Understanding price slides when buying and selling feeder cattle

A price slide is most efficient when it is roughly equal to the market discount as cattle get heavier.

March 20, 2024

By Kenny Burdine, University of Kentucky

Everyone who buys or sells feeder cattle regularly understands that in most markets the price per pound decreases as cattle get heavier. This can create a challenge for pricing cattle in situations where weight is not known with certainty. This applies to forward contracts, internet sales and cattle that are sold off the farm but are hauled to another location to determine pay weight. In these situations, cattle are often sold with a base weight, and a price slide is utilized to adjust price as the weight of the cattle exceeds that base weight.

As an illustration, let’s consider a backgrounder that sold cattle via an internet auction with an advertised base weight of 800 lbs. and a price slide of $8.00/cwt. Let’s further assume that the cattle sell for $240.00/cwt in the auction and will be hauled to a weigh station the following week to determine the pay weight.

If those steers were to weigh exactly 800 lbs., no price adjustment is needed. The pay weight is 800 lbs. and the price is $240.00/cwt for a total of $1,920 per head. However, if the cattle weighed 850 lbs., the price is adjusted downward because they are 50 lbs. above the base weight. With an $8.00/cwt. slide, the price would be adjusted downward by $4.00/cwt. (50 lbs. is half of a cwt.). With a pay weight of 850 lbs. and an adjusted price of $236.00/cwt., the per head total is $2,006.

Price slides can get much more complicated than this, but this simple illustration captures the process well enough for this discussion. As long as the price slide is not so large as to actually result in a lower value per head, the seller is typically happy to have more pounds to sell. In the previous example, the cattle sold for $86.00 more than they would have had they weighed right at the base weight.

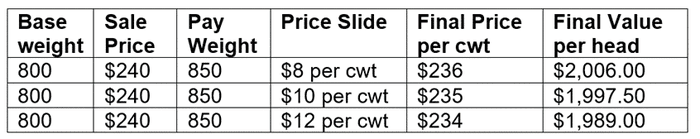

Now I want to focus this discussion on the difference between the artificial price slide used to adjust the price for cattle weighing above the base weight and the actual market price discount as cattle get heavier. The table below illustrates this point in relatively simple terms. Suppose the market price for an 800 lb. steer is $240.00/cwt. and the market price for an 850 lb. steer of the same type and quality was $235.00/cwt. This would imply that the actual price discount in the feeder cattle market was $10.00/cwt. and the market value of those 850 lb. steers would be $1,997.50 per head (850 lbs. x $235.00/cwt.). If a seller advertised that group of steers with a base weight of 800 lbs. and a $10.00cwt. price slide, the price slide and the market discount for weight would match perfectly. The final price would be the same despite the fact that the pay weight exceeded the base weight. This scenario is shown in the middle row of the table below, but this will not be the case when differences exist between the market discount for weight and the price slide.

If the artificial price slide is less severe than the market discount as the cattle get heavier, then the seller is actually better off if the pay weight exceeds base weight because the lower artificial price slide would result in a smaller price discount due to the additional pounds. This is illustrated below with the $8.00/cwt. price slide and note that the final value per head is higher for these steers. Previous research has found evidence that sellers tend to underestimate weights in these situations (Brorsen et al., 2001). Conversely, if the market discount is greater than the price slide, the seller would actually receive a lower final price than had they advertised the cattle with the higher base weight to begin with. Note that the $12.00/cwt. price slide below, which exceeds the market discount, results in a lower final value. In situations such as this, sellers have no incentive to overestimate weight (Burdine et al., 2014).

In theory, price slides used for selling cattle with weight uncertainties should evolve with the market. But my experience has been that they are often slow to adjust, whereas market conditions change very quickly. The key point from this discussion is that a price slide is most efficient when it is roughly equal to the market discount as cattle get heavier. In those situations, there is no incentive for sellers to underestimate weight when selling cattle on a slide and there is little true penalty if they do. Buyers and sellers both need to understand the implications when prices slides and market weight discounts diverge, as this can have an impact on both parties.

References:

Brorsen, B. W., N. Coulibaly, F. G. C. Richter, and D. Bailey. 2001. “Feeder Cattle Price Slides”. Journal of Agricultural and Resource Economics. 26: 291-308.

Burdine, K.H., L. J. Maynard, G.S. Halich, and J. Lehmkuler. 2014. “Changing Market Dynamics and Value-added Premiums in Southeastern Feeder Cattle Markets”. The Professional Animal Scientist. 30:354-361.

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)