Feedyards were squeezed from both sides of the market in 2015.

December 22, 2015

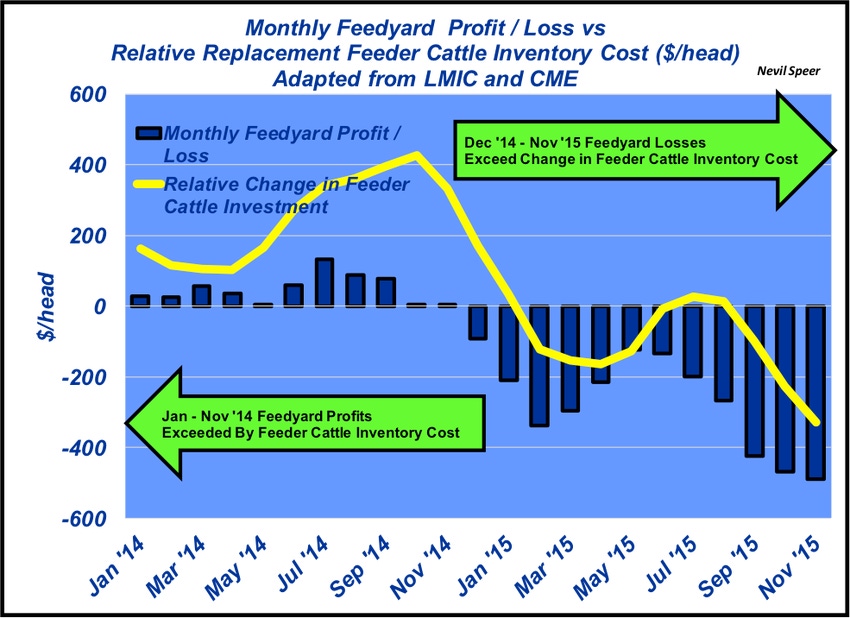

The importance of the cost of feeder cattle, and the inherent relationship to current losses in 2015, has been the focus of several Industry At A Glance illustrations during the past several months (for example, see Crush Trends or Fighting The Market). This week’s illustration provides a somewhat different view to gain further perspective around what occurred in 2015.

One of the common reactions to steep feedyard losses in 2015 is to look back to feedyard profits in 2014. There’s a common perception that gains in 2014 were stored away in savings and are now available to draw upon to make up for losses in 2015.

That perspective, however, misses the mark on several counts:

Losses in 2015 are far steeper than gains in 2014.

Closeout profit in 2014 didn’t necessarily result in free cash flow – gains were simply plowed back into purchase of replacement feeder cattle.

Let’s take a look at those two key factors, both illustrated in this week’s graph.

First, while closeout estimates across the industry are never perfect because of large differences in cost structure, as well as differing marketing strategies and risk management across the feeding sector, the trend remains the same. This year’s equity drain is unprecedented; feedyard closeouts were positive through most of 2014 but have turned historically negative in 2015 and far outpace gains made in 2014.

What’s more, cattle feeders have been squeezed from both sides of the market in 2015. For the purpose of this discussion, what’s most important are the trends revolving around buying feeder cattle in 2014. The second aspect of this week’s graph depicts the comparative difference in monthly replacement investment versus the previous five to six months. Closeout profits �– and then some - were simply rotated back into cost of new inventory, meaning there’s no savings to offset the current round of losses. Meanwhile, feedyard losses in 2015 still outpace the relative difference in replacement feeder cattle costs for future closeouts.

What’s your perception of the current squeeze in the feeding sector? What changes do you foresee coming because of this year’s sharp losses? What long-term impact will 2015 have on the cattle business going forward?

Leave your thoughts in the comments section below.

You might also like:

7 ranching operations who lead in stewardship, sustainability

Why we need to let Mother Nature select replacement heifers

Photo Gallery: Laugh with Rubes cow cartoons

Beta agonists wrongly blamed for fatigued cattle syndrome

Lessons from the 2015 cattle market wreck

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)