What to expect from the upcoming cattle cycle

One of the important economic impacts of the 2013 and 2014 cattle markets was the herd expansion that was triggered, setting in motion the next cattle cycle. Barring major future shocks such as droughts or national economy setbacks, to name just two, beef producers are facing — finally — another cattle cycle in the beef industry.

As this new cattle cycle starts to develop in 2016 and 2017, it is important for beef cow producers to gain a general idea of how this cycle might look for the next seven to 10 years. It is with this in mind that I will share some benchmark projections for the next cattle cycle.

My primary source for these projections is the March 2016 FAPRI (Food and Agricultural Policy Research Institute) report from the University of Missouri, titled U.S. Baseline Briefing Book. This research group annually prepares a set of long-run agricultural production and economic benchmarks for all agricultural commodities, including beef.

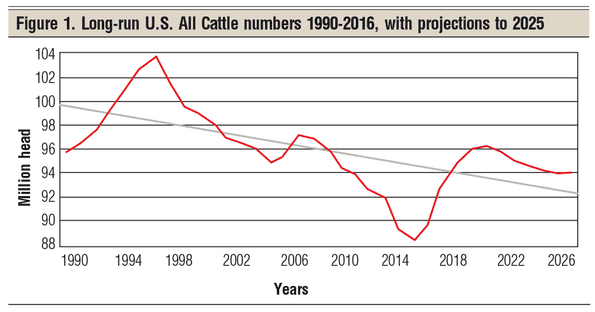

USDA All Cattle numbers: Let’s start by taking a look at historical U.S. All Cattle numbers (dairy and beef) going back to 1990, with FAPRI’s projections through 2025 (Figure 1). From 1990 to 1996, we saw cattle numbers increase. Starting in 1997, cattle numbers decreased for eight consecutive years. In 2004, we started another herd expansion, only to be aborted with the introduction of ethanol in 2006.

Pastures were plowed up and planted to corn. Farmers sold their cow herds and turned to straight farming. Increased corn prices drove cattle feeding profits down, leading to lower feeder and calf prices which added even more pressure to decrease the size of the cattle herd.

Cattle numbers continued downward until the reduced supply triggered the higher cattle prices of 2013 and 2014, which in turn triggered the current expansion. USDA inventories show the current cattle cycle started in 2015, and FAPRI projects an annual increase in cattle numbers through 2019 and then a slow decrease in cattle numbers into 2025.

Instead of the historical nine-to 11-year cattle cycle, the 1990 through 2004 cycle was a 14-year cycle. The 2005 through 2015 cycle was a 10-year cycle. FAPRI projects the next cattle cycle to also be approximately 10 years in length.

When these three cycles are combined, the long-run trend line for 1990 through 2025 is a minus 200,000 head per year for each year of the 1990 to 2025 time period. This has interesting industry long-run implications.

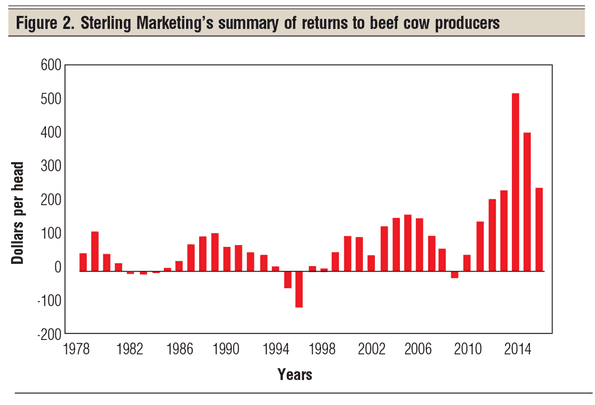

What causes cattle cycles? Cow-calf producers respond to beef cow profits, but with a biological time lag. By the time cattle numbers are increased, prices may well be going down. A study of Figure 2, generated by Sterling Marketing of Vale, Ore., gives us a good clue.

Note the beef cow net return increase in Figure 2 going into 1990 and the drop in net returns by 1996. Also note the increase in net returns from 2000 going into 2004, and the drop again in 2006 through 2010. Finally, notice the return to increased returns in 2013, 2014 and 2015.

Calf price was the key generator of these net returns. Cattle cycles are beef cow producers’ collective response to net income from beef cows, along with the related biological lag in developing heifers.

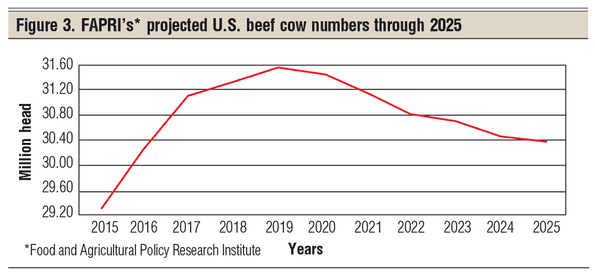

Projected beef cow numbers: Let’s now look at FAPRI’s projections for beef cow numbers going into 2025 (Figure 3). They suggest that the 2013 through 2014 run-up in calf prices has triggered a significant buildup in the national beef cow herd. An increased number of 2014 heifer calves were held back to be developed for breeding in 2015, and will start calving in 2016.

Now that growth has been triggered and calf prices are lower, FAPRI suggests that the U.S. beef cow herd growth will slow down but still stay positive through 2019. After peaking in 2019, beef cow numbers are projected to decrease through 2025. All of this is predicated on no major drought in cow country for the 2016 through 2025 period.

The final industry implication of this cattle cycle is reflected in the projected number of cattle on feed over the projected cattle cycle. FAPRI’s projected cattle on feed number will increase through 2019 and remain high as heifers are slowly diverted from breeding to feeding, leading to herd liquidation through 2025.

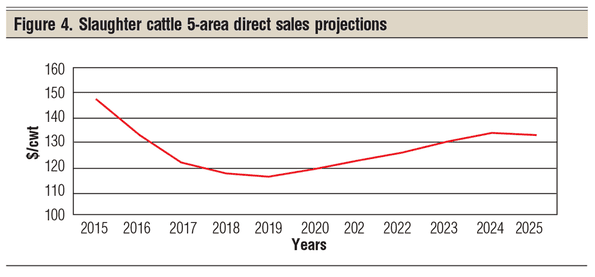

Price implication of next cattle cycle: Let’s turn our attention to price implications of the above-projected cattle cycle. Figure 4 summarizes FAPRI’s price projections for three cattle groups: slaughter cattle 5-area direct sales, Oklahoma 600- to 650-pound feeder steers, and utility cows in Sioux Falls, S.D.

Annual slaughter cattle prices are projected to decrease as cattle numbers increase from 2015 through 2019. Then, as cattle numbers peak and start to decrease in the last half of the projected cattle cycle, annual slaughter cattle prices are projected to gradually increase through 2025.

Oklahoma 600- to 650-pound feeder steers are projected to follow a similar cyclical pattern by decreasing slowly through 2019 and then slowly increasing through 2025. Utility cull cow prices are projected to follow this same price pattern.

These three price cycle projections suggest the lowest cattle prices will be in the 2018 through 2020 period.

In summary: All indications are that the cattle cycle is back, alive and well. Cattle cycles are not always friendly to beef cow producers, but are a true reality of the cattle business. Your challenge is to study the current cattle cycle and try to make it work for you. Easier said than done. Stay tuned.

You might also like:

55 photos celebrating spring on the ranch

Get to know the 2016 Seedstock 100 operations

6 tips for proper electric fence grounding

Rubes cartoons updated with new laughs

5 tips for preventing diagnosing & treating foot rot

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)