyard.”

Bigger cattle on the front-end facilitate more consistency. It’s easier to position around both health and risk management upon arrival. Heavier cattle at placement time are also more predictable in terms of performance and thus simplify management around inventory turnover. That’s important for every feedyard.

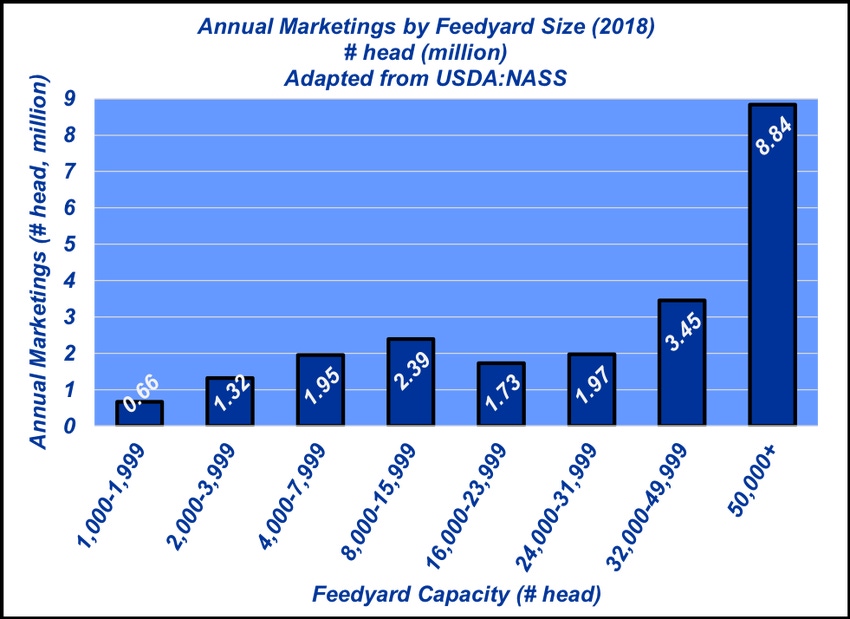

However, is it the same across all sizes of feedyards? This week’s graph helps address that question. Every year, as part of the Cattle on Feed survey, USDA reports number of feedyards, total inventory, and annual marketings categorized by feedyard size. This week’s graph outlines annual marketings by feedyard size.

The results aren’t surprising. However, it does provide some important insight into the structure of the industry and subsequent priorities.

The largest feedyards—those with 50,000 head capacity or more—market substantially more cattle annually than even the next closest category. In fact, it takes the next 376 feedyards in capacity to equal the total marketings of the 74 feedlots with capacity greater than 50,000 head.

Clearly, the largest feedyards are able to generate efficiencies due to economies of scale, unlike marginally smaller operations. But perhaps most important in this discussion circles back to the importance of consistent throughput to really leverage those efficiencies (i.e. the push towards heavier placements).

Within that context, though, also comes the ever-prevalent discussion around price discovery. Several priorities are even more important at the top end of scale: risk management and consistent throughput are the key drivers – not weekly back-and-forth negotiations about the market.

Thus, amidst all the current discussion about price discovery, it’s important to keep the marketings perspective in mind when trying to forge an industry-wide solution. While the basic fundamentals of profitability are the same for every feedyard—no matter the size—there likely isn’t a one-size-fits-all solution because the business models vary up and down the scale.

Speer serves as an industry consultant and is based in Bowling Green, Ky. Contact him at [email protected].

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)