Buyers continue to reward sellers for decommoditizing the product.

August 27, 2020

The feeder market has been on a solid run of late. CME’s Feeder Cattle Index is encroaching $145 per cwt—that’s up from around $115 in early April. And as noted in this column several weeks ago, the runup has occurred, “despite two black swan events, bigger supply and sharp [feedyard] losses.” And along the way, “…the feeder market has staged a solid recovery and is encroaching the top side of a well-established trading range.”

However, for some it gets even better from there. That is, buyers have seemingly shaken off concerns about the market going forward and proven to be especially aggressive when purchasing program cattle. CattleFax recently described the scenario this way in its July 31 Update:

Video sales season surges on, as major sales over the past three weeks featured fall delivery calves from most regions and states. The continued optimism in the futures complex has caused prices to trend generally firmer compared to similar offerings earlier in the summer. Calves with long lists of valued-added program continued to return stout premiums compared to commodity calves.

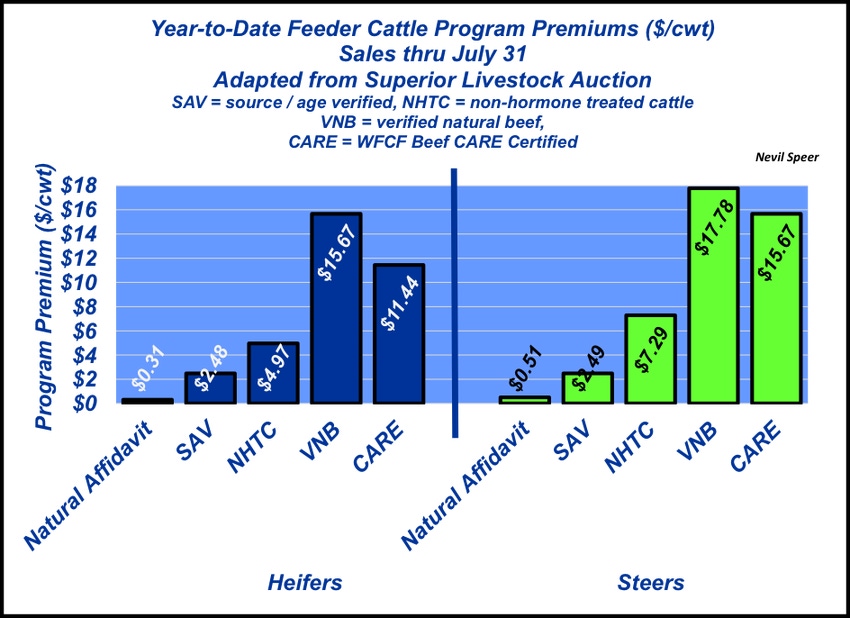

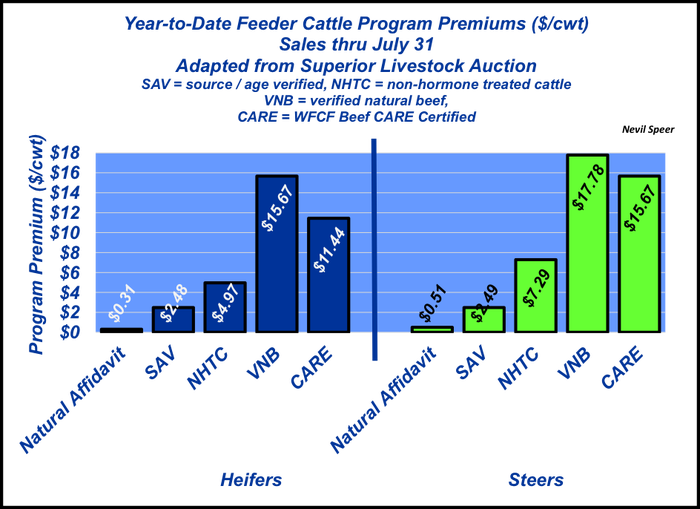

This week’s illustration highlights feeder cattle program premiums, year to date, based on video sales hosted by Superior Livestock Auction. The values are on-par to stronger compared to previous years.

Bottom line: differentiation and documentation pays. Even at the most minimum program level, simply providing source and age verification equates to receiving an additional $2.50 per cwt or ~$16 per head for a 650-pound calf, both steers and heifers.

The trend here isn’t surprising. It’s consistent with some prior discussion about the general direction of the beef industry back in March with respect to the growing prevalence of branded programs. The primary takeaway being that, despite all the noise around the market during the past year, buyers continue to reward sellers, “…to decommoditize the product and establish value creation through differentiation.”

Nevil Speer is based in Bowling Green, Ky. and serves as director of industry relations for Where Food Comes From (WFCF). The views and opinions expressed herein do not necessarily reflect those of WFCF or its shareholders. He can be reached at [email protected]. The opinions of the author are not necessarily those of beefmagazine.com or Farm Progress.

About the Author(s)

You May Also Like