It's time to focus on cash flow in order to get your business through the current low price phase of the beef price cycle and through the current low corn prices.

April 24, 2017

In a cyclical enterprise such as beef cows, ranchers tend to make most of their economic profit, after depreciation and inventory changes, during the high phase of the beef price cycle. Hopefully, the economic profits earned in the high portion of the price cycle, as we saw in 2014-15, can be carried forward and used to finance the low portion of the price cycle, as we’ll see in 2016-17. The truth is that ranchers typically cannot make an economic profit each and every year.

While ranchers do not need to make an economic profit every single year, they do, however, have to cash-flow each and every single year. As ranchers move through the expansion phase of the cattle cycle and its resulting low cattle prices, where we are now, ranch managers need to put most of their management emphasis on cash flow planning.

In any given year that the ranch is projected to not cash-flow, the first strategy that has to be looked at is to temporarily change the business plan to get through the cash flow squeeze. If you cannot change the business plan, you then look to sell something in inventory to generate the needed cash.

When I analyzed my eastern Wyoming/western Nebraska study herd, it became clear that 2016 was a year to focus almost totally on cash flow. A previous Market Adviser column documented the low 2016 economic profit generated from the beef cow herd and the farming operations of that particular business.

The management focus had to turn totally to a cash flow focus designed to get this business through the current low price phase of the beef price cycle and through the current low corn prices.

Two cash flow plans considered

Weak October 2016 calf prices forced my study rancher to hold onto his 2016 calves and then try marketing them after the first of the year. Two different emergency business plans were proposed in late fall and evaluated:

marketing 2016 calves with a backgrounding enterprise, capitalizing on lower-priced, 2016-produced corn

culling 15 good bred cows in late 2016 and replacing them in 2018 and 2019 with home-raised, -bred heifers. This plan was to have these new heifers reach their peak production during the peak of the next beef price cycle. Year 2017 was skipped for added replacement heifers as it looks to be a second tough year.

We explored preconditioning for 30 days and/or backgrounding these 2016 calves to 800-plus pounds by feeding some of the rancher’s low-priced 2016 corn and low-priced 2016 alfalfa hay.

The continued stronger feeder calf prices from December 2016 through March 2017 led to a favorable backgrounding option, and led us to conclude selling off part of the beef cow inventory was not needed in the 2016 business plan. The “selling of bred female option” could then be held in reserve for the 2017 business plan.

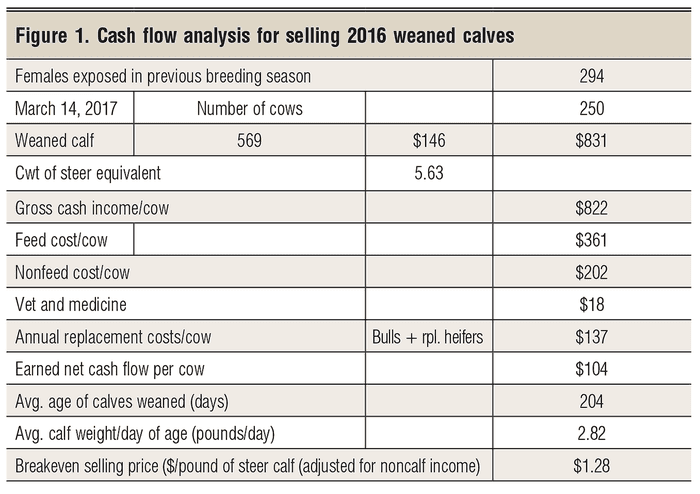

Figure 1 summarizes the final cash flow analysis of the study beef cowherd in 2016.

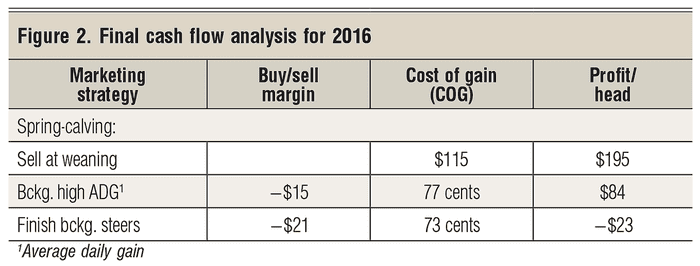

Figure 2 summarizes the combined cash flow analysis of the 2016 beef cowherd, coupled with the backgrounding enterprise as it was executed. The beef cow herd generated $48,600 of net cash flow.

The calves were then transferred to the backgrounding enterprise at October’s weaned market value and backgrounded to the end of February 2017. The feeder cattle market stayed favorable all through this added time period so that the backgrounding enterprise worked out quite successfully, generating another $17,700 net cash flow. This is sure different than what it looked like at October 2016 weaning time!

As we neared the time to market the backgrounded calves, our projections for finishing the backgrounded calves in a commercial feedlot did not look favorable, so the decision was made to market the backgrounded calves.

Building the 2017 business plan

In summary, the 2016 business year looked pretty bleak about weaning time, but turned out considerably better than anticipated. Now the focus is moved to building a business plan for 2017.

This manager does not expect a good corn year again in 2017, so he has to rely on the beef cow enterprise to generate his family living in 2017.

Two critical factors that should influence the 2017 business plan for this study rancher are:

extra winter moisture

lower national corn prices that could lead to stronger feeder cattle prices

The extra moisture should result in extra grass in 2017. This raises the question of running some short yearlings on grass this summer.

