Beef imports and exports from 2010 through 2019

International trade has become a contentious issue recently. But it’s essential to the beef business.

June 10, 2020

You don’t have to look very far to find something related to COVID and the cattle market. Amidst all that noise, it’s easy to get lost in anecdotes and rhetoric. As a result, this column has been intentional in recent months about providing a longer-run picture of beef industry dynamics to help cut through some of the noise.

Much of the coverage has revolved around international trade. Undoubtedly, it’s one of the most contentious issues within the industry. And it’s one that can be seemingly complex. Therefore, this week’s graph provides broader, bottom-line context around the topic

It’s important to note, talking about “beef” imports and exports can take on a lot of different meanings. Beef products come in a wide variety of forms—variety meats, wholesale primals, beef trimmings, etc. While we often talk about trade in a general fashion, that’s not really the case: there are real qualitative differences between the types of products that get imported versus those that are exported.

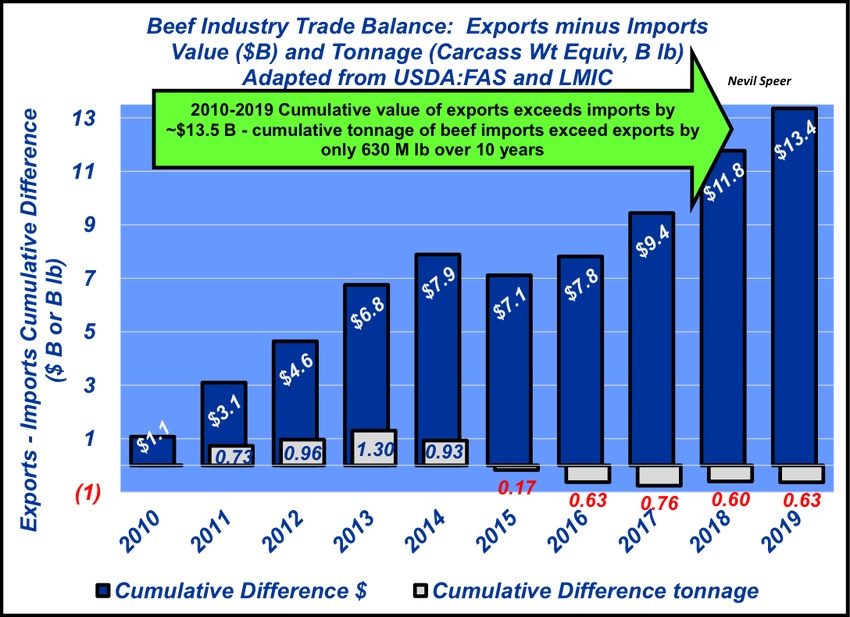

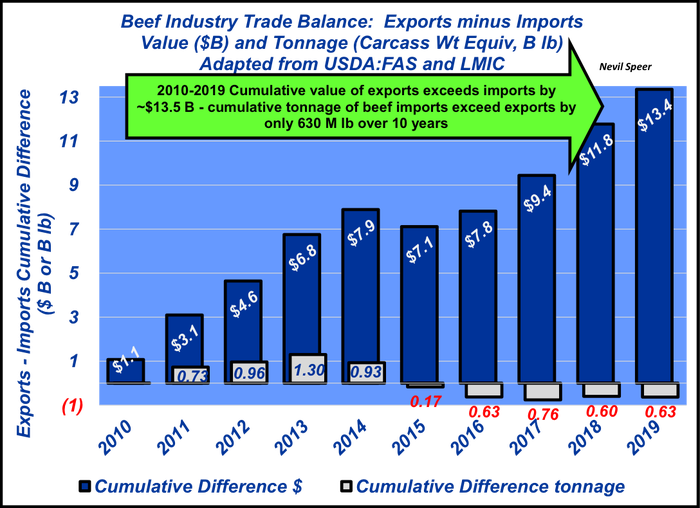

For now, though, let’s lump everything together as “beef” and look at international trade quantitatively. This week’s illustration highlights the cumulative trade balance (exports minus imports) over time from two different perspectives: tonnage/volume basis (carcass weight equivalent), and value/dollar basis. It's important to note, none of this discussion addresses the influence cattle imports and their potential market impact; more on that topic next week.

First, the tonnage or volume basis. Between 2010 and 2019, imports of beef and veal (carcass weight basis) exceeded exports by 630 million pounds, resulting in a negative trade balance. But here’s where perspective is especially important.

The negative trade balance equates to an average of 63 million pounds annually—or roughly 1.2 million pounds per week. Now some context: the beef industry averaged nearly 486 million pounds of beef production annually during the same 10-year period. Hence, trade’s marginal contribution of “beef” tonnage to the nation’s beef supply is immaterial—about 0.2%.

Second, the value or dollar perspective. This is what really matters; it’s dollars, not pounds, that establishes opportunity. During the last 10 years, the beef industry’s cumulative trade balance is nearly $13.5 billion to the positive; export value exceeds import value. The benefit is self-explanatory.

Some argue international trade is unnecessary and detrimental, asking, “Why are we importing that cheap, international beef?” But trade is a two-way street.

If the U.S. were to ban imports, there’d be certain retribution: trading partners would in turn close their doors to U.S. beef, and end opportunity to profit from that market access. With that knowledge, it’s a safe bet no producer wants to forego the trade premium stemming from international trade.

Now let’s circle back to the qualitative discussion (distinguishing apples and oranges). That’s especially important with respect to imported beef products.

Despite the common mischaracterization around “beef imports,” the bulk of imported beef consists primarily of lean beef and/or trimmings. Those imports aren’t competitive (apples to apples); they’re complementary (apples and oranges), being blended with 50/50 trim to make saleable ground beef.

In the absence of that imported product, beef trim from fed steers and heifers would become far less valuable, thus stripping value from the fed cattle market.

To summarize:

From a volume perspective, international trade is essentially a wash.

Most significant, from a dollar perspective, international trade proves advantageous and institutes substantial benefit for beef producers.

With that in mind, on both sides of the ledger (imports and exports), international trade creates value; hence, the incentive to establish such transactions.

Nevil Speer is based in Bowling Green, Ky. and serves as director of industry relations for Where Food Comes From (WFCF). The views and opinions expressed herein do not necessarily reflect those of WFCF or its shareholders. He can be reached at [email protected]. The opinions of the author are not necessarily those of beefmagazine.com or Farm Progress.

About the Author(s)

You May Also Like