Battle at the meat case: Relative retail meat prices

Beef’s relative retail price continues to drop. Is that a good sign or does it portend future weakness in the live cattle markets?

December 1, 2016

Last week’s Industry At A Glance focused on the current trend around beef demand. The discussion included the most current update of quarterly beef demand numbers reported by Kansas State University. As noted, the data of late is disappointing. The beef demand index peaked in the fourth quarter of 2014 at nearly 94; the most recent reading from the third quarter of 2016 was 88.31.

Part of that discussion focused on the principles surrounding aggregate demand. That is, aggregate demand is a function of both quantity and price driven by five key factors:

Population

Income

Tastes/preferences

Expectations

The price of other goods

And for beef, the “price of other goods” means potential substitution primarily from pork and poultry. If consumers perceive the price/value relationship to be in favor of the competitors, they’ll choose the substitution versus beef. That discussion inherently involves the relative price trends between beef and its competitors.

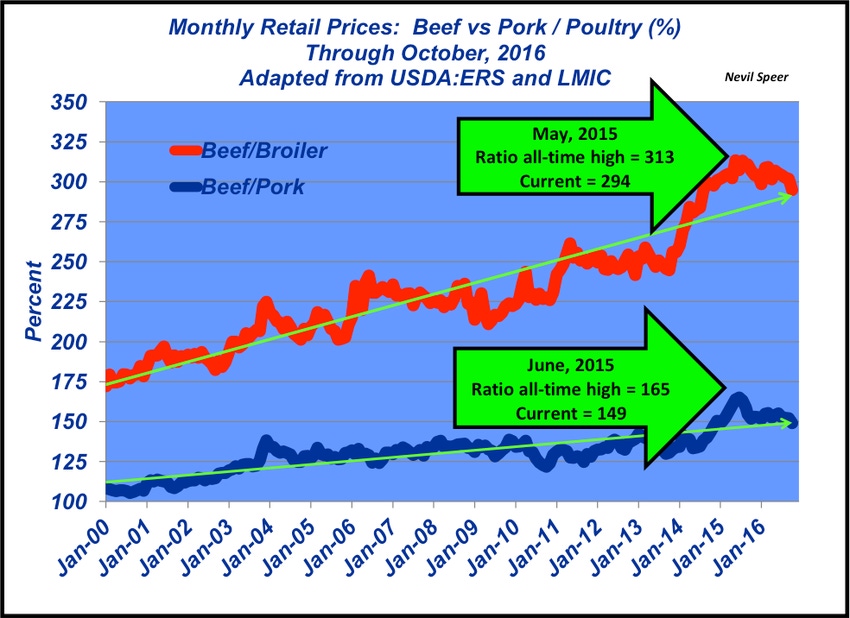

As such, this week’s graph highlights that trend through October. Beef’s relative retail price has come down from previous high-water marks established during the summer of 2015 and currently stands right in line with the long-term trend for both pork and poultry, respectively.

The current trend is somewhat of a double-edged sword, however. On one hand, it’s a favorable sign providing some cushion for those concerned about beef’s retail pricing in recent years; beef is becoming more price competitive in the marketplace versus pork and poultry. On the other hand, the trend could be perceived as a sign of weakness; beef is losing its pricing power in the meat case – it was beef’s pricing power that served to underpin the cutout and live prices in recent years.

What’s your perception of the current trend? Are softer prices, compared to pork and poultry, serving to keep consumers loyal to beef? Or is it an ominous sign about beef’s competitiveness in the marketplace? Where do you see the relative prices headed in the months ahead? Leave your thoughts in the comments section below.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

About the Author(s)

You May Also Like