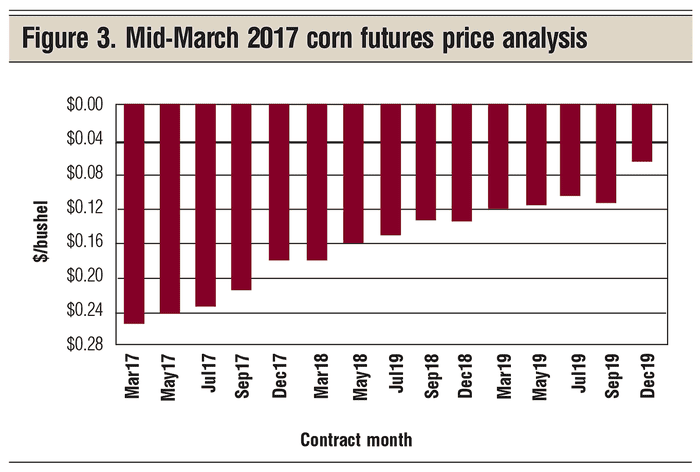

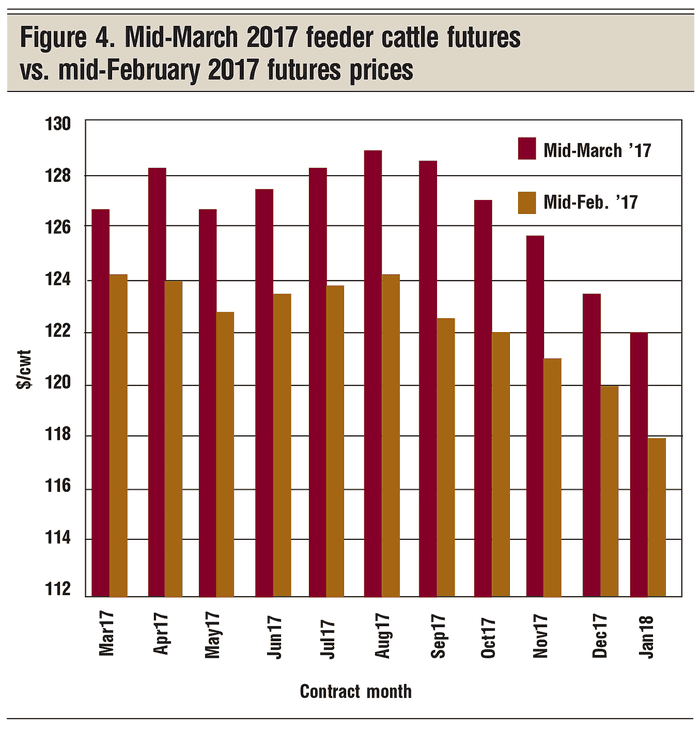

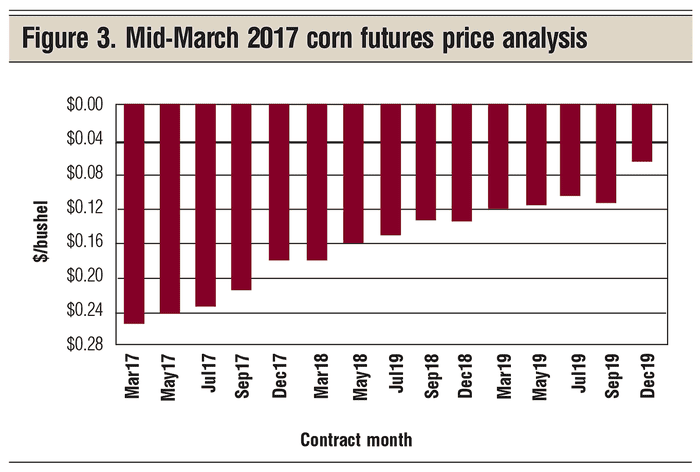

Figure 3 shows the result of my mid-March corn price analysis. I am suggesting that this kind of a corn price drop has a potential impact on lowering feedlot costs of gain, possibly leading to stronger feeder cattle prices (Figure 4, Page 7). There may be an opportunity to hedge in a good grass cattle selling price for September 2017.

Figure 5 presents my grass cattle budget for 2017. Note that grass cost is figured in at $20 per animal per month. I have 625-pound feeders going on grass at $157 per cwt and coming off grass in September at 850 pounds at $134 per cwt, for a buy/sell margin of a −$23.60 per cwt.

This suggests a marketing loss of $147.50 on the original 625 pounds.

My projected cost of gain, including going rental rate for grass, is 65 cents per pound for the 225 pounds gained.

My projected sale price is $134 per cwt, giving a profit per pound gained of 69 cents, or a positive return from gain of $155 per head.

Projected profit = +$155 – $148 = +$7 per head. Not very exciting.

Looking at it another way, running grass cattle is projected to generate about $100 per head for the extra grass consumed. Not bad — so I will keep watching this projection until grass time. By then, I will have a better estimate of the overall grass situation.

Space precludes my publishing the current beef cow cash flow budget for 2017. At this time, the cash flow projection for the beef cow herd is favorable enough that we are staying with his typical 250-cow herd business plan.

This plan is projected to generate $897 cash income per cow by selling calves at weaning and selling cull animals, just as the rancher has done in past years.

This month’s projected cash cost of production per cow is $676, for a projected net cash income of $221 per cow. Given his current 250 cows, this projects a $55,250 net cash flow from the beef cow herd. This meets the manager’s $50,000 family living goal. Stay tuned.

About the Author(s)

You May Also Like