Rabobank: Global beef supply to remain balanced

North American cattle prices climb to historic highs.

According to Rabobank's latest quarterly beef report, global beef supplies will remain balanced over the next 12 months as increased production in Brazil and Australia offsets declines in the United States.

With production expanding, both Brazil and Australia are relying on an increase in export volumes as domestic consumption remains static or in decline.

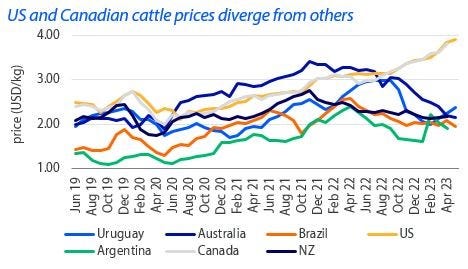

Cattle prices in North America are pushing into new record territories, the result of declining production volumes and firm demand. Meanwhile, other beef producing and exporting countries have declining or steady cattle prices.

Looking ahead, Rabobank said the Argentine elections, scheduled for October, will be a key factor to watch.

China was considered a growth opportunity as the country emerged from COVID-19 lockdowns in late 2022. However, Rabobank expects Chinese imports to slow in Q2 and potentially decline in Q3 given the slow pace of market recovery.

Will Argentine elections impact the global beef supply?

“The landscape of Argentina’s beef industry is changing,” explained Angus Gidley-Baird, senior analyst of animal protein at Rabobank. “Despite export restrictions in an effort to curb rising inflation and limit rising beef prices, beef exports have increased. This is partly due to increased Chinese demand.”

However, changes might be on the way with Argentina’s presidential election scheduled for October this year. The most recent poll in April indicates the top three candidates are from opposition parties.

“These parties support a freer market and the removal of protectionist measures such as export restrictions. While existing export restrictions have not reduced export volumes, removing these measures may actually lead to further increases in exports,” Gidley-Baird added.

Solid U.S. beef demand supporting prices

Drought conditions in the U.S. have improved but still remain a concern in key cow-calf regions, causing continued herd liquidation. Even with lower U.S. beef production and demand—both down 5% through April—the report said wholesale beef demand remains the second largest of the last 30 years.

In early May, the USDA comprehensive boxed beef cutout was more than $3.05/lb., which Rabobank said is a new all-time high under normal market conditions. However, retailers have been shielding beef consumer from wholesale prices increases.

Gidley-Baird said the spread between U.S. cattle prices and those in other countries is the largest in the history of Rabobank’s index. “We expect it will start to impact trade flows, with a redistribution away from the more expensive U.S. product to cheaper Australian and Brazilian product.”

In Q1, U.S beef exports were weaker than Rabobank anticipated, down 7% in volume. The largest declines were seen in China and South Korea, down 14% and 15%, respectively.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)