We have the grain stocks. Now, what about price?

Since the beginning of the ethanol era, a 1% change in stocks/use (or carryover) roughly equates to a 38 cent impact to the market. What will happen in 2017?

July 11, 2017

Last week’s focus was on USDA’s recent June 1 grain inventory estimate. USDA revealed that June 1 grain inventories totaled 5.11 22 billion bushes; 510 million bushels bigger versus 2016. Perhaps more important, bigger year-over-year stocks have been an enduring theme since the recent low scored in 2013 – with the overwhelming proportion of increased stocks (65%) being held on the farm. Grain stocks remain ample with no real threats to carryover.

Meanwhile, USDA’s June 30 acreage report has the current corn crop pegged at 90.9 million planted acres – 900,000 acres more than USDA’s original estimate. Simultaneously, USDA is currently targeting 2017 yield at 170.7 bushels per acre. In total, we’re looking at an estimated harvest of 14.065 billion bushels. Lastly, USDA projects total usage in 2017/18 at 14.3 billion bushels and projected carryover of 2.11 billion bushels (14.75%).

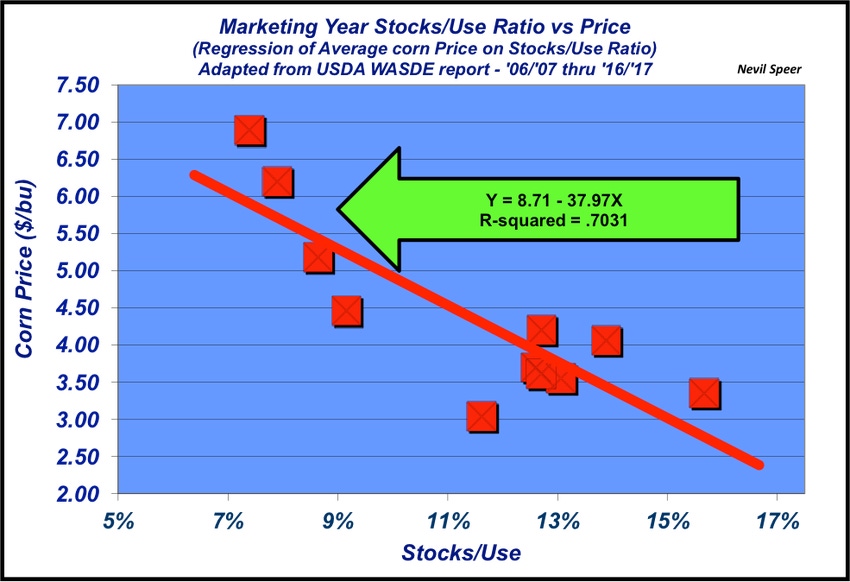

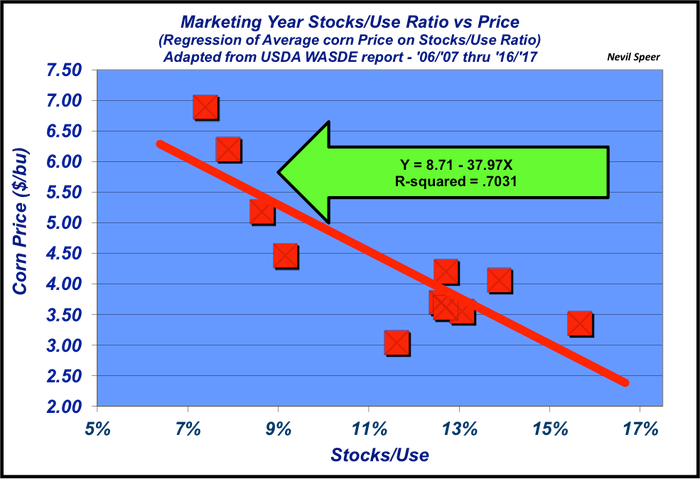

Now comes the important part – price. This week’s illustration highlights the relationship between stocks/use ratio (%) versus marketing year price since the beginning of the ethanol era. During that time, a 1% change in stocks/use (or carryover) roughly equates to a 38 cent impact to the market.

Fast forward to 2017: 14.75% carryover would yield a market price around $3.10-$3.15 per bushel (USDA is pegging the market at $3.00-$3.80). USDA also estimates 82 million acres will be harvested this fall. With that in mind, a 1 bushel change in yield equates to roughly 80 million bushels. Based upon usage of 14.3 billion bushels, a 1 bushel yield adjustment means a change in carryover of approximately 0.55%.

With the description above, let’s call that a 20 cent change in the market (1% = 38 cents). In other words, if crop conditions deteriorate and we end up with a yield closer to 169.7 bushels, the resultant carryover would decline 0.55% and the market would respond by tacking on approximately 20 cents to the upside versus the $3.10-$3.15 value.

The market has experienced a solid rally in recent weeks. How do you perceive the progression of the crop? What concerns do you have about the corn market going forward? Will 2017 ultimately see a solid weather market in July or will the recent rally be short-lived? Leave your thoughts in the comments section below.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

About the Author(s)

You May Also Like