Is ground beef losing out to pork and poultry?

Are consumers showing signs of ground beef fatigue?

September 29, 2016

Last February, Industry At A Glance featured shifting dynamics in the beef case. Specifically, the retail market was beginning to show signs of ground beef fatigue and that reality was causing some challenges for both the wholesale and fed markets. At the time, Cattle Buyers Weekly (CBW) explained that,

“Retailers featured beef aggressively in January, especially ground beef. But sales of this critical category were weaker than expected. Consumers have become a little tired of ground beef after having to trade down to it during the 2009-2010 recession, say analysts. They have been eating more pork and chicken, especially as they remain cheaper than beef. Ground beef is no longer their “go to” protein, even in hamburger form, say analysts.

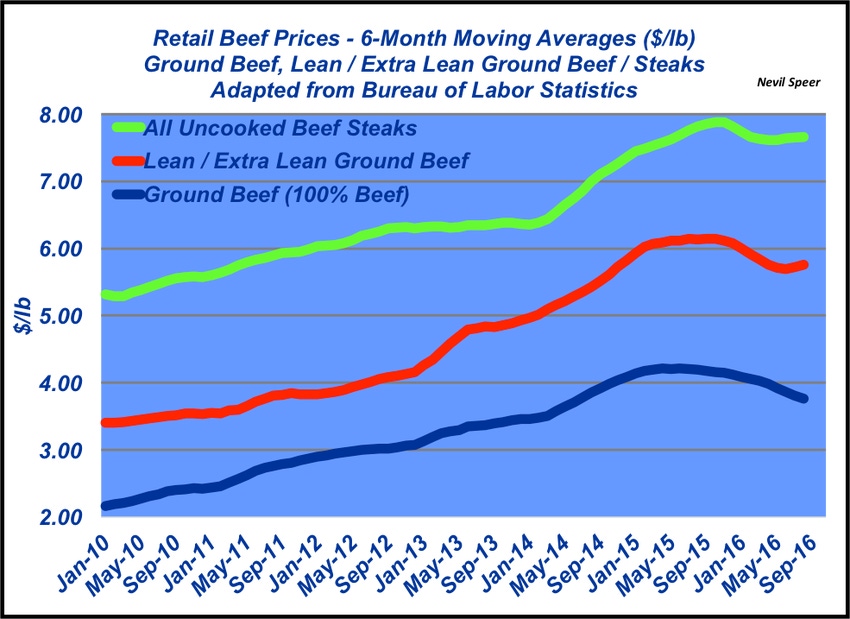

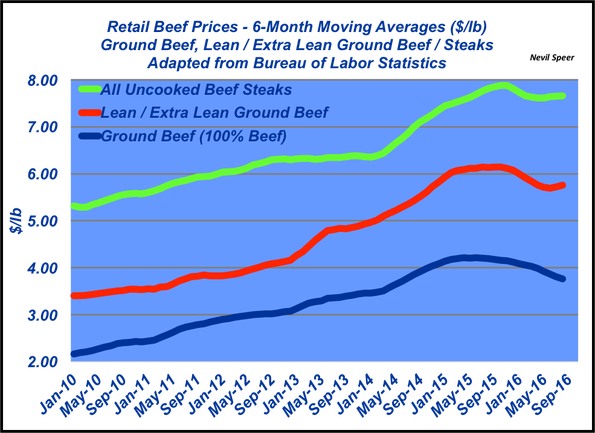

Now that summer’s over, this is an opportune time to review pricing dynamics within the retail beef case. This week’s illustration features a comparison among six-month moving averages (to remove month-to-month variation) for ground beef, lean and extra lean ground beef and uncooked steaks.

Several distinct trends are evident. First, retail prices for all three products peaked in 2015. Second, and not surprisingly, beef retail prices have since trended in a negative direction.

However, most pertinent to this discussion is that the downward shift is variable between offerings:

The current six month moving average for steaks is running at $7.67 per pound versus the peak of $7.88 per pound in October and November 2015. As such, the current average is around 97% of last year’s peak price.

Meanwhile, the lean and extra lean ground beef moving average peaked in July 2015 at $6.15 per pound. The average through August 2016 is $5.76 per pound – or around 94% of last year’s peak.

Lastly, the general, non-lean ground beef category slipped the most. The six month moving average now stands at $3.76 per pound – just 89% of last spring’s peak of $4.21per pound.

As such, it appears CBW’s observations about the market remain intact. That’s an important development. There’s increased pricing pressure because of additional supply from all three sectors (beef, pork and poultry). And that additional supply is pressing hardest on the low-end and most commoditized sector of all – ground beef, with the lean and extra lean products faring better in the face of that pressure. Meanwhile, the higher end of the market in terms of both cuts and quality has proven more successful in fending off pricing pressure.

For more discussion on the last aspect see:

With those comments in mind, do you perceive the market will see even greater pricing diversion in the future? Or will these categories come back into line in the near future? Does the trend represent greater price consciousness among consumers when deciding between products at the bottom end of the protein market? Meanwhile, can high-end, differentiated beef products maintain their pricing power going forward? Leave your thoughts in the comment section below.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

You might also like:

Young ranchers, listen up: 8 tips from an old-timer on how to succeed in ranching

13 utility tractors that will boost efficiency in 2016

Burke Teichert: How to cull the right cow without keeping records

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)