Ag banks see uptick in business, thanks to livestock loans

Adjusted for inflation, livestock loans reached a historical high for the second quarter while the volume of farm machinery and equipment loans has narrowed to the lowest second-quarter level since 2015.

July 27, 2018

By Cortney Cowley and Ty Kreitman

The cattle market thus far in 2018 has surprised many with its continued strength. And, as beef producers are apt to do when the market is good and cattle numbers are ample, cattle have traded hands.

That means lending activity tends to increase as well as beef producers seek the financing they need to buy cattle and fund the enterprise. In fact, supported by larger loans for livestock, Lending activity in the agricultural sector increased slightly in the second quarter of 2018.

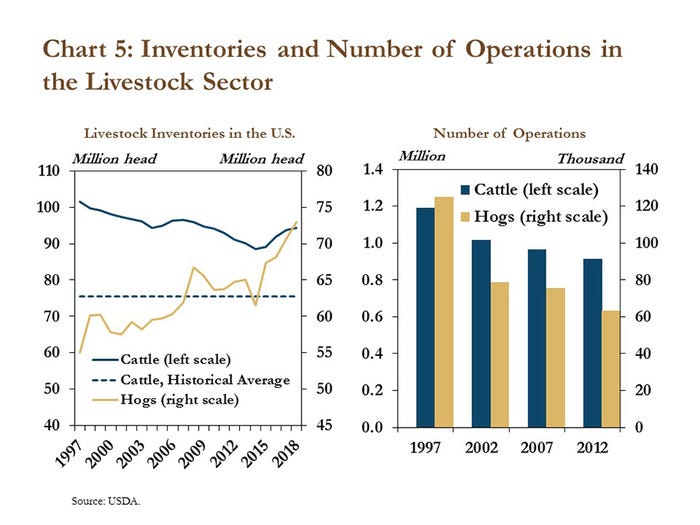

In the short term, higher livestock prices in the first half of the quarter likely were responsible for the increased size of livestock loans. Longer term, the size of livestock loans also has been trending higher, suggesting that consolidation has contributed to fewer, larger farms with larger lending needs. Increased lending on farm operations comes amid increasing risk in the agricultural sector, as expectations of large supplies and trade disputes have contributed to sharp declines in June of prices for most major agricultural commodities.

Second quarter national farm loan data

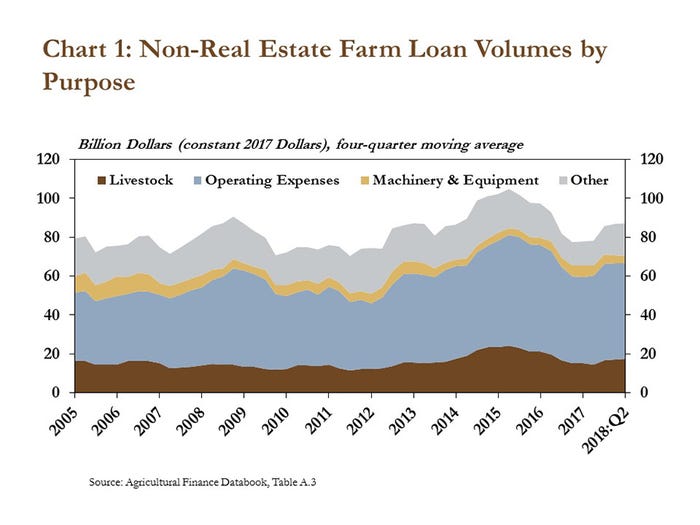

Farm lending activity increased slightly in the second quarter, according to the National Survey of Terms of Lending to Farmers. The total volume of non-real estate farm loans was about 2% higher than the same period last year.

After falling to five-year lows in 2017, the volume of farm loans grew leading into 2018 and has continued to increase in the second quarter. Adjusted for inflation, livestock loans reached a historical high for the second quarter while the volume of farm machinery and equipment loans has narrowed to the lowest second-quarter level since 2015.

