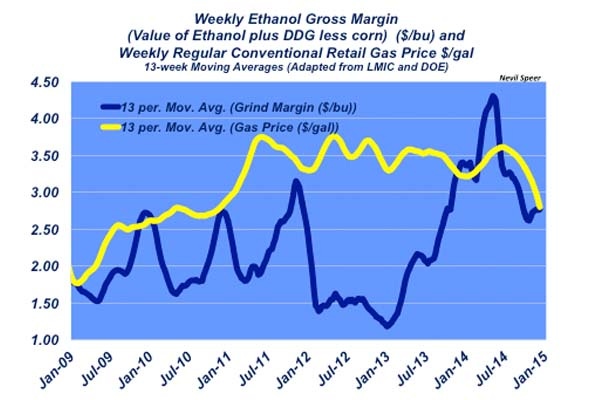

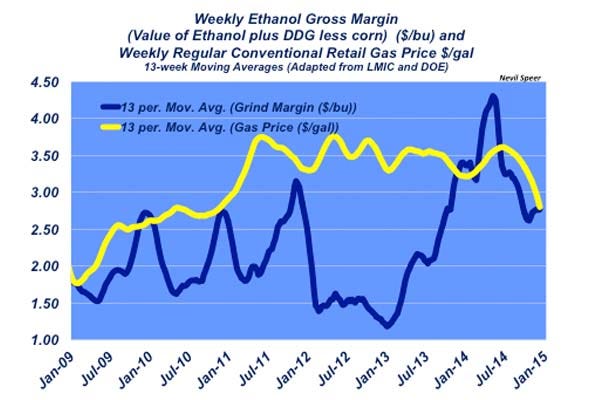

Industry At A Glance: Ethanol margins narrow dramatically

Gross margins for ethanol production have trended sharply lower in recent months, while ethanol plants have also had to deal with a stronger dollar and a stubborn corn market.

January 15, 2015

Several weeks ago, Industry At A Glance focused on the potential influence of declining gas on consumer behavior and the beef industry. Meanwhile, plunging fuel prices have also caused the ethanol industry to receive a lot of attention in recent weeks.

Ethanol industry revenue is derived from the sales of fuel (~2.8 gals. of ethanol per bushel of corn) and distillers grain (~17.75 lbs. per bushel of corn). On the flip side, production costs are overwhelmingly dictated by the price of corn. Therefore, calculation of gross profit is relatively straightforward. Gross profit must then cover fixed costs, variable production costs (e.g., natural gas), return to management, return to investment and profit.

The chart highlights moving average trends for ethanol plant gross margin (basis Iowa) and fuel prices through 2014. Gross margins have trended sharply lower in recent months. Meanwhile, ethanol plants have also had to deal with a stronger dollar (slowing down exports) and a stubborn corn market.

How do you perceive the influence of lower fuel prices on the ethanol industry? How might this play out considering other dynamics around foreign exchange and the overall corn market? If tighter ethanol margins become a prolonged reality, how might that affect the livestock industry going forward? Leave your thoughts in the comments section below.

You might also like:

70 photos honor the hardworking cowboys on the ranch

It's the cowboys turn in the market driver's seat

Seedstock 100: Meet the U.S. cattle industry's biggest bull operation

5 biggest themes for the U.S. cattle industry in 2014

9 ranch management concepts to improve your ranch

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)