Are consumers ready to replace beef from cattle?

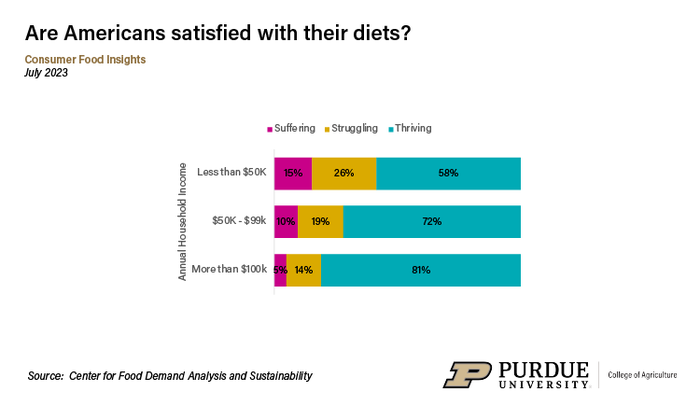

Nearly three of every four Americans continue to report that their food satisfaction is thriving, according to July Consumer Food Insights Report.

August 9, 2023

Consumers who report they are most satisfied with their food consumption also spend the lowest share of their incomes on food, according to the July 2023 Consumer Food Insights Report. The report's July survey also asked consumers how they feel about beef from cattle compared to three meet alternatives: plant-based, cell-cultured and lab-grown.

The survey-based report out of Purdue University's Center for Food Demand Analysis and Sustainability assesses food spending, consumer satisfaction and values, support of agricultural and food policies and trust in information sources. Purdue experts conducted and evaluated the survey, which included 1,200 consumers across the United States.

Nearly three of every four Americans generally continue to report that their food satisfaction is thriving, said the report's lead author, Joseph Balagtas, the new CFDAS director and a professor of agricultural economics at Purdue. The report's consumer behaviors survey results further underscored the significant gap that separates consumers at different levels of food satisfaction.

Center researchers adopted the Cantril Scale of satisfaction from Gallop's Life Evaluation Index. Survey respondents rated their own diets on a 0-10 scale. The categories are: suffering (0-4), struggling (5-6) or thriving (7-10).

Center researchers adopted the Cantril Scale of satisfaction from Gallop's Life Evaluation Index. Survey respondents rated their own diets on a 0-10 scale. The categories are: suffering (0-4), struggling (5-6) or thriving (7-10).

"Consumers who report that they are thriving are more often than not checking the nutrition label on a new product before they buy it, while those who are suffering are only sometimes or rarely checking nutrition labels," Balagtas said. "This gap also relates to consumption choices that are typically thought of as more sustainable or ethical, such as choosing local foods or grass-fed beef."

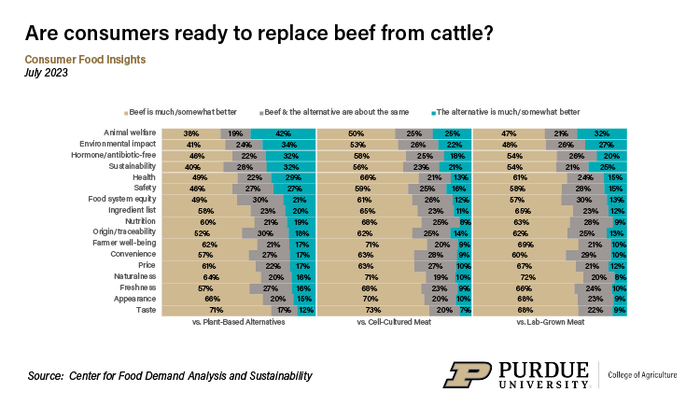

The researchers found that consumers have yet to embrace meat alternatives as better than beef from cattle. The sole exception is that plant-based alternatives are rated higher than beef on the animal-welfare dimension.

"The biggest takeaway from our alternative meat questions is that consumers still overwhelmingly prefer beef from cattle across a wide range of product attributes. This result reinforces the fact that plant-based meat remains a niche product. And while cell-cultured meat has not yet hit the market, our study highlights that marketing — and in particular the naming of a new product or technology — can influence consumer perceptions of the product," Balagtas said.

"The biggest takeaway from our alternative meat questions is that consumers still overwhelmingly prefer beef from cattle across a wide range of product attributes. This result reinforces the fact that plant-based meat remains a niche product. And while cell-cultured meat has not yet hit the market, our study highlights that marketing — and in particular the naming of a new product or technology — can influence consumer perceptions of the product," Balagtas said.

The USDA's Food Safety and Inspection Service has used the term "cell-cultured" in its recent directives on these products. "There is potential for some tension if food companies find that a term like 'lab-grown' markets better," he said.

Additional key results include:

Household food-at-home spending is up 4.6% from July 2022, reaching its highest level yet.

Consumers' predictions for food inflation over the next 12 months have dropped to 3.7%, the lowest recorded by this survey.

Food insecurity is a percentage point lower than last month but higher than the 2022 average for the third straight month.

"With food-at-home spending continuing to drive up total food spending at the same time that consumers predict annual food inflation will drop below 4%, we could continue to describe consumers as cautiously optimistic," said Sam Polzin, a food and agriculture survey scientist for the center and co-author of the report. "However, it seems that the government measure of food inflation is now dropping faster than consumer expectations for inflation, which signals that consumers are potentially becoming more accustomed to higher inflation."

He also noted that food spending has been much more variable for consumers who report that they are suffering on the food satisfaction index. It appears that there is a certain group of consumers that has struggled to cope with the high-price environment while more well-off consumers can maintain a stable level of consumption.

"This trend also relates to our food insecurity measure, as consumers we describe as struggling have faced both higher and more variable insecurity. But this group of consumers is relatively smaller, so changes in their ability to purchase food is more likely to show up as larger swings in our sample," Polzin said.

The sustainable diets section of the report shows consumers who are considered to be thriving are far surpassing consumers who are suffering on the sustainable food purchasing index. For example, the researchers noted a somewhat unexpected gap of more than 20 points in achieving nutrition goals as a factor that separates consumers who are most and least satisfied with their diets.

"We see further that the most satisfied consumers also value nutrition much more, nearly as much as the taste of their food," Polzin said. "These trends help demonstrate that considering nutrition in food consumption is a fairly big privilege afforded to those with more resources."

The researchers also saw other expected trends, including the most unsatisfied consumers placing the most value on food affordability. This aligns with the conclusion that purchasing power relates closely to food satisfaction, they noted.

You May Also Like