2015 is the year to focus on all calf marketing options

I started this series suggesting that ranchers need to take both today’s strong absolute market prices as well as today’s relative market prices into account when they formulate their 2015 marketing plans. In this third and final article in the series, I’ll evaluate the economics of selected post-weaning marketing alternatives and illustrate how this year’s relative price slides are going to challenge many post-weaning market plans.

Each month, I conduct a detailed analysis of prices for sale barn feeder cattle, as well as livestock and corn futures markets. This month’s market analysis turned out to be a mixed bag, leaning toward the positive side.

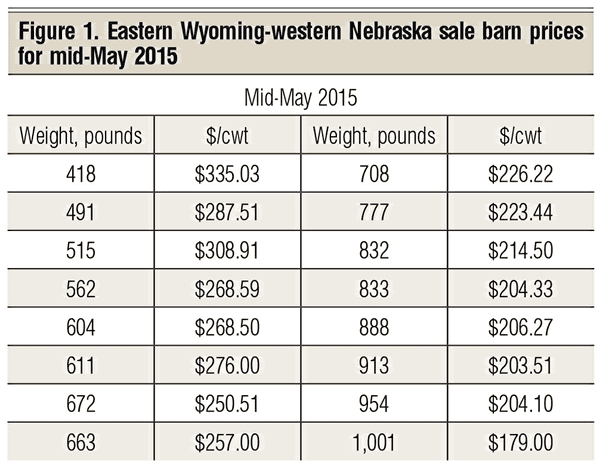

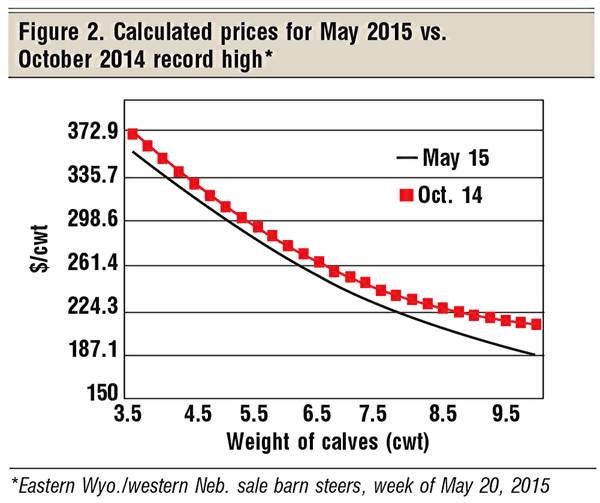

USDA’s eastern Wyoming-western Nebraska sale barn prices for mid-May are presented in Figure 1, and were almost exactly the same as for early April. In fact, May sale barn prices were only slightly lower than the record-high prices recorded in October 2014. (Figure 2).

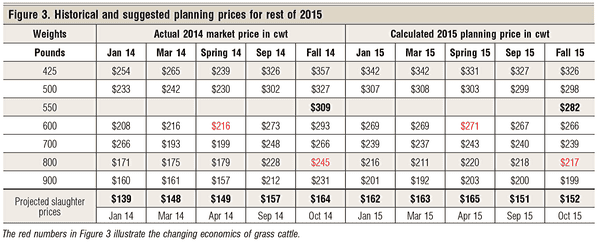

Figure 3 presents my current price projections for the rest of 2015. My current projections are that weaned calves will sell for $282 per cwt this fall. That compares with $309 per cwt last fall — making the 2015 projection the second-highest on record. Yearlings off grass at 800 pounds this fall are projected to sell for $217 per cwt — again, the second-highest on record. Slaughter cattle this fall are projected in the $152-per-cwt range, down from $164 per cwt in fall 2014.

The good news for ranchers is that sale barn prices for feeder steers were approaching the October 2014 record high (again, see Figure 2). Current projection for my eastern Wyoming-western Nebraska study herd is a profit of $551 per cow, marketing calves in fall 2015. If this materializes, it will be the second-highest profit on record.

The bad news is that the price slides represented by the slope of the price lines in Figure 2 are also record-high. These record slides are going to challenge any rancher owning feeder cattle beyond weaning.

The red numbers in Figure 3 illustrate the changing economics of grass cattle. Figure 3 suggests 600-pound feeders went on grass in 2014 at $216 per cwt in the spring, and came off grass at 800 pounds in the fall at $245 per cwt, for a price slide of plus $29. Not only did one make money on the pounds gained, money was also made on the initial weight purchased.

Now contrast this with my projections for 2015. The red numbers in Figure 3 suggest going on grass with 600-pound steers in the spring at $271 per cwt and coming off grass at 800 pounds in the fall at $217 per cwt, for a price slide of minus $54. This generates a projected $324 loss ($-54 x 6.00 = -$324) on the original 600 pounds. Of course, some of this loss can be made up with low-cost gain on grass — but maybe not all of it. Let’s take a look at some detailed summer grass-cattle budgets.

