Pasture conditions continues to impact feedlots

Lighter cattle drive increased feedlot placements during July.

August 24, 2022

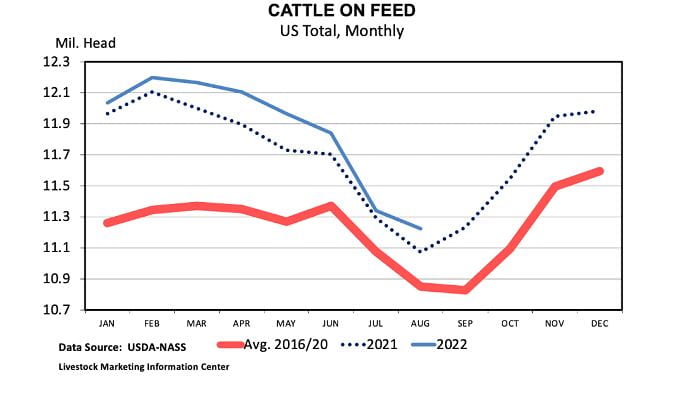

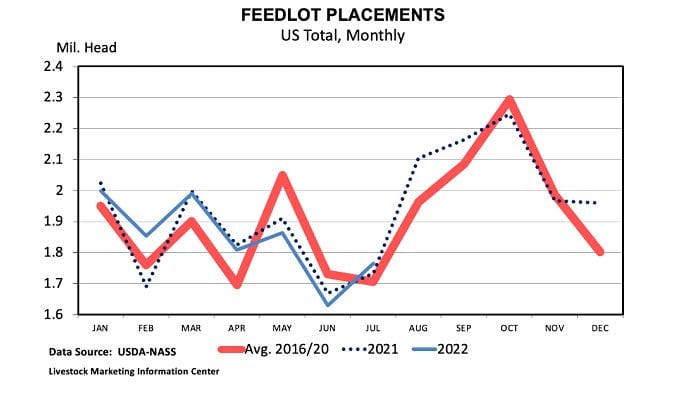

The August 1st Cattle on Feed report was released on August 19 and showed feedlot inventories declined seasonally but remained above year-ago levels. As James mentioned last week, drought continues to play a key role in the movement of cattle into feedlots this summer. Placements again exceeded expectations driven by large placements of lighter-weight cattle.

Placements of cattle into feedlots during July were up about two percent above July 2021. This was above pre-report expectations and was driven by placements of lighter cattle. Placements of cattle weighing less than 700 pounds were about 10 percent above July 2021 levels while placements of cattle weight less than 700 pounds were down 2.5 percent. This continues the trend that has occurred most of the year – feedlots inventories continue to be supported by stronger placements of lighter cattle. Marketings were down four percent compared to a year ago. This was on the low end of expectations but within the range. Total cattle on feed was up about one percent above August 1, 2021.

Drought and pasture conditions continue to push some cattle into feedlots sooner than normal which is contributing to the larger placements of lighter cattle. The obvious implication is those cattle will not be sold later this fall when we might normally expect them.

The broad implications for cattle markets are similar to those of past reports – smaller expected supplies and higher expected prices. Tighter feeder cattle supplies are almost certainly already upon us, despite placements and cattle on feed still being above 2021 levels. We are in a scenario where there are more cattle in feedlots than a year ago only because there are less feeder cattle “outside of feedlots” than would normally be expected. Feeder cattle futures prices are reflecting these expectations with late fall and early spring contracts trading near $190 per cwt.

Source: Mississippi State University, who is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)