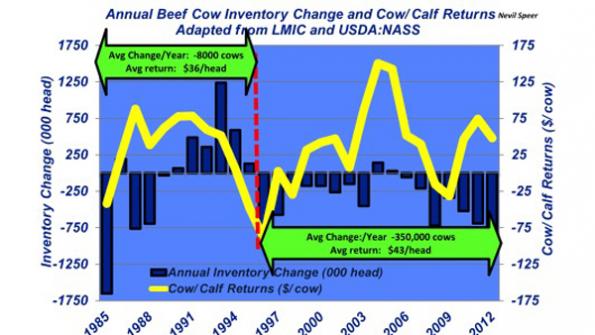

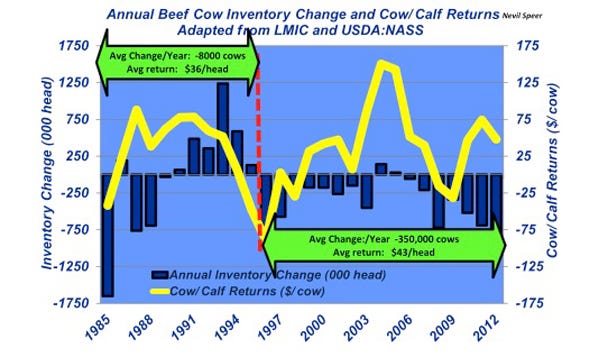

Industry At A Glance: Annual Beef Cow Inventory & Cow-Calf Returns

February 14, 2013

Last week’s Industry At A Glance focused on USDA’s most recent cattle inventory report and the U.S. cowherd liquidation that has been ongoing since 1996. In fact, 2013’s inventory mark represents the sell-off of 6 million cows during the past 17 years – or the equivalent of about 350,000 head/year. This brings up a few thoughts:

Producers have proven far less responsive to higher prices during the 17-year contraction. Despite some relatively favorable years in the middle of that run, cow-calf operators didn’t keep back heifers and/or reduce culling rates in the typical fashion of previous 10-year cattle cycles. That’s highlighted in the graph above. Clearly, drought has played a major role in recent years.

Secondly, changes in the business environment, including higher feed and overall operating costs, have impacted longer-term decision making (return/cow is almost equal to the previous 11 years).

Third, access to capital has also influenced the decline in cow numbers.

And, finally, there’s also the consideration of producer demographics and long-term risk/reward considerations when making investment into replacement heifers and/or cows.

So, while prices have been high, they apparently haven’t been high enough. The ultimate question becomes, given the new operating dynamics, what level of return will be required to reverse this trend and encourage producers to begin rebuilding the cowherd? In other words, what level of annual return would motivate you to assume risk in retaining more heifers and/or investing in additional cows? Leave your thoughts in the comments section below.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)