What are the risks with Brazilian imports?

Is importing beef from Brazil a good idea?

August 18, 2016

For the past several weeks, this column’s major theme has revolved around international trade. First, we explored the importance of exports relating to management of total meat supplies. The key take-home in that column is that expanded production highlights the importance of greater access to international markets; any slowdown in exports potentially results in bigger supply within the domestic market.

Then we discussed the recent USDA announcement regarding the new trade status with Brazil. That discussion noted that Brazil will be operating under the Tariff Rate Quota (TRQ) outside of country-specific agreements such as we have with Canada and Mexico. As such, Brazilian imports will fall under a quota limit shared with other countries of 64.8 million tons. And under that quota system, access to U.S. markets is on a first-come, first-served basis for countries lacking a specific agreement with the U.S.

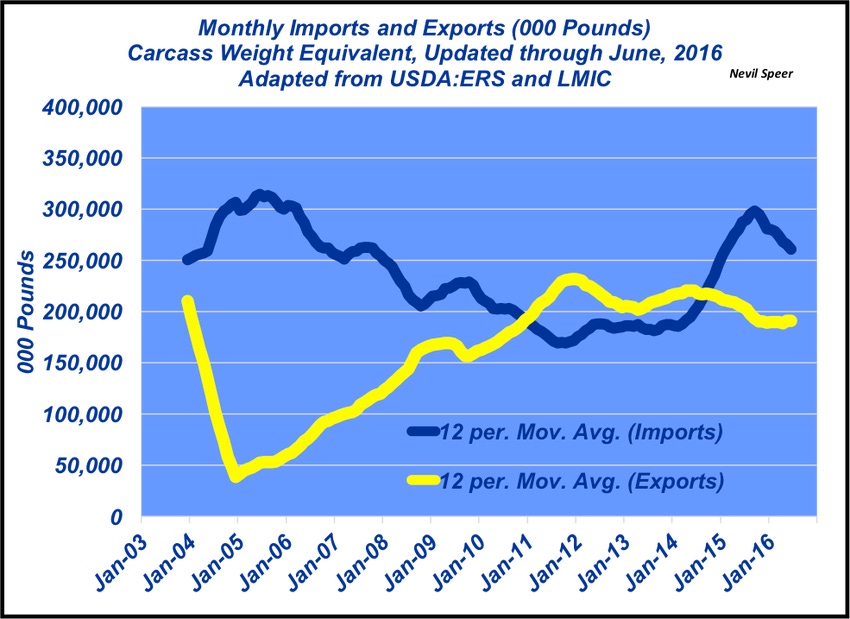

Stated another way, 64.8 million tons is equivalent to 129.61 million pounds annually – or about 10.8 million pounds on a monthly basis. With that in mind, this week’s illustration highlights 12-month moving averages for both imports and exports through June 2016.

Based on the moving average, year-over-year, monthly imports are down nearly 27 million pounds (9%) versus this same time last year. Meanwhile, the same comparison indicates exports are down only 13.8 million pounds (7%) versus 2015. Viewed from the broader perspective, if the total quota under which Brazil will ship product was filled on a monthly basis, it would represent only about 4% of total imports (TRQ = 10.8 million pounds vs. total imports averaging 260 million pounds).

Therefore, quantitatively speaking, the direct economic effect of additional supply from Brazil will likely be limited even at the highest rate of quota fulfillment. The bigger concern comes from a qualitative standpoint.

That is, if there were ever a shortfall in inspection and/or an opening for foot and mouth disease infection in the U.S., the fallout would be catastrophic from any number of perspectives including potential for stop-movement orders, breakdown of commerce continuity and loss of international markets – not to mention potential impact on the dairy industry. The quantitative versus qualitative perspective represent two very different concerns.

Given that delineation, what’s your perspective about the agreement with Brazil? Do you view upside potential for exports to Brazil as more favorable than downside risk of imports coming from Brazil? Or the other way around? Leave your thoughts in the comments section below.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

You might also like:

14 thoughts to help get those heifers bred

Photo Tour: World's largest vertically integrated cattle operation

10 tips for avoiding baler & hay fires this summer

Are you the best ranch manager you can be?

60+ stunning photos that showcase ranch work ethics

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)