What beef consumers want and what it means for producers

Anything producers can do to positively influence consumer demand for beef will ultimately benefit them.

January 15, 2024

Practically every new dollar that enters the U.S. beef industry originates from consumers who purchase beef products. When consumer beef demand is robust, beef industry participants flourish. But when demand is sluggish, industry participants are immensely challenged. Anything producers can do to positively influence consumer demand for beef will ultimately benefit them.

With funding assistance from the Kansas Beef Council, we are currently completing a study designed to rank factors affecting consumer beef purchase behavior. In the study we sought to rank factors affecting beef purchasing decisions by consumers. To accomplish this, we conducted a nationally representative survey of 3,001 U.S. consumers to identify and measure importance of factors influencing beef product purchasing decisions. Results reveal numerous things cattle producers can do to enhance beef demand.

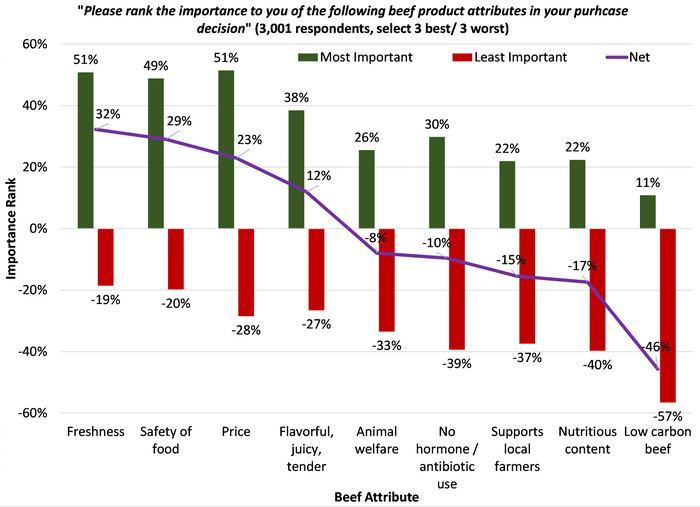

In the survey consumers completed a set of questions in which they ranked the importance of nine beef product attributes when making purchase decisions. Survey respondents indicated their 3 most and 3 least important among nine product attributes. Attribute rankings are summarized in the chart below. The chart reports percentages of respondents that rated each attribute as Most Important (positive green bars), Least Important (negative red bars), and Net (purple line, Most Important plus Least Important). More detailed results of study are available here and here.

Source: Kansas State University

Key findings:

Product freshness, safety, price and flavor were the top ranked attributes overall with the two most often ranked Most Important being product freshness and price. This is a common result found in several recent studies.

Next in line of importance overall included animal welfare, use of hormones, and antibiotics in producing beef, and supporting local farmers.

The lowest ranked attribute, by a sizeable margin, was low carbon beef, defined as beef produced with 10% lower greenhouse gas emissions.

Each of the nine attributes were identified as Most Important by at least some consumers. This indicates there are opportunities for niche markets for perhaps every attribute presented, even the least frequently identified as important attribute of low carbon beef – 11% of consumers indicated it was important.

What can producers do with this information (see our article for further details)?

Beef product freshness is essential. Producers must stress importance of product freshness with downstream retail customers through producer association work with packers and retailers.

Ensuring food safety must continue to be a focus for the industry. Every stage of beef production from producer to consumer potentially impacts food safety. Food safety regulations in downstream beef production and marketing must be continuously assessed and producers should support efforts to help ensure safety of their products all the way to the consumer’s dinner plate.

Beef price matters and development and adoption of production technologies that make the industry more efficient will affect long run prosperity of producers through lower cost of production and cost competitive beef products for consumers.

Some consumers rank price relatively low in importance. There is a strong market for high-end expensive beef products offering exceptional quality, branded products, special assurances and certifications. Continued differentiation of beef product offerings is recommended to provide desired eating experiences for diverse consumers.

Beef quality including flavor, juiciness, and tenderness are important to many consumers. A desirable eating experience will continue to attract consumers to beef products. Efforts improving beef quality in the industry have been remarkable over the last several years. Valuing cattle using grids and other value-based signals has been instrumental in enhancing beef quality.

The market segment for beef produced without use of hormones or antibiotics appears to be at least stable at roughly 25% of consumers. Producers are cautioned not to over-expand the industry into naturally raised and related beef production practices if they are more costly to adopt as supply could quickly outpace demand growth resulting in lower market premiums.

Ongoing efforts to ensure consumers the entire industry practices good animal welfare stewardship matters. However, potential ambiguities between animal welfare and using fewer antibiotics in cattle production must continue to be monitored and efforts assessed to make these more compatible.

A niche market opportunity may be present for low carbon beef; however, it represents a small market segment that most producers are not likely to benefit pursuing. Regulatory issues surrounding greenhouse gas emissions have become prevalent regardless of its low importance to consumers. Producer associations are advised to continue to inform policy debates around environmental regulations relative to greenhouse gas emissions. Addressing greenhouse gas emissions in beef production through increased production costs are unlikely to be recoverable through consumer demand enhancements. If overall consumer demand does not increase sufficiently to offset costs associated with regulated production practices, cattle producers will incur economic harm.

Consumer preferences vary, which is both beneficial and challenging for the industry. The fact that no single beef product attribute was ranked among the three most important by much over half of respondents reveals diversity in preferences across consumers. The benefit is numerous production and marketing strategies can be successful if designed and targeted toward consumers having specific preferences. The challenge is a single strategy is likely to be less successful than a variety of strategies targeting varied consumer segments.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)