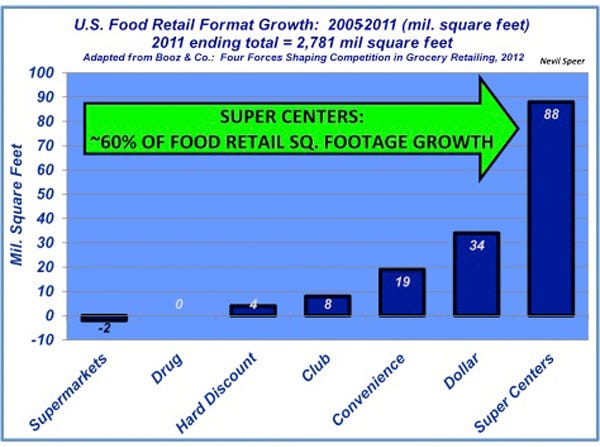

Beef Industry At A Glance: Growth Of Super Centers

The growth and domination of the super center means a lot of change within the food marketing business, but it also carries ramifications for suppliers.

March 21, 2013

The retail food world has changed dramatically over the past 10-15 years. Traditional supermarket sales were beginning to be challenged by all sorts of new formats during the late 1990s. There’s no doubt, though, that Walmart was the largest driver of change. The company positioned itself as the leader among food retailers.

Walmart relentlessly monitors individual item turnover performance, and its format success depends heavily upon efficient inventory management (including the meat case). Those efforts aid in eliminating supply chain management shortfalls. As a result, Walmart is able to cut costs and pass along savings to customers.

Therein enters the promotional emphasis upon everyday low pricing. Lower grocery prices attract customers, build store loyalty among consumers, and ultimately stimulate traffic within higher-margin departments, thereby increasing overall store yield.

The success of the super center concept hasn’t gone unnoticed in the food world, and thus explains the format’s domination of growth during the past six years. A number of competitors are increasingly trying to introduce similar formats, including Target and K-Mart. Meanwhile, even traditional grocers are expanding their product offering to more closely mimic the super center concept.

That all means lots of change within the food marketing business, but also ramifications for suppliers. How do you perceive the shifting business environment and its subsequent influence on the beef industry? What further influences do you foresee in the coming 5-10 years? Leave your thoughts in the comments section below.

You might also like:

Horsemeat Scandal Could Boost U.S. Beef Exports

$10,000 For A Commercial Bull?

Good Heifer Development Is All Or Nothing

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)