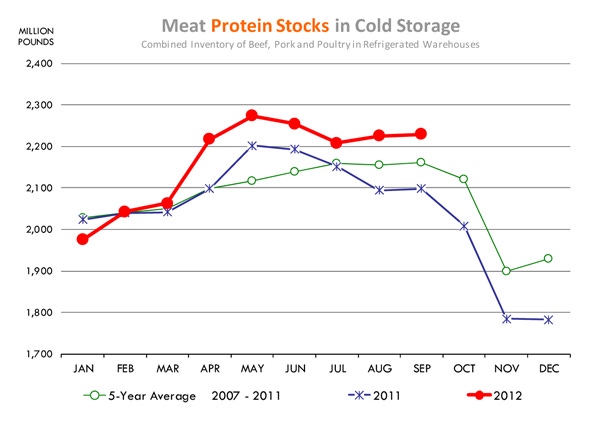

Protein Cold Storage Continues To Rise Sharply

Generally, increases in cold storage are a signal of slowing demand, but this year’s scenario could be due to end users building stocks as a hedge against expected future price increases.

October 23, 2012

Inventories of meat in cold storage rose sharply this past spring and summer and they continue to be well above year-ago and five-year average levels. In the past, an increase in inventories was seen as an indication of slowing demand and packers having trouble moving product. Today, the picture is a bit more complicated.

In some cases, the rise in inventories reflects efforts on the part of end users to build stocks as a hedge against expected rising prices in the future.

• The surge in broiler wing ending stocks is a great example, as end users are afraid of even more significant price appreciation going into the Super Bowl at a time when broiler producers are indicating they expect further cutbacks due to record high feed costs.

• Higher export volume also tends to bolster freezer inventories as product needs to be staged before it is shipped.

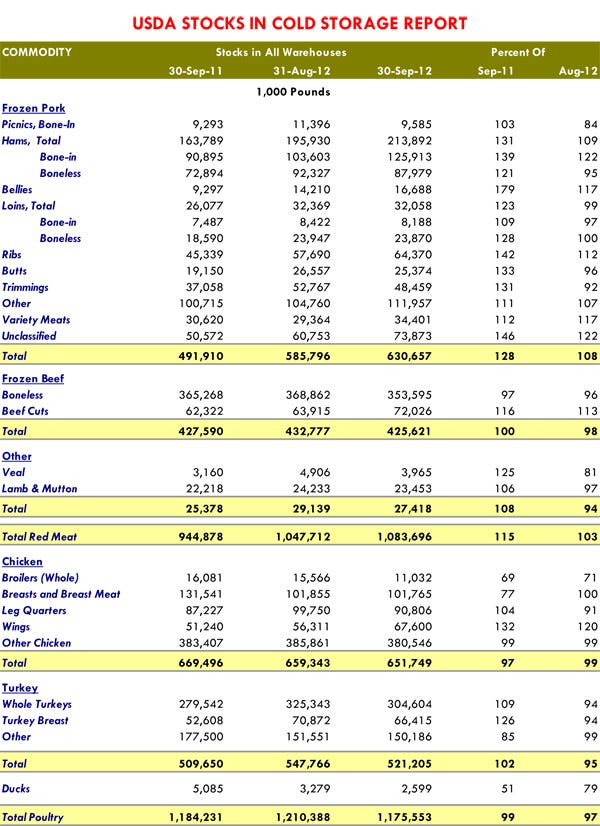

The latest cold storage surge offered a mixed picture of the supply situation, with pork stocks clearly heavy and indicating some challenges in the short term. Beef and chicken stocks, on the other hand, appear to be relatively current. Below are some of the highlights for pork and beef:

Beef: Total beef inventories as of Sept. 30 were 425.6 million lbs., 0.5% lower than a year ago. Inventories of boneless beef continued to decline and were down 3.2% from a year ago. Some of the fat beef trim stocks that were built up during the spring and summer have been depleted. Also, record-high prices for lean beef mean end users are more reluctant to have large freezer positions. Inventories of beef cuts rose 13% from the previous month; the five-year m/m average increase in September is 3%.

Pork: Pork inventories rose sharply in August and September as producers accelerated marketings to get ahead of surging feed costs. Total pork in cold storage was 630.7 million lbs., 28% larger than a year ago. Ham inventories as of Sept. 30 were 213.9 million lbs., 31% larger than last year. End users should start to deplete those inventories in the next two months for the holiday period and this will put some downward pressure on ham prices in the short term. Keep in mind, however, that some of the extra supply will likely go to export markets, especially Mexico.

Belly inventories are near annual lows but inventory building has already started as end users seek to build some inventory hedges given strong demand and tighter hog supplies in the coming months. The inventory of pork trim was pegged at 48.5 million lbs., 30.8% higher than a year ago and 33.8% higher than the five-year average.

Poultry: Total broiler meat in cold storage was 651.7 million lbs., 2.7% lower than a year ago. Breast meat inventories are down 22.6%, while inventories of wings are up 31.9%. End users are clearly relying on freezer hedges more than in years past, especially now that wings are trading at a 50¢ premium to breast meat. Turkey stocks were 521.2 million lbs., 2.3% larger than a month ago but still about 4.3% lower than the five-year average.

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)