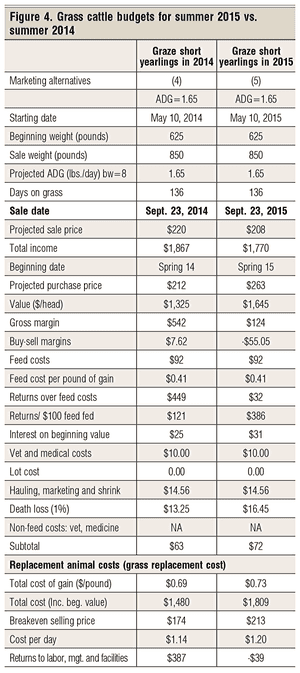

Figure 4 presents my detailed summer grass-cattle budgets for 2014 and 2015. Note in these budgets that I went on grass in both years with 625-pound feeders, and came off grass at 850 pounds. I’ll let you study Figure 4 to see my production parameters.

Figure 4 presents my detailed summer grass-cattle budgets for 2014 and 2015. Note in these budgets that I went on grass in both years with 625-pound feeders, and came off grass at 850 pounds. I’ll let you study Figure 4 to see my production parameters.

Gross margin shows the gross sales value minus the purchase cost of the grassers. In 2014, the gross margin was $542 versus the projected 2015 gross margin of $124. The price slide (labeled as buy-sell margins) in 2014 was positive $7.62, and in 2015 it was a negative $55.05. That’s a huge negative number.

The net results in these two budgets was a positive profit of $385 per head in 2014 and a projected loss of $33 per head in 2015 — a difference of $418 per head between the two years. While the yearly difference in the cost per pound of gain was only 4 cents per pound, the rest of the profit difference is attributed primarily to the price slides. (Note that the interest on the purchase of feeder cattle and the projected death loss are up in 2015 due to higher initial feeder prices.) Yes, the industry has turned.

Series summary

Each month I prepare a projection of four alternative marketing programs that ranchers can consider for the current calf crop. The four marketing alternatives are:

Selling 569-pound feeder calves at weaning

Backgrounding 569-pound weaned calves in a drylot to 875 pounds and selling in February 2016

Finishing 875-pound backgrounded calves in a custom feedlot and harvesting at 1,375 pounds in July 2016

Retaining ownership and growing and finishing 569-pound calves in a custom feedlot and harvesting at 1,329 pounds in May 2016

Current economic projections

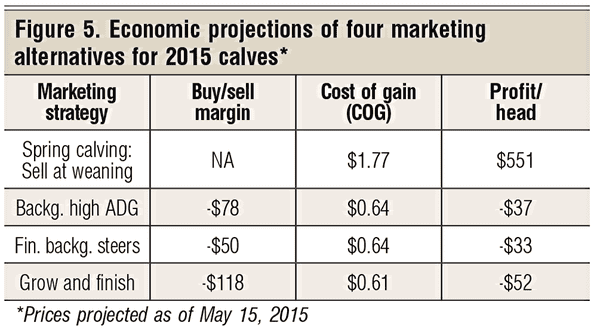

My current economic projections for these four alternatives are summarized in Figure 5. The first number in each row is the projected buy-sell margin for each marketing alternative. The second number is the cost-of-gain projection for each production alternative, and the third number is the projected profit per head.

Here’s a summary of Figure 5 projections:

Selling calves at weaning: steers averaging 569 pounds, with value primarily based on the projected absolute calf price of $272 per cwt, plus cull animals sold. I project a $551-per-cow profit. (Note this is per cow and not per calf.) This compares with $604 calculated profit per cow selling 2014 weaned calves.

Backgrounding with high target average daily gain (ADG): The marketing loss is projected at -$78 x 5.69 = $438 per head. The cost of the 306 pounds gained is projected at 64 cents per pound for a projected loss of $37 per calf backgrounded. This compares with a positive $71 per head calculated for 2014 backgrounded calves.

Custom finishing backgrounded steers: The marketing loss is projected at -$50 x 8.75 = $446 per head. The cost of 500 pounds of gain is projected at 64 cents per pound, for a projected loss of $33 per head. This compares with a $349 loss calculated for 2014. No harvest market premiums were taken into account either year.

Retained ownership in custom feedlot: The marketing loss is projected at -$118 x 5.69 = $671 per head. Cost of 760 pounds of gain is projected at 61 cents per pound, for a projected profit of $52 per head. This compares with a calculated $203 loss per head in 2014. Again, no harvest market premiums were taken into account for either year.

In summary, this year’s increasing marketing costs based on increased buy-sell margins are going to be record-high, and are going to substantially reduce the profit potential of this year’s lower costs of gain. I encourage ranchers to put a major focus on marketing costs (buy-sell margin x beginning weight) for all post-weaning marketing alternatives considered with 2015 calves. Yes, this year has turned.

You might also like:

Picture perfect summer grazing scenes from readers

How to prevent & treat pinkeye in cattle

60 stunning photos that showcase ranch work ethics

7 tools to win the war against cattle flies

7 U.S. cattle operations that top the charts for their stewardship efforts

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)