Feedyard revenue: Why it matters to you

Feedyard revenue eventually makes its way back into the hands of backgrounders, stockers and cow-calf operations.

July 28, 2016

Estimating total feedyard revenue is an important measure for the beef industry. The estimate is an indicator of total dollars entering the production sector. It’s those dollars that are ultimately available upstream. In other words, feedyard revenue eventually makes its way back into the hands of backgrounders, stockers and cow-calf operations.

The revenue trend is important to assess over time. More revenue coming into the feedyard means more dollars available to the production sector – and vice-versa. If the trend is positive, there are new opportunities for growth and expansion. Conversely, if the trend is negative, the opposite is true.

It should be noted that the revenue estimate is not an indicator of profitability and shouldn’t be interpreted as such. The calculation is straightforward and a function of three key components:

live weight

number of fed steers and heifers marketed

the live market

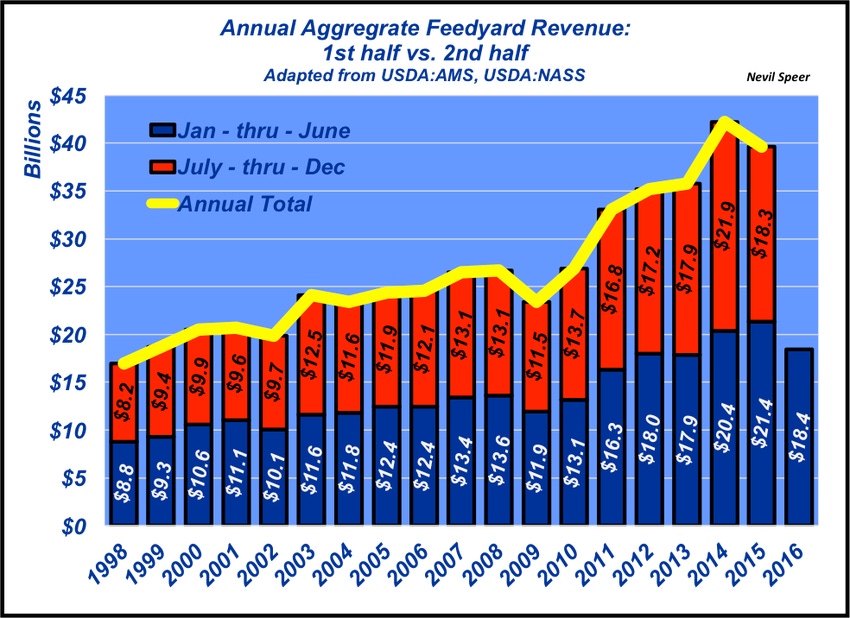

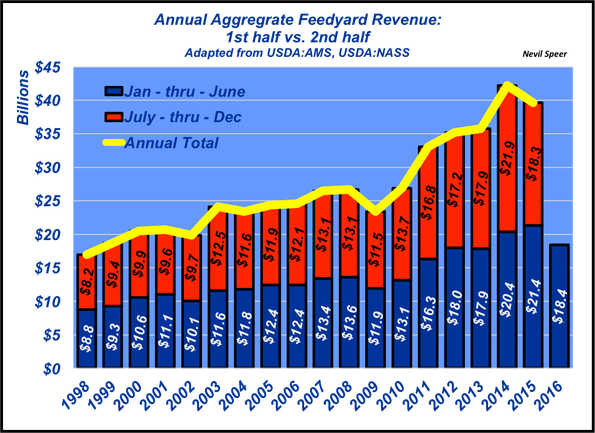

This week’s illustration highlights feedyard revenue trends; first vs. second-half of the year along with annual total. The breakout provides meaningful comparison on an ongoing basis.

Not surprisingly, this year’s first-half mark is sharply lower on a year-over-year comparison: 2016 revenue through June was $18.4 billion compared to last year’s $21.4 billion. But remember that last year marked the best-ever first half – that reversed direction sharply during the second half.

Not surprisingly, this year’s first-half mark is sharply lower on a year-over-year comparison: 2016 revenue through June was $18.4 billion compared to last year’s $21.4 billion. But remember that last year marked the best-ever first half – that reversed direction sharply during the second half.

This year’s January through June revenue mark is on par with 2012 and 2013. In other words, 2016 has stepped backward for the first time in several years. That is having, and will continue to have, an influence on the beef complex going forward.

How do you foresee the revenue squeeze playing out in the production sector? Will it result in further consolidation going forward? How might it influence expansion plans in the year(s) to come? Does declining revenue force a shift in terms of chasing new opportunities for your operation? Leave your thoughts in the comments section below.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

You might also like:

4 facts to debunk "Meat is horrible" article

60 stunning photos that showcase ranch work ethics

Best risk strategy options for cattle producers

Does it really take six years to cover your costs on a cow? NO!

Photo Gallery: Get to know the 2016 Seedstock 100 operations

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)