The futures markets have been called about every name the human mind can conjure up, with speculators a close second. But the market’s actions of late show the necessary role speculators play in the dynamics.

February 7, 2017

Futures markets seem to illicit an array of descriptions – and how they’re worded often depends upon one’s background and/or experience using futures markets. None of that’s new. In his great book titled, Wheels of Fortune: The History of Speculation from Scandal to Respectability, Charles Geist describes it this way:

Almost from the very beginning, the markets have been called every imaginable name, from gambling dens to vital centers of commerce. They have been decried as having no economic value, yet praised as valuable marketing mechanisms. After 150 years, their place in financial markets is vital and still disputed. The commodities futures markets invite a wide panoply of interpretation – from being the home of Satan himself to the cathedrals of the messiahs of business, depending upon one’s point of view.

Within that discussion, speculators often get a bad name – especially around agricultural contracts. Geist’s most compelling illustration revolves around a popular publication during the1880s: Seven Financial Conspiracies That Have Enslaved the American People, by Sarah E.V. Emery. The over-arching theme was “…to show how the average agrarian was at the mercy of the Wall Street crowd that cared only for money, not products.”

To that end, the past several years have seen a lot of volatility at the CME. That’s especially true when considering large intra-day swings. That’s made decision-making very challenging along the way. However, those intra-day swings are due primarily to high-frequency trading (HFT) algorithms – not speculators.

For the purpose of this discussion, set aside HFT – let’s take a longer view. Since late October, the market has experienced a solid rally. For example, the front-end contracts (December and February, respectively) surged nearly $25 in just over 90 day

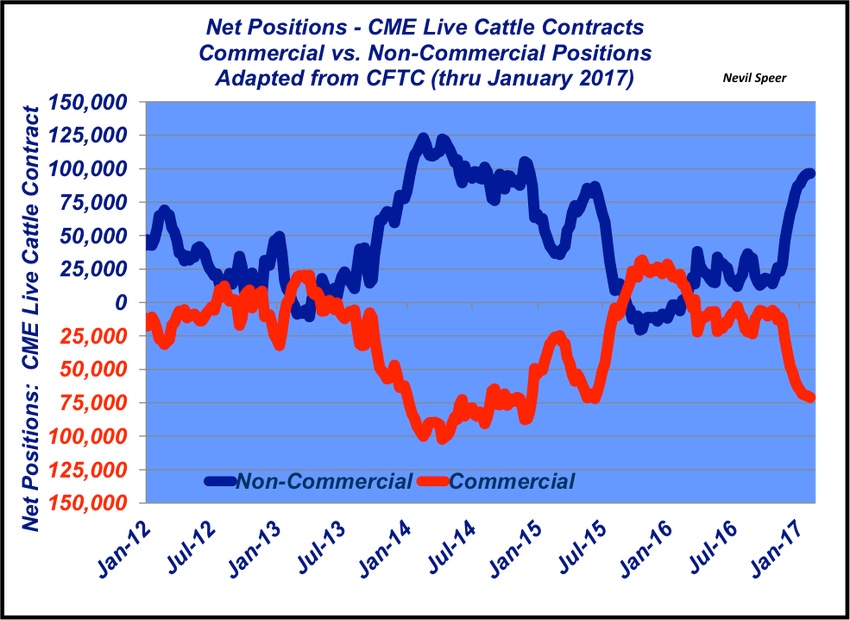