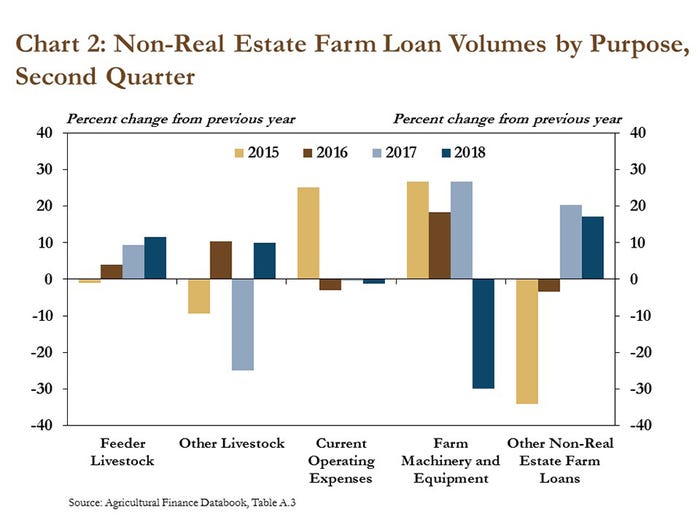

Total loan volumes increased relative to last year, driven primarily by moderate increases in livestock loans. Loans for both feeder and other livestock increased 10% from a year ago. In contrast, farm machinery and equipment lending contracted nearly 30%, following three consecutive years of increases. However, despite declines in other types of loans, the increase in livestock loans was large enough to boost total loan volumes in the second quarter.

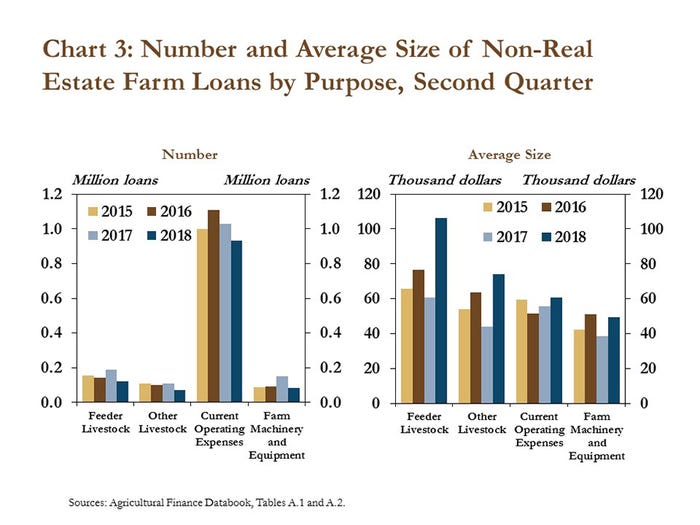

The number of livestock loans originated in the second quarter declined 35%, on average, compared to the previous year. However, the average size of loans for feeder livestock and other livestock increased 75% and 70%, respectively. Larger loans in the livestock sector could be the result of higher prices for feeder and breeding animals in the second quarter and longer-term implications of increasing consolidation.

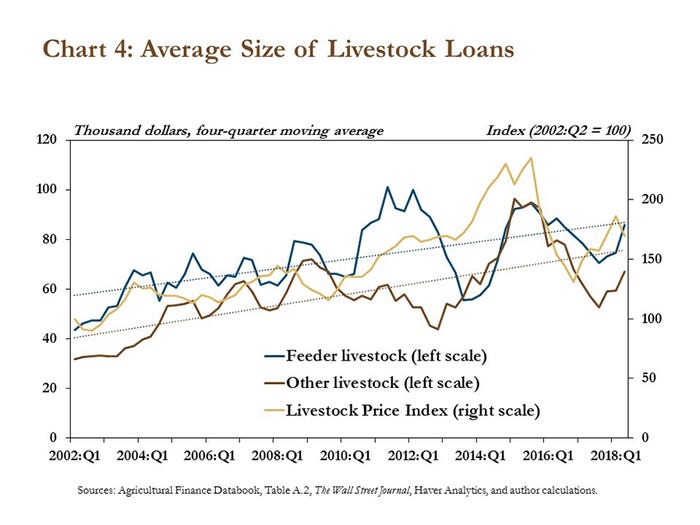

Alongside significant gains in the first quarter, the average size of livestock loans historically has trended higher. Corresponding to steep declines in market prices for livestock in 2016, the average size of livestock loans declined in 2016 and the first half of 2017 but has rebounded since.

In fact, the size of loans to purchase feeder livestock increased back to trend levels in the second quarter of this year. The average size of loans to purchase other livestock has been below trend since the fourth quarter of 2016 but since then has increased for four quarters. Although the actual sizes of livestock loans tend to follow prices for feeder and breeding animals, trend loan sizes could continue to increase in the future due to consolidation.

Increased lending and larger loan sizes in the livestock sector have coincided with higher interest rates on livestock loans. Interest rates on feeder livestock loans have increased 15% from last year, and interest rates on loans to finance other livestock have increased 18% since the first quarter of 2016.

Higher interest rates on larger loans have increased debt obligations for farmers. Although the increase in interest expense has remained relatively small compared with other expenses on farm balance sheets, higher expenses during a period of relatively tighter profit margins (compared to previous years), increased market volatility and trade uncertainty could put additional pressure on some livestock operations.

Cowley is an economist and Kreitman is an assistant economist with the Federal Reserve Bank of Kansas City, Omaha Branch

You May Also Like