Let’s play a game of cattle market What Ifs

COVID-19 has decimated cattle markets. Is it time for a change?

It’s no longer a matter of debate—COVID-19 is real and it’s bad. Cattle markets have been decimated while wholesale and retail beef prices are reaching rocket-propelled heights.

Assigning blame gets us nowhere but if you must, blame the coronavirus. The market is functioning as it should, even though it’s become an ugly, depressing and devastating phenomenon. That has led to several proposals to change how cattle are bought and sold.

So, if we really want to change the cattle market, consider this: What if the cash price for fed cattle was determined by some sort of formula that takes wholesale and retail prices into account? We’d have an entirely different market and an entirely different mood and psychology in the country if that were the case now.

READ: Tips for cattle feeders using the hold and hope strategy

Let’s take the cutout as an example. I’m not suggesting that the cutout be the mechanism that we embrace in moving the price point for fed cattle to the meat market. But it’s been a point of contention and serves to make the argument very clearly.

And, if we do want to change how the market functions, it may be that the ultimate solution won’t be found in the meat. So my intention here isn’t necessarily to suggest a particular approach, although I think looking to the meat market should be investigated.

My intention is to change the discussion from a legislated, punitive solution to a more positive approach that comes from within the market framework we already have.

If there is serious interest by beef producers to consider such a market-changing idea, I’ll leave it to those who are much smarter than I to work it out. And, given the laws of unintended consequences, it must be very carefully researched and vetted before any change is made.

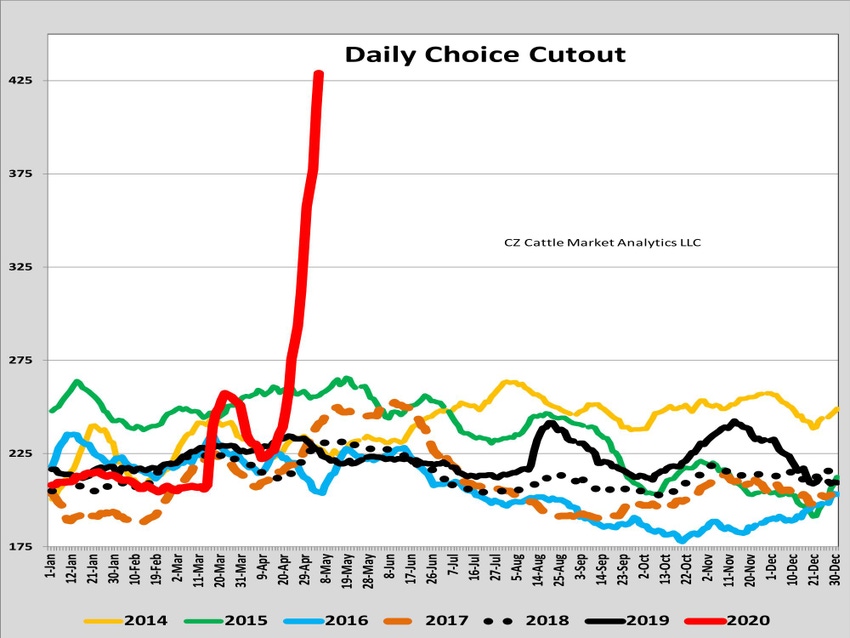

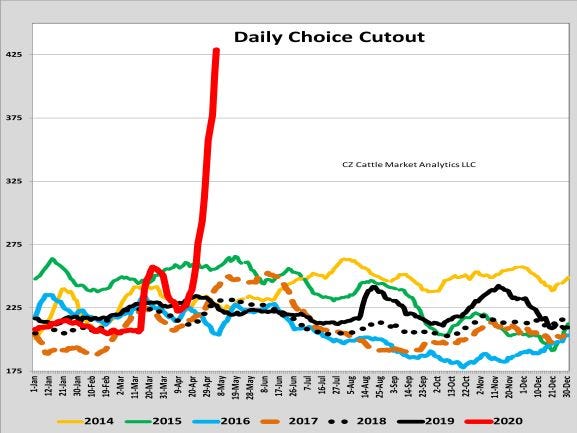

For instance, what would the cash market for fed and feeder cattle look like if we have the opposite dynamics sometime? If the wholesale and retail beef market tanks and the sharp vertical line in the graph goes down instead of up?

This graph, courtesy of Ed Czerwien with CZ Cattle Market Analytics LLC in Amarillo, Texas, and author of three weekly market reports posted on our website, tells the tale better than any 1,000 words could possibly do. Because of the remarkable dynamics facing cattle and beef markets, we’ve seen the cutout shoot to historic levels. We all know that, but this shows it in a way that makes those dramatic dynamics simply incredible.

Because of that, there have been proposals floated to change the cattle market. However, legislative or regulatory fixes to something that most likely isn’t broken will only make things worse in the long term, says Stephen Koontz, ag economist at Colorado State University.

In a recent letter to NCBA, Koontz addressed the 30/14 proposal that would require beef packers to purchase at least 30% of individual plant fed cattle needs in the negotiated cash market and that those purchases would be delivered within 14 days.

“The main issue I have with the policy proposal is that it would cost the cattle and beef industry millions and possibly billions of dollars per year. This is known from research in which I participated,” Koontz wrote.

“The U.S. Congress funded the USDA/RTI Livestock and Meat Marketing Study in 2003 and the work was completed in 2007. The use of alternatives to the cash market are cost saving and revenue enhancing. The main beneficiaries of these relationships are the cow-calf producing sector and the U.S. consumer. We have known this for a long time, and we have solid empirical evidence.”

Koontz says that while there are strong economic reasons that cattle feeders have moved away from the negotiated cash market for fed cattle, “I also think it is possible that the industry has gone too far. …Price discovery is a public good and there is just insufficient price information being produced.”

Recall another ugly time in the history of the beef business—the time between 1980 and 1998 when beef demand fell by half and around 400,000 cow-calf producers left the business. Consumers were paying less money for less product—the exact opposite of a demand increase.

Why did that happen? Because a cash market gives no incentive to beef producers to provide the quality product consumers now enjoy.

Do we want to go back to producing a product that consumers don’t want to buy? Mandating a floor for the cash market will, among other things, take us in that direction.

So…What if?

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)