Did mandatory COOL have a positive or negative effect on feedyard profits?

October 2, 2019

During the past several weeks, this column has addressed potential inclusion of mandatory country of origin labeling (MCOOL) as part of the new USMCA (U.S., Mexico, Canada) trade agreement (often referenced as NAFTA 2.0). Those columns have focused on 1: meat demand, and 2: feeder cattle prices in the U.S. vs. Canada in reference to MCOOL, respectively.

However, interest in COOL has seemingly ramped up even more in recent weeks following the fire in Tyson’s Holcomb, KS beef plant. The #FairCattleMarkets campaign on Twitter is largely in response to the widening live-to-cutout spread since the fire. And as part of that campaign, COOL has been repeatedly referenced as an item that’s important to the beef industry’s profitability.

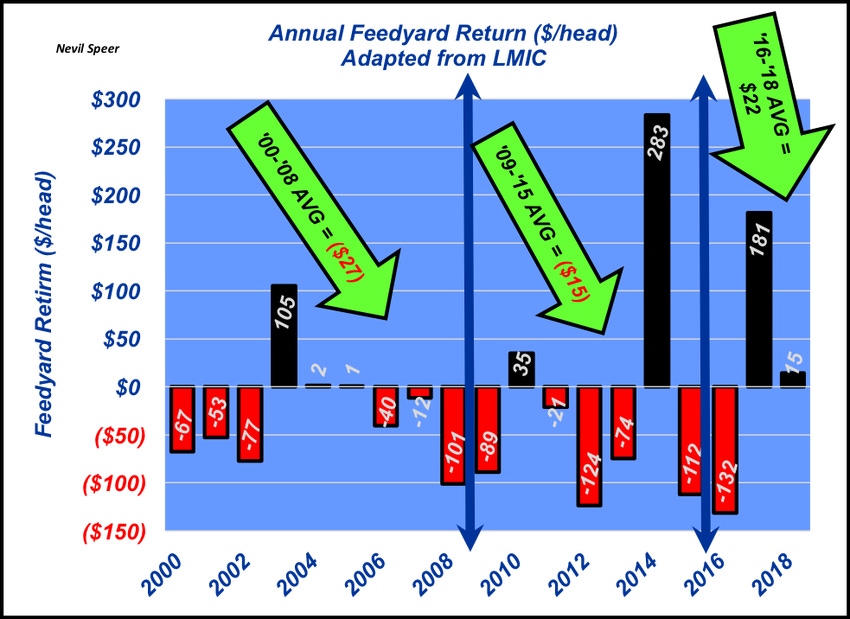

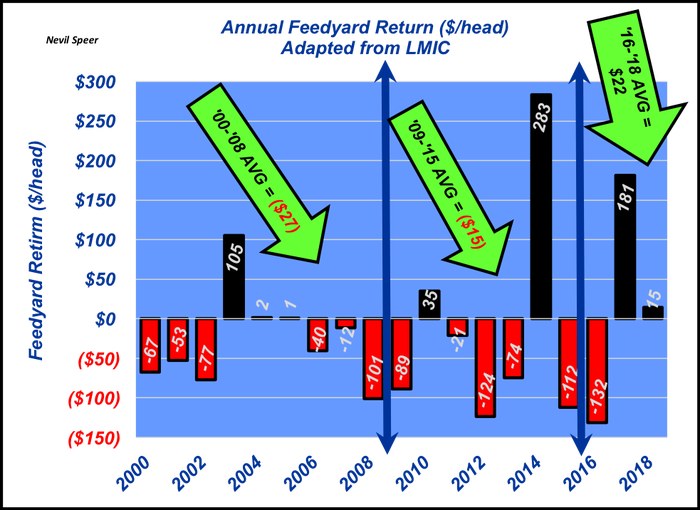

To that end, this week’s graph provides a look at annual feedyard profitability since 2000. Annual averages are provided in the illustration for the following years:

2000 to 2008

2009 to 2015 (MCOOL years)

2016 to 2018

Profitability averages are $-27, $-15, and $+22 per head, for the three periods outlined, respectively.

In other words, the best period of profitability at the feedyard level has occurred since MCOOL was repealed (2016 to 2018). And without 2014’s huge boost for profitability, the average return for cattle feeders while MCOOL was in effect would have been $-64 per head—far and away the worst of the three periods.

That brings us back to the #FairCattleMarkets campaign. There’s seemingly some confounding of topics with respect to the live to cutout spread, profit, and COOL. In summary, based on the data, at best it would seem COOL was NOT an influential factor in driving feedyard profitability.

Therefore, there were no extra dollars derived from COOL to make their way back upstream; COOL didn’t contribute to the favorable margins cow-calf operators experienced in ’13, ’14, and ’15.

One final note on the merging of these topics: Given current concern about the live to cutout spread and industry profitability, it’s important to note the live to cutout spread also has not historically been an important influence on profitability at the cow-calf level. For more on that see: Packer gross margins vs cow/calf profitability.

Leave your thoughts in the comments section below.

Speer serves as an industry consultant and is based in Bowling Green, Ky. Contact him at [email protected]

About the Author(s)

You May Also Like