Exports are key to managing total meat supplies

Because meat is perishable, all production that isn’t exported must be cleared through the domestic market.

August 1, 2016

Annual meat supply is a function of beginning stocks (cold storage), domestic production, imports and exports. And because meat is effectively a perishable product, all production that isn’t exported must be cleared on the domestic market, along with all sources of imported meat adding to the domestic supply.

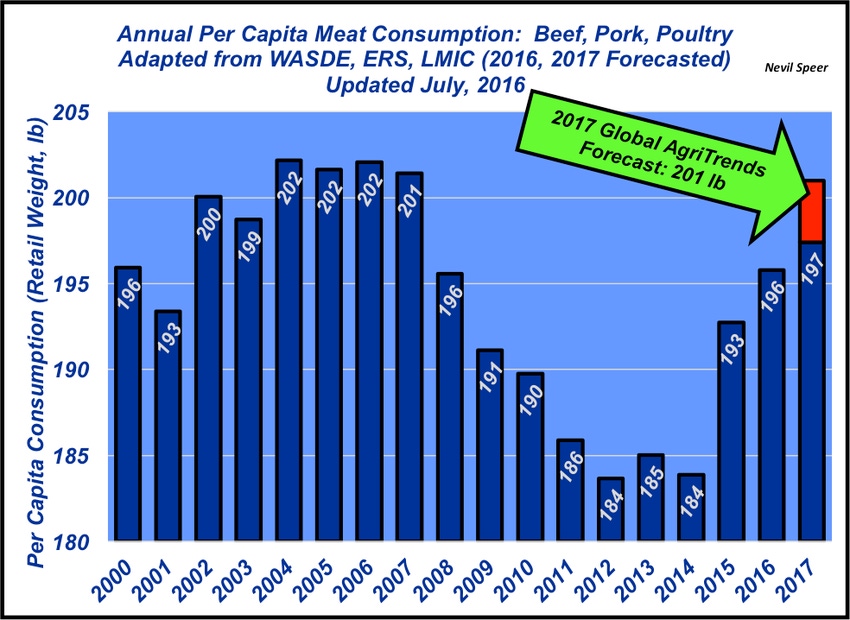

The challenge, on a weekly and monthly basis, is finding the market-clearing price to ensure that product keeps moving in a relatively timely manner and protecting against significant buildup of inventory. With that in mind, this week’s graph reflects total meat supply (disappearance) since 2000 – expressed as per capita consumption.

The meat industry experienced a sharp decline during the past decade. However, that trend reversed sharply in 2015 and is likely to experience further upside in 2016. That largely stems from bigger production: USDA is currently forecasting annual beef, pork and poultry production up 1.25, 0.5 and 1.02 billion pounds, respectively, in 2016.

With expanding production comes the requirement for growing access to international markets. Stated another way, export slowdowns could result in even bigger supply within the domestic market; that is, product stays home versus being shipped to other countries. And if exports begin to slow, the required domestic clearance could become much larger versus the current USDA forecasts, mandating lower prices.

That very challenge is highlighted in this week’s graph and aptly articulated by Global AgriTrends in their recent newsletter (mid-July, 2016):

…production is not the only factor in supply. Exports and imports also move production supplies. And on a year with these production gains ahead, trade becomes much more critical to prices.

U.S. imports are relatively small for poultry (<1% of consumption) but are 5% of pork consumption and 11% of beef consumption…Our forecasts show 2017 adding an additional +6.1 pounds per capita [201 pounds in 2017 vs 195 pounds in 2016].

So in three years (2015-2017), we see U.S. meat & poultry supplies rising by +17 pounds per capita [from 184 pounds in 2014]. That undoes the prior seven years of overall net supply declines of ~17 pounds per capita. Can exports save the markets from impending supply pressure? ...the weak global economy and petro-dollar-decline has stalled overseas demand.

How do you foresee U.S. competitiveness shaping up for beef, pork and poultry during the second half of 2016 and into 2017? And if that occurs, how do you perceive beef’s pricing power amidst those larger supplies? How might that drive price differences between steak and ground beef; or the Choice/Select spread? Leave your thoughts in the comments section below.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

You might also like:

Enjoy a few laughs with Rubes cartoons

5 tips for preventing, diagnosing & treating foot rot

Seven keys to ranch profitability

8 apps for ranchers recommended by ranchers

9 new pickups for the ranch in 2016

Do your cattle fit your country? Here's how to tell

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)