U.S. beef exports on a roll

Mixed signals regarding U.S. foreign and trade policy have markets concerned. What’s the outlook for beef?

June 14, 2018

International trade has arguably been the most important issue facing agriculture in 2018. The Trump administration’s recent tariff assignment to imported steel and aluminum will result in punitive measures from other countries. And ag products are at the front of the line when it comes to reactive tariffs by our trade partners. That immediately draws attention to the importance of international demand for the beef industry.

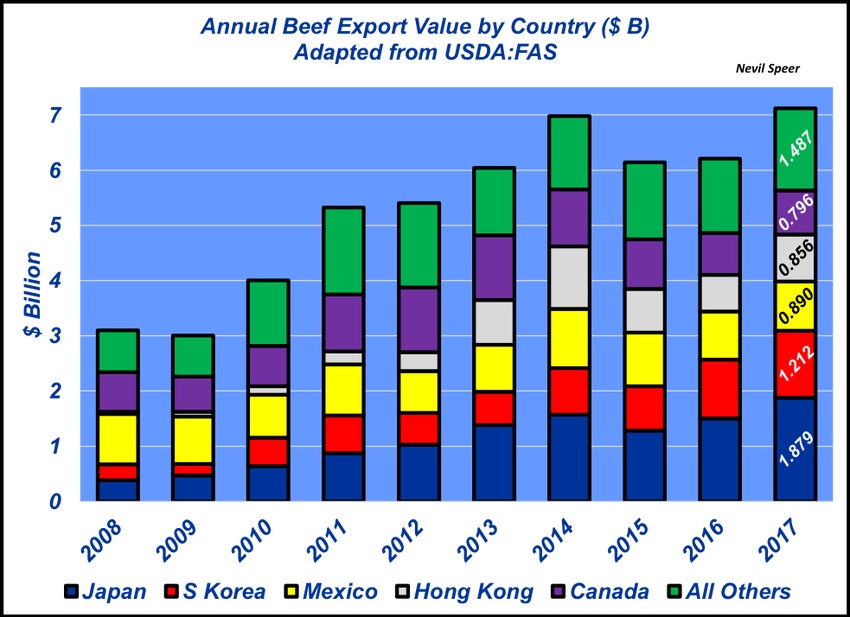

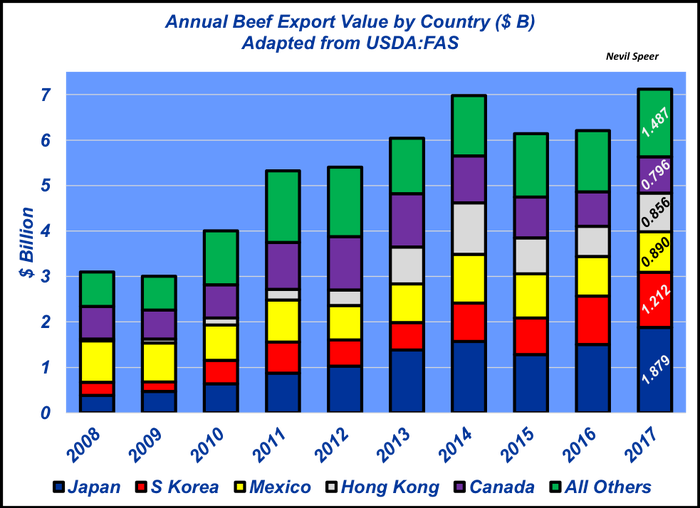

Exports serve as a critically important source of revenue for U.S. beef producers. To that end, last year’s export value totaled $7.12 billion–a new record surpassing the previous record of $6.98 billion established in 2014. That value spread across every fed steer / heifer is equivalent to about $325 per head–expressed across the 2017 average slaughter weight, it works out to $24 per cwt.

In practical terms, that means that any backup of product movement – i.e. extra product on the domestic market as the result of foreign tariffs – could cut into the export premium in a sharp manner. Because of that reality, this week’s illustration highlights the importance of the industry’s key destinations.

In order of export value in 2017, the top five international customers for U.S. beef reside in Japan, South Korea, Mexico, Hong Kong and Canada. And in aggregate, Canada and Mexico combine for nearly $1.7 billion in export value – or roughly 24% of total export value.

How do you foresee trade policy developing in the months ahead? Where do you see all of this ending up – and its ultimate influence on the U.S. beef industry? Amidst all this noise, should the industry commit even more checkoff dollars to help promote U.S. in international markets? Leave your thoughts in the comment section below.

Nevil Speer serves as an industry consultant and is based in Bowling Green, KY. Contact him at [email protected].

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)