Dairy exports to Canada have NAFTA implications

One of the first trade grenades launched by President Trump was aimed at Canadian dairy producers who, predictably, reacted loudly. What’s the big deal?

May 8, 2017

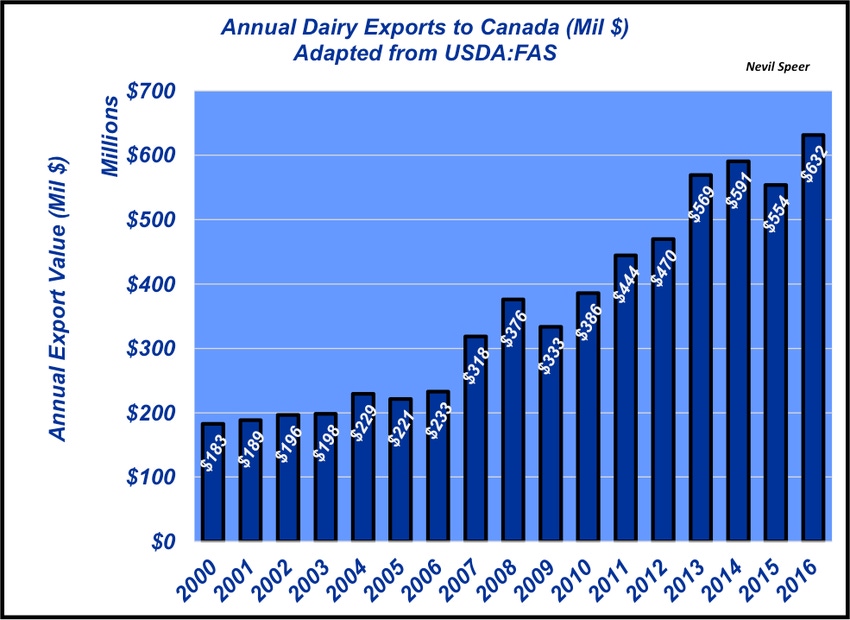

Canadian dairy trade has been a major focus in the news in recent weeks. As such, this week’s illustration provides some backdrop to the controversy. Annual dairy exports to Canada began to rise in 2007 and have been largely stronger year over year ever since. Last year’s export value to Canada for dairy products equaled $632 million—that’s nearly double 2007’s annual value and 3.5 times bigger versus 2000.

Much of the increase in exports has come in the form of ultra-filtered milk. The milk is passed through a specialized membrane that captures larger protein and fat molecules. It’s that concentrated protein component that’s especially important to making cheese. Additionally, the process removes much of the excess water, enabling it to be transported far more economically than would be possible otherwise.

But more important to the trade controversy, ultra-filtration technology was adopted after NAFTA was implemented. As such, shipment of ultra-filtered component across the border is not subject to normal milk tariffs in Canada.

That’s made U.S. ultra-filtered milk price competitive in the Canadian marketplace—especially considering improved cheese yields using the U.S. product. Therefore, Canadian cheese producers have readily imported the product. Hence, the large increase in export value outlined above.

Meanwhile, Canada has now created a new class of milk – Class 7 – for the purpose of categorizing high-protein dairy products (i.e. ultra-filtered milk). The new category enables Canadian border officials to recognize the product, and thereby enforce an import tariff on U.S. milk. As a result, U.S. ultra-filtered milk is no longer price competitive and shipments have largely ceased.

All of this has rightfully received lots of attention. It’s a very important topic for the dairy industry—and could potentially have ramifications around NAFTA in general. How do you perceive the controversy? Do you think it could have secondary ramifications to beef and/or pork trade with Canada? What would you recommend to the Trump administration to help resolve this issue for dairy producers? Leave your thoughts in the comment section below.

Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

About the Author(s)

You May Also Like