2015 year-end cattle industry analysis

Regardless of how you market your beef calf crop, at year’s end it is always useful to document the economic performance of your beef cow herd as if you sold your calves at weaning. This year-end analysis becomes the profit benchmark for evaluating postweaning marketing alternatives.

So, whether you sell at weaning or not, you need to price your calves at weaning time. That price becomes the entry price into your postweaning enterprise. Successful postwean enterprises need to be evaluated by the added profit generated after weaning. I do not find added profit after weaning to always be used in profitability discussions.

To determine whether or not a postweaning enterprise is a viable option, this process should begin as you near weaning with an economic projection of the profit potential of alternative marketing programs for your calves; these alternative marketing programs have to be evaluated on the added profit potential beyond selling at weaning, however. Without a weaning profit base, you cannot fully evaluate your postweaning marketing alternatives.

So how did 2015 treat us? Let’s look at the profit benchmark generated for my eastern Wyoming-western Nebraska study herd. This is a static 250 beef cow herd — it is neither growing nor shrinking in beef cow numbers — as the manager tries to maintain 250 cows year in and year out.

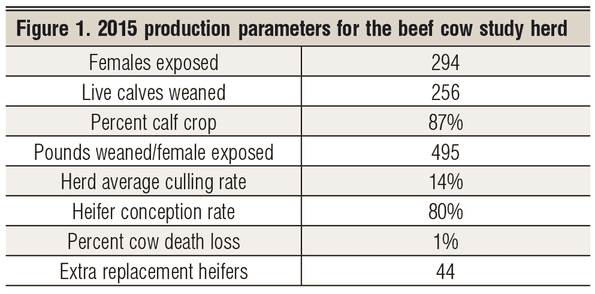

Figure 1 presents the 2015 basic production parameters for this study herd. In 2015, the 294 females exposed (250 cows and 44 replacement heifers) in the previous breeding season weaned 256 live calves, generating an 87% calf crop. The herd weaned 495 pounds of calf per the 294 females exposed.

During 2015, the herd manager culled 14% of the cow herd and experienced a 1% cow death loss. He needed 35 preg-check replacement females to enter back into the herd in fall 2015. With an 80% heifer conception rate, he had to develop 44 replacement heifers to preg-check in fall 2015 to get the needed 35 preg-checked replacements. No extra replacement heifers were developed to expand the herd.

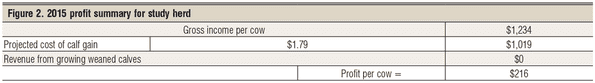

Let’s go right to the calculated bottom line and look at the 2015 profit generated per cow. The calculated gross income for the 2015 year came to $1,234 per cow. Cost per cow came to $1,019, or $1.79 for each pound of calf weaned. (The cost per pound of calf gained gets difficult to calculate, due to the fact that not every cow produces a calf.) Profit per cow totaled $216 (Figure 2).

Profit here is defined as the “earned return to unpaid operator and family labor, operating capital and management.” This is the third-highest in the last 24 years. In order to simplify the comparison with postweaning marketing alternatives, this profit per cow is divided by the percent calf crop to get the profit per calf weaned, which is $248 per calf weaned ($216/0.87 = $248).

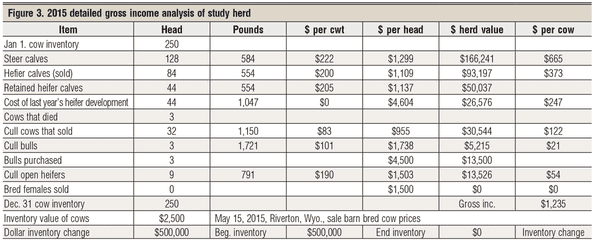

Wait a minute! Last month I reported calf prices were the second-highest on record, and now I am saying that beef cow profits in 2015 are the third-highest in the last 20 years? Why is this? The answer is that the cost of developing a preg-checked replacement heifer in 2015 was record-high. The economic cost of developing 44 preg-check heifers in 2015 came to $97,510, or $2,216 per preg-checked heifer.

These 44 heifer calves held over to be developed in 2015 could have been sold for $70,934 at weaning time in 2014. Add in the $26,576 required to develop these 44 heifer candidates through preg-check in 2015, and the total economic cost of these 44 replacement heifers comes to $97,510. Year 2015 may well go down as the year of the “highest-cost replacements.”

Add in the $13,500 purchase of three replacement bulls at $4,500 per head, and the gross replacement cost per cow comes to $444 per head. This is almost 44% of the total cost of running this beef cow herd in 2015.

This 2015 cost of replacement heifers is the highest replacement cost on record. Replacement costs are projected to drop substantially in 2016. Yes, there were nine open replacement heifers that were sold and their market value is included in the $1,234 gross income per cow (Figure 3).

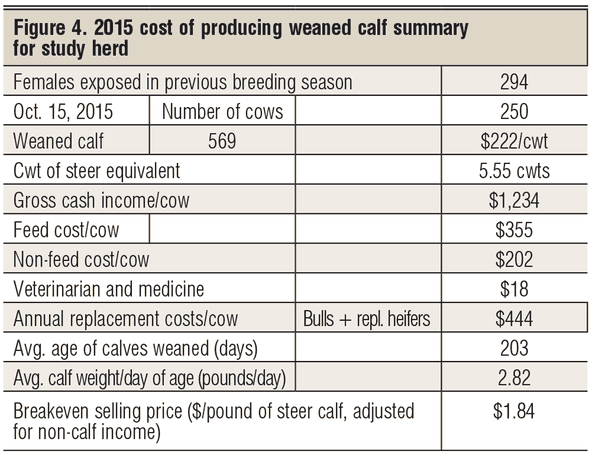

In order to round out the beef cow enterprise summary, I have included a cost of production summary for the 2015 study beef cow herd in Figure 4. The hundredweights of steer equivalents are calculated by dividing the gross income per cow ($1,234) by the price received for steer calves (5.56 = $1,234/$222). These are rounded numbers, as the computer calculated 5.55. The breakeven steer calf price needed to cover all production costs is $184 per cwt. This number is designed to take into account the non-calf income of the beef cow herd and assumes non-calf income stays constant.

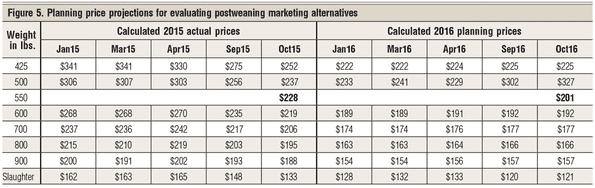

To evaluate postweaning marketing alternatives, we have to come up with a set of planning prices. My suggested planning prices are presented in Figure 5. For example, 2015 weaned steer calves priced at $222 per cwt in October 2015 could be backgrounded to 800 pounds and marketed in January 2016 with a planning price of $163. By pricing these feeder calves into the lot at the weaned selling price of $222, I am able to calculate the projected added profit over selling at weaning.

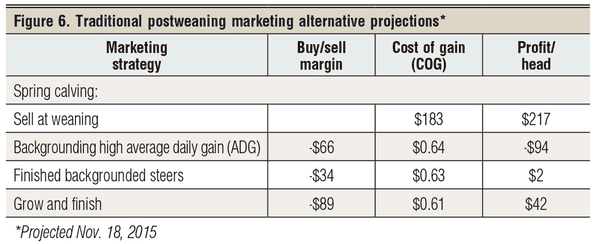

Three traditional marketing alternatives were projected as of mid-November 2015. After 2014, I have now increased the marketing weights of the postweaning enterprises evaluated. I am not at all sure that I should have done this; but the three marketing alternatives evaluated are:

• backgrounding calves at a fairly high rate of gain, to be sold at 875 pounds in February 2016

• finishing the backgrounded calves in a custom feedlot, to be marketed at 1,375 pounds in July 2016

• custom retained ownership until slaughter in a custom feedlot, marketing at 1,328 pounds in May 2016. The key here is hitting the more favorable May market.

The economic projections for these heavier postweaning marketing alternatives are presented in Figure 6. The only marketing alternative that has any appeal now is the retained ownership targeting the May 2016 market. A projected additional $42 profit per calf over and above that earned at weaning is inviting.

This study herd has 212 calves to market. At $42 per head, that’s another potential $8,904 profit. My study herd manager now has to decide if it is worth the price risk to go for the added $8,900. What would you do? A $3 swing in selling prices would wipe out this projected profit. Stay tuned.

Harlan Hughes is a North Dakota State University professor emeritus. He lives in Kuna, Idaho. Reach him at 701-238-9607 or [email protected].

You might also like:

7 ranching operations who lead in stewardship, sustainability

Why we need to let Mother Nature select replacement heifers

Photo Gallery: Laugh with Rubes cow cartoons

Beta agonists wrongly blamed for fatigued cattle syndrome

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)