No slowdown yet for Australian beef exports as Aussie cowherd looks to rebuild

In spite of forecasts to the contrary, Australian beef exports to the U.S. have continued on a record pace so far this year. But will rain in the island nation put a stop to all that?

May 7, 2015

After nearly three years of drought-induced slaughter levels that were the largest since the 1970s, the Australian beef industry was expected to undergo a significant slowdown in slaughter, beef production and exports as producers began rebuilding herds. Entering 2015, Meat and Livestock Australia (MLA) projected a year-over-year decline of 14% in beef production and a 20% drop in exports from the record levels of 2014.

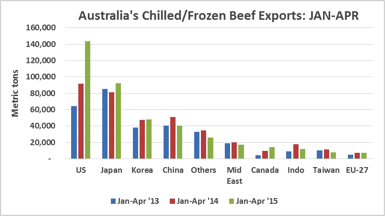

Through the first four months of the year, however, this scenario has not yet materialized. Slaughter levels have remained record-large, and exports have not skipped a beat. January-April export volume was 409,711 metric tons (mt), 10% ahead of last year’s record pace.

Exports were higher year-over-year to the U.S. (143,598 mt, up 56%); Japan (92,467 mt, up 14%); South Korea (47,867 mt, up 1%); and Canada (14,453 mt, up 46%). Those increases more than offset lower totals for China (40,788 mt, down 20%); the Middle East (17,380 mt, down 13%); Indonesia (11,807 mt, down 33%); Taiwan (8,138 mt, down 30%); and the EU (7,202 mt, down 3%).

These results led MLA to revise its 2015 outlook, and the organization is now projecting an 11% decline in year-over-year production and a corresponding 11% decline in exports. MLA expects slaughter levels to remain high through the current quarter before dropping significantly in the second half of the year as supplies begin to tighten.

One signal of tightening supplies is that cattle prices jumped to record levels in April and early May, as rain across parts of Australia helped producers retain more animals. But continued rainfall and improvement in grazing conditions are still necessary for the projected slowdown in production to occur.

A combination of factors has driven Australia’s surge in exports to the U.S., with record prices for lean grinding beef topping the list. With U.S. cow slaughter trending lower again this year, demand for imported grinding beef remains very robust. Exchange rates have also contributed significantly, as the Australian dollar has weakened by nearly 20% versus the U.S. dollar over the past year.

Australia’s exports to China have trended lower since May 2014, when China began enforcing its hormone ban. Prior to that, Australia was the biggest beneficiary of the surge in China’s beef imports that occurred in late 2012 through 2013, holding more than 50% of the imported beef market at that time.

But beef trade in China has shifted over the past year, with Australia and Uruguay each now holding about one-third of the market in 2015. New Zealand is China’s third-largest provider with 16% of the market. In addition, China’s imports of Argentine beef more than doubled year-over-year in the first quarter as Argentina’s market share reached 11%.

However, Australian beef may be in position to regain some momentum in China as a result of the soon-to-be-implemented China-Australia Free Trade Agreement, which was unveiled in November. China’s tariffs on Australian beef products, which are 12% on the most commonly exported cuts, will be eliminated over nine years. These terms are similar to the New Zealand-China FTA, in which duties on chilled and frozen beef muscle cuts have been steadily reduced since 2008 and will be eliminated in 2016. China’s tariffs on Australian livestock, currently at 10%, will be eliminated over four years.

Australia also has a significant trade deal in place in Japan. The Japan-Australia Economic Partnership Agreement took effect Jan. 15, reducing import tariffs on chilled and frozen Australian beef (which had been 38.5% – the rate that still applies to U.S. beef) by 6 percentage points and 8 percentage points, respectively. Tariffs dropped again on April 1, with the rate for chilled beef falling to 31.5% and frozen beef dropping to 28.5%.

70+ photos showcasing all types of cattle nutrition

Readers share their favorite photos of cattle grazing or steers bellied up to the feedbunk. See reader favorite nutrition photos here.

These tariff advantages are especially significant when considering the current strength of the U.S. dollar versus both the Japanese yen and Australian dollar. Since reentering the market in 2006, U.S. beef has been steadily recapturing market share in Japan. While this could still be the case in 2015, the U.S. industry will have to overcome the stiffest headwinds it has faced in some time.

Date sources: MLA, Australia’s Department of Agriculture Fisheries and Forestry and the Global Trade Atlas

You might also enjoy:

When should you call the vet on a difficult calving?

60+ stunning photos that showcase ranch work ethics

Try one of these 9 ranch management concepts to improve your ranch

How to treat lump jaw disease in cattle

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)