Want a starting point to price feeders? Look at fed cattle futures.

January 30, 2020

Last week’s column highlighted recent trends around negotiated trade for fed cattle. Most importantly, the trends of late defy conventional wisdom. That is, “despite very thin cash markets during the past four months, the market has made an incredible recovery; through December, fed prices tacked on $25 in just 15 weeks – and completely reversed the packer margin trend.”

Clearly, any discussion around the fed market has implications for feeder cattle, too. However, too often the discussion gets confused. Feeder cattle are not priced off the current (cash) price of fed cattle, but rather based on deferred CME futures contracts.

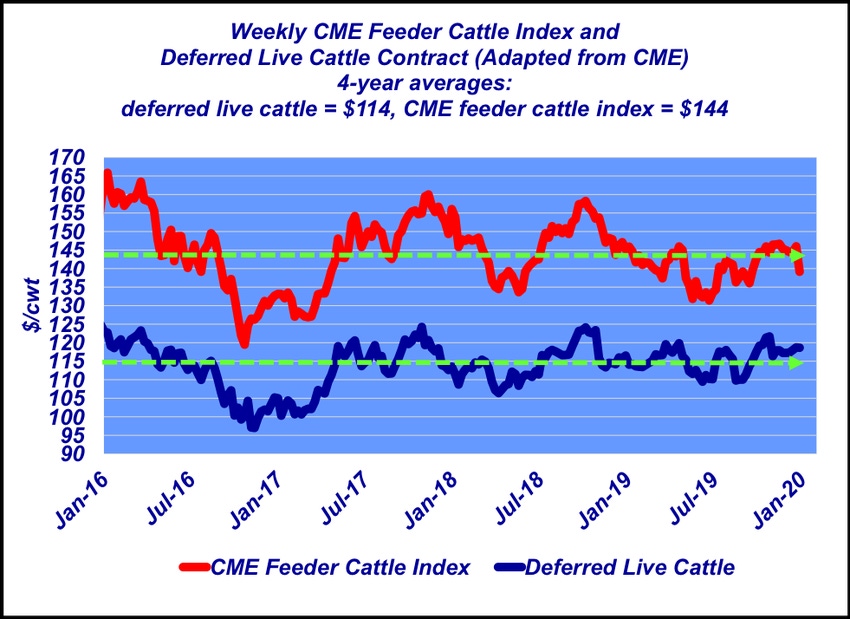

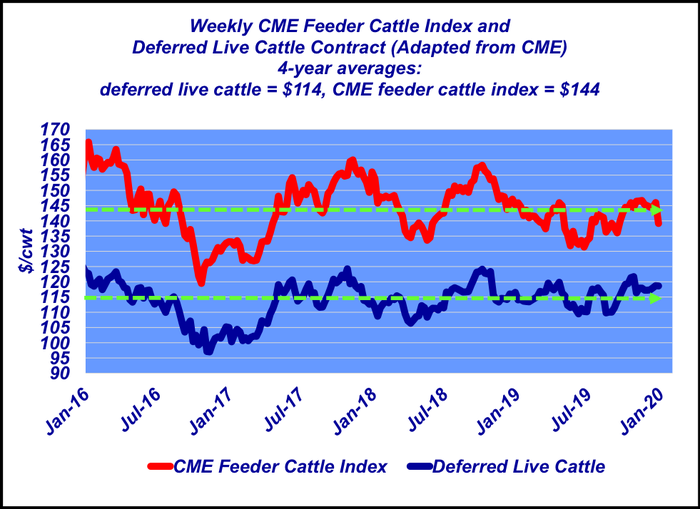

This week’s graph highlights the relationship between those two markets. The price relationship has remained surprisingly consistent ever since the market transitioned through the sharp plunge of 2015. In general, the CME feeder cattle index has been running about $30 ahead of the deferred live cattle contract. To that end, during the past four years the deferred fed average is $114, while the feeder cattle index has averaged $144.

Inevitably, one of the most common questions from producers goes something like, “What’s your outlook for feeder prices?” Based on this trend, the answer inherently invokes a question on the other side, “What’s your outlook for fed prices?”

In other words, wherever the respective deferred live cattle contract is priced, tack on $30 and that’s your starting point for feeder cattle.

That also invokes the concept of added value. The $30 spread is a strong and consistent trend. And so, in the absence of any additional value (or at least documentation of such), it’s hard to overcome that trend. It represents the power of large numbers – without additional information everything gets regressed to the mean.

Therefore, adjustments for management and genetics have to be clearly documented and marketed in the proper venue to overcome that trend and be appropriately awarded in the marketplace.

Speer serves as an industry consultant and is based in Bowling Green, Ky. Contact him at [email protected].

About the Author(s)

You May Also Like