Commodities have proven to be a popular investment vehicle since the initiation of quantitative easing by the federal government, while the tight supply of cattle has also driven the market higher.

March 14, 2013

There’s been a lot of buzz in recent weeks around the financial markets, as the Dow Jones Industrial Index continues to make new highs and the S&P 500 is encroaching on doing the same. That accomplishment would be especially important for the S&P 500, as it’s commonly regarded as a more comprehensive barometer of business performance and the economy.

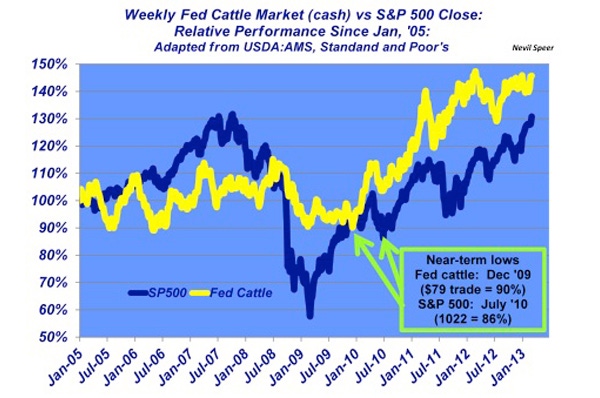

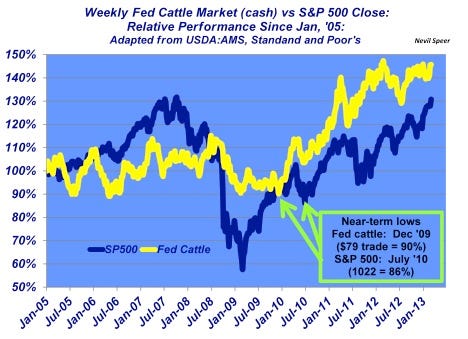

The picture over the long-run is even more important. The graph below highlights the relative performance of the fed cattle market vs. the S&P 500 since January 2005 (a good starting point as it washes out all of the market impact of BSE that endured through much of 2004). The S&P 500 established new highs in 2007, but the financial crisis sent it all downhill from there to eventually hit bottom in March 2009. In the meantime, fed cattle largely traded sideways, but were also impacted by the financial crisis, with the near-term low coming in December 2009.

In December 2009, both fed cattle and S&P 500 were near 90% of their respective January 2005 levels. Since then, though, the fed cattle market has consistently outperformed the S&P 500 and is now about 15% ahead of the broader stock market index. Commodities have proven to be a popular investment vehicle since the initiation of quantitative easing by the federal government, while the tight supply has also driven the market higher. However, it’s somewhat surprising that beef values and fed cattle prices have been able to outpace the broader economy – especially in an era of high unemployment and relatively weak consumer confidence.

How do you see the market shaping up in the next several years? Is the best of the market run over? Or are traders in the stock pits signaling an improving economy? If so, does that mean more robust spending for beef products? Are you bullish or bearish on where cattle prices are headed? Leave your thoughts in the comments section below.

You might also like:

60+ Stunning Photos That Showcase Ranch Work Ethics

Cattle Market Weekly Audio Report, March 2, 2013

About the Author(s)

You May Also Like