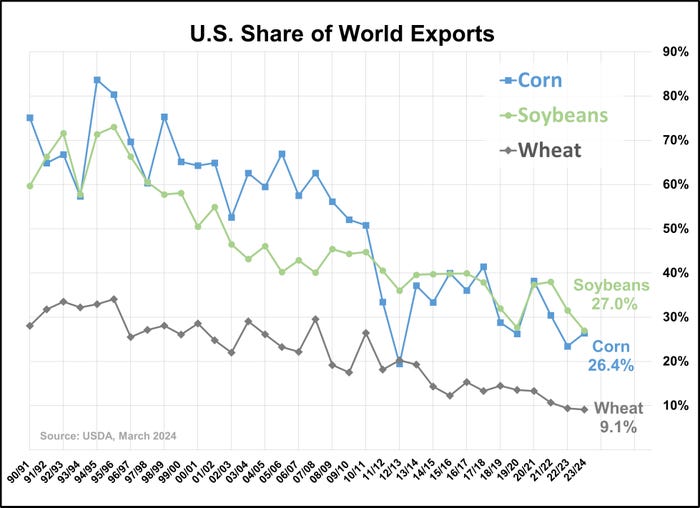

U.S. share of world exports continues to slide

Transfer of technology and available land has U.S. share of world corn and soybean exports dropping.

March 19, 2024

By Richard Brock, Brock Associates

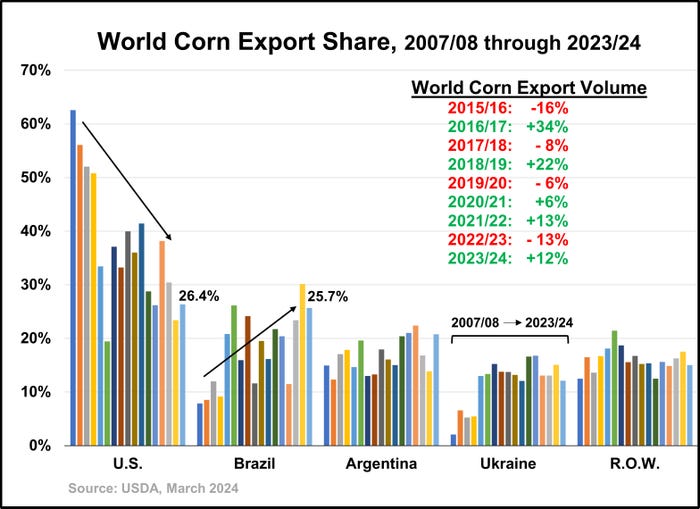

You have to wonder who if anyone is paying attention to what is happening to the U.S. share of world corn and soybean exports. They have been in a long-term slide now for 30 years. In 1994/95 the U.S. had 82% of the world’s corn exports. It’s now 26%. Soybeans have dropped from 72% to 27%. Wheat has declined from 30% to 9%. Just since 2007 Brazil’s share of corn exports has risen from 8% to 25.9% and Ukraine has gone from 3% to 12%.

Is there any way of regaining that market share? Very doubtful. It isn’t just one factor that has caused our exports to slide but there are two primary factors that have resulted in the shift. First of all, we have exported our technology. Fifteen years ago, advances in seed technology were primarily only available to U.S. farmers. Then one of the dominant seed companies sold to ChemChina and another one sold to Bayer, a German company. Suddenly, farmers around the world had the opportunity to purchase much better seed and chemicals than they had before. A good example is corn that was bred to use less water. Countries without adequate rainfall could now produce corn where it could not be produced before. Yields increased in areas where the technology was not available and all of a sudden many countries could ramp up grain production.

Available Land

The other factor that came into play was land, particularly in Brazil, with higher priced grains could now economically be brought into production. Planted acres of corn and soybeans in Brazil ramped up sharply. Some other countries around the world could also bring in new production on land that wasn’t suitable with the old line of genetics. Suddenly, our market share has slipped dramatically.

Where to From Here?

Fortunately for corn and soybean producers domestic demand has been strong. We are going to become more and more dependent on domestic demand as competition for exports continues to increase. U.S. producers are going to have to rely more on ethanol and livestock consumption for corn.

In the soybean complex producers are betting heavily on increased consumption from the renewable diesel business. For their sake, let’s hope they are right. The renewable diesel market does have the potential not only to help soybean producers but to also help the livestock industry. Soybeans are going to be crushed for the oil which means there is going to be an abundance of soybean meal available. In the long run it would be a win-win opportunity for both producers and the livestock industry but there is always danger in counting on one industry to be the leading source of demand. If the renewable diesel business doesn’t mature to the level as some are forecasting, the demand picture for soybeans isn’t pretty as export competition continues to build.

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)