BEEF Reader Survey Finds Both Optimism And Concern

BEEF readers have a strong positive outlook for the beef business in 2013, but are decidedly less optimistic about the nation’s direction.

Will Rogers, in one of his many commentaries on the state of U.S. politics, once lifted his eyes to the heavens in mock seriousness and said: “Congress meets tomorrow morning. Let us all pray: Oh Lord, give us strength to bear that which is about to be inflicted upon us. Be merciful with them, oh Lord, for they know not what they’re doing. Amen.”

While BEEF readers may get a bit of comic relief from the cowboy philosopher, they’re dead serious about his sentiments, which is reflected in their concern about the direction that America is headed at present. But when it comes to the future of the beef business, their outlook is much brighter.

Those are the two major takeaways from BEEF magazine’s annual outlook survey of its readers, conducted at the end of each year to gauge the sentiments of the nation’s cattle business on the industry, politics and the future of each.

Political outlook negative

Those who follow the weekly reader polls at beefmagazine.com will find no surprises in the responses to whether readers see the outcome of last November’s elections as positive or negative. Consistently a conservative group, 65.6% of readers said the results were negative, while 21.9% said it was neutral and 5.3% said it was positive. Another 7.2% of survey respondents didn’t know.

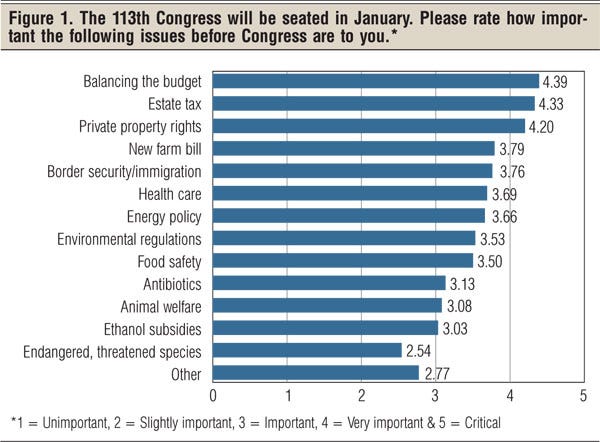

With the 113th Congress now in session, BEEF readers were asked to rank the importance of issues before the House and Senate, with 1 being unimportant and 5 being critical. The top three issues are balancing the budget, with an average response of 4.39, estate tax at 4.33, and private property rights at 4.20.

Coming in right behind with an average ranking of important to very important were a number of issues: a new farm bill at 3.79; border security/immigration at 3.76; health care at 3.69; energy policy at 3.66; environmental regulations at 3.53; food safety at 3.50; antibiotics at 3.13; animal welfare at 3.08; and ethanol subsidies at 3.03 (Figure 1).

Whether or not these issues will be addressed to the satisfaction of cattlemen remains to be seen, but readers generally have deep concerns about the future. “Unless the direction that Washington is taking us is not changed, we will never again be what my father fought for at Normandy and the Bulge,” one reader commented. Several mentioned taxes and tax reform. “Congress needs to address serious spending cuts. More taxation is not the answer,” another reader commented.

Industry outlook is positive

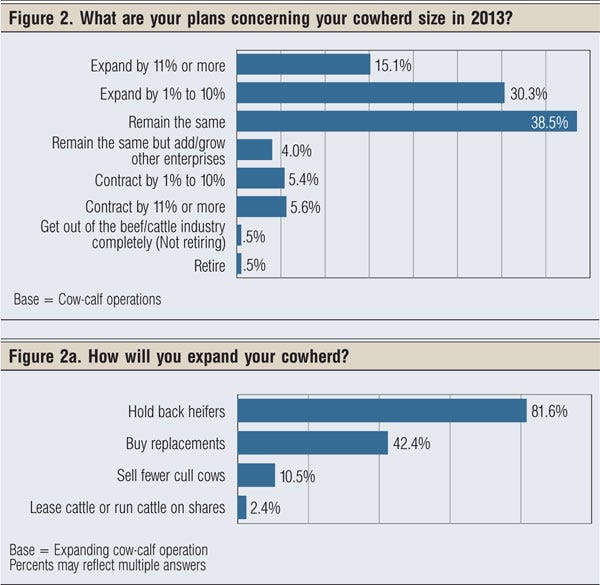

However, when looking ahead at the potential in the beef business, BEEF readers are decidedly optimistic. When asked “What are your plans concerning your cowherd in 2013?” 38.5% say they plan to remain the same, 30.3% plan to expand by 1-10%, and 15.1% plan to expand by 11% or more (Figure 2).

Given the drought-induced liquidation of the past several years, those are optimistic numbers indeed.

And if BEEF readers are any indication, cattlemen have done all the liquidation they care for. Only 5.4% indicate they plan to decrease the size of their cowherd by 1-10%, and an additional 5.6% plan to cut back by 11% or more.

Only 0.5% plan to get out of the cow business (but not retire), while another 0.5% plan to hang up their spurs and take life a little easier than wrangling a bunch of cattle permits. Only 4% plan to keep their cowherd constant, but grow other enterprises such as stockers, retained ownership and commercial heifer development.

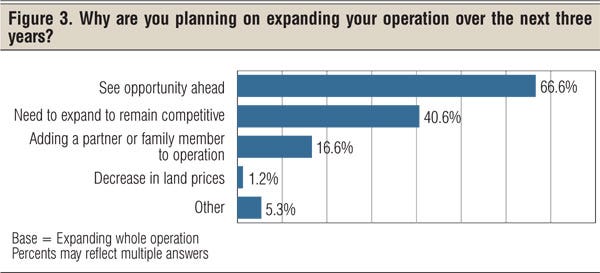

The majority of those planning to expand believe the future is bright. Of those producers planning to grow their herd, 66.9% are doing so because they see opportunity ahead. Indeed, with the smallest cowherd in more than a half-century, high calf and feeder prices will remain a bright spot in the business. Another 38.5% say they need to expand to remain competitive; with input costs naggingly high, many ranchers see the need to get bigger simply to stay in business (Figure 3).

And it appears cattlemen are going to expand the old-fashioned way – by retaining heifers. In fact, 81.6% plan to do just that, while 42.2% say they’ll buy replacements, and 10.5% will sell fewer cull cows. The total equals more than 100% because most ranchers will do some combination of all three in an effort to keep cattle in their pastures (Figure 2a).

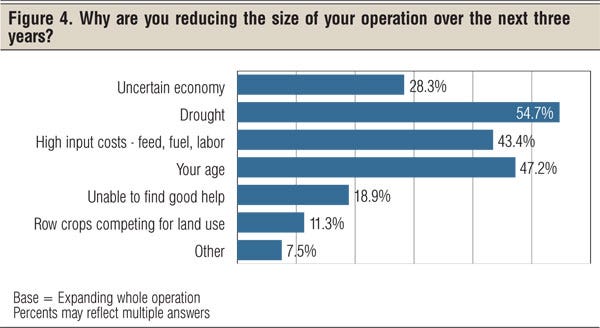

Those planning to reduce operational size in the coming years attribute it to several factors. Most are still dealing with the devastation of drought, with 54.7% listing that as their reason for cutting back. Close behind, at 47.2%, is the producer’s age, followed by high input costs for feed, fuel and labor at 43.4%, and an uncertain economy at 28.3%. Another 18.9% say they’re unable to find good help, 11.3% say row crops are competing for the land, and 7.5% have other reasons (Figure 4).

The majority (52%) of those who plan to just keep on keepin’ on at their present size say they have enough land and cows for their present situation and don’t want to hire additional labor. Another 39.9% say they’ll maintain the ranch regardless of market ups and downs. However, 11.4% see better times ahead, but don’t plan to either expand or cut back. And 9.7% have other reasons.

While a small number of respondents say they plan to exit the cattle business, they plan to keep the land in production. A total of 30.8% plan to keep the land but not raise cattle, while 30.8% will rent the land to a family member. Another 23.1% will rent the land to a non-family member, 7.7% will sell the land to a family member, and 7.7% will sell to someone outside the family.

The big three trifecta of government regulations, drought and high input costs were the reasons given for exiting cattle production. Overregulation was the number-one factor at 53.8%, with drought at 42.3%, and high input costs at 38.5%.

Both optimism and foreboding

Indeed, BEEF’s 2013 outlook survey tells two tales – a pessimistic and fearful story for the nation as a whole, and an upbeat, optimistic tome about the cattle business. Perhaps this respondent summed both emotions best:

“I love cattle and have my life’s work thus far in them. I love the land I live on, which has been in my family since 1835. I care none for selling my cows or land for any price. I care deeply for both, and work continuously to improve them. Any attack on them is an attack on me, and a mere paragraph cannot put into understanding what it has taken to get to the point I am. I’m not special; there are many more that have worked, sacrificed, achieved and done far more than I, and I am proud of them. A cattle operation can be as much a work of art as any painting.

“If my life’s work is to ever be destroyed, I want at least all who watch, and those involved, to have a common understanding that, for a time, there was a great testimony to land, animal and human working together, so that people question, ‘was it really worth destroying?’”

Bull prices to rise?

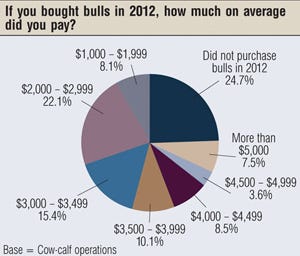

BEEF readers expect the strong market for bulls seen the last year or two to continue into 2013. Of those who bought bulls in 2012, 22.1% paid $2,000 to $2,999; 15.4% paid $3,000 to $3,499; and 10.1% paid from $3,500 to $3,999. A few (8.1%) went bargain shopping, paying from $1,000 to $1,999, but just as many (8.5%) paid from $4,000 to $4,499, while 3.6% paid from $4,500 to $4,999, and 7.5% paid more than $5,000.

BEEF readers expect the strong market for bulls seen the last year or two to continue into 2013. Of those who bought bulls in 2012, 22.1% paid $2,000 to $2,999; 15.4% paid $3,000 to $3,499; and 10.1% paid from $3,500 to $3,999. A few (8.1%) went bargain shopping, paying from $1,000 to $1,999, but just as many (8.5%) paid from $4,000 to $4,499, while 3.6% paid from $4,500 to $4,999, and 7.5% paid more than $5,000.

Those who plan to buy bulls in 2013 don’t expect prices to back up any. Most (51.3%) think prices will resemble those of 2012, while 25.9% expect higher prices. Only 2.4% expect prices to be less than 2012, while 20.4% don’t plan to buy bulls in 2013.

The majority of those who anticipate higher bull prices in 2013, at 57.7%, think prices will jump 10-15%, while 30.3% expect an increase of 10% or less. Only 9.1% expect prices to increase 16-20% and 2.9% expect prices to increase by more than 20%.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)