COVID-19 felt in beef markets around the world

Beef Outlook: U.S. consumers need to spend more money on beef as exports tighten.

October 5, 2020

Just as every U.S. market projection for the past few months has contained a disclaimer or an assumption about how future COVID-19 impacts could affect the outlook, similar uncertainty also exists in many other countries around the world.

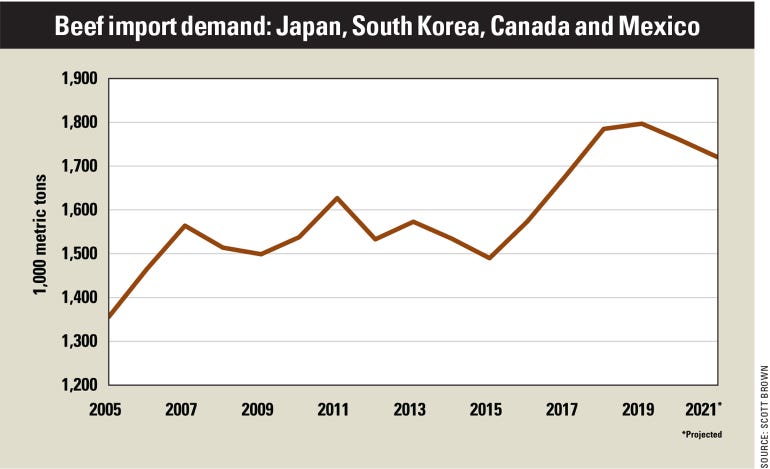

With 70% to 75% of U.S. beef exports destined for the four nations of Japan, South Korea, Canada and Mexico, it is worthwhile to consider some of the developments that have occurred in these important markets and how they may affect international demand for U.S. beef.

One of the best sources of public information for agriculture markets is the Global Agricultural Information Network maintained by USDA’s Foreign Agricultural Service.

Related: Complete coronavirus coverage

Discussions of beef market activity and expectations in many countries have recently been updated, and in addition to identifying what has and is expected to drive the market, supply and demand projections for 2021 often are included.

Beef demand varies by country

Recent reports all identify COVID-19 as a driver of beef markets this year and next, although the pandemic’s effect on the demand for U.S. beef differs around the world. For instance, beef import demand in Japan is expected to remain relatively flat as there is an industry desire to keep stock levels up to prepare for any future market shocks, especially with the Tokyo Summer Olympics postponed to 2021.

Meanwhile, imported beef demand took a larger hit in South Korea, where restaurants use a larger percentage of imported beef than grocery stores, and the pandemic has primarily negatively affected restaurant purchases.

Canada is set to require more beef imports this year because of processing disruptions and elevated ground beef demand, while Mexico’s beef import demand has declined because of negative economic conditions and numerous restaurant closures.

A look at the competition

In addition to the direct effects of COVID-19, gloomy economic outlooks weigh on future beef demand in many markets, just as is the case in the U.S.

The Organization for Economic Cooperation and Development, an international organization that looks at policy challenges, recently released its interim economic outlook forecast.

It projects recovery in 2021 gross domestic product, or GDP, growth. It still leaves the 2021 GDP level below that of 2019 in three of the four top U.S. beef markets.

Relative to 2019, GDP in 2021 is projected 7.5% lower in Mexico, 4.4% weaker in Japan, down 2% in Canada, and only 2.1% higher in South Korea.

Exchange rates also play a factor. While the U.S. dollar has weakened against most currencies since this spring, it is still more than 10% stronger against the Mexican peso relative to 2019 through the first few weeks of September. A stronger dollar weakens the competitive position of U.S. beef in international markets relative to other suppliers.

While there are bright spots when it comes to U.S. beef export projections — herd rebuilding in Australia has led to tight exportable beef supplies there, and growing beef demand in China has not only resulted in a rise in U.S. shipments to that market, but also has soaked up exports from some U.S. competitors — total beef import demand for the traditional top four U.S. markets is expected to be weaker through 2021.

This will continue to pressure U.S. beef and cattle prices and place even more importance on U.S. consumer spending for beef.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

About the Author(s)

You May Also Like