Fed Cattle Recap | Is the worst behind us?

The feedlot cattle trades were mostly steady to slightly higher and the cash sales volume was lower than the previous week.

Has the cash market for fed cattle found its bottom? Many are speculating that it has, based on this week and last week’s performance.

Time will tell, of course, but bearish fundamentals still dominate the conversation. Chief among them are the more than 900,000 overweight cattle still standing at the feedbunk and concerns over beef demand as we pant our way through the dog days of summer.

Looking at volume, the Five Area formula sales volume totaled 253,214 head for the week ending July 18, compared with about 241,000 the previous week. The Five Area total cash steer and heifer volume was 81,023 head, compared with about 108,000 head the previous week.

Nationally reported forward contract cattle harvest was about 22,000 head for the week. The nationally reported 15- to 30-day delivery was 12,444 head along with 13,754 head the previous week.

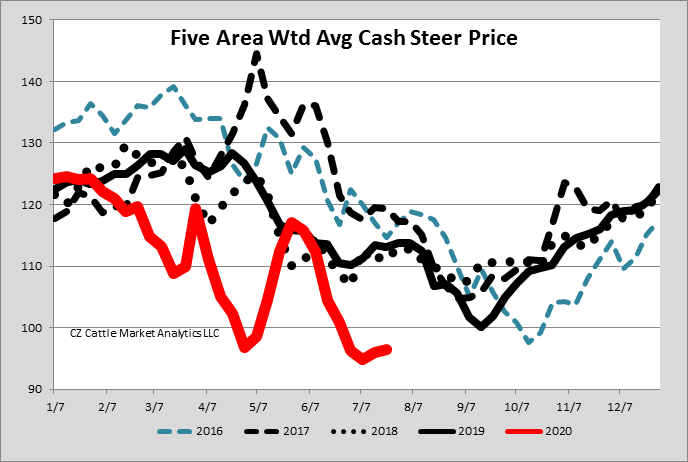

Now looking at prices, the Five Area weekly weighted average cash steer price for the week ending July 18 was $96.36 per cwt, which was 38 cents higher compared with the previous week.

Last year the same week it was $113.02, which was just 35 cents lower than the previous week. The current Five Area weighted average live formula price was $97.61 this week.

The weighted average cash dressed steer price was $157.56 per cwt, which was 10 cents lower. The Five Area weighted average formula price was $153.98, which was $1.00 lower.

The estimated weekly total federally inspected cattle harvest on Friday, July 17, was reported at 650,000 head, which compares with 655,000 head the same week last year. The current year-to-date total steer and heifer slaughter numbers show about 37.3% heifers compared with 36.8% the same time last year.

The latest average national steer carcass weight for the week ending July 4 was 896 pounds, which was exactly the same as the previous week. That compares to 861 pounds the same week last year, which was 7 pounds higher compared to the previous week.

The Choice-Select spread ended the week at $10.16 on Friday, July 17, compared with $10.21 the previous week and a $23.91 spread last year.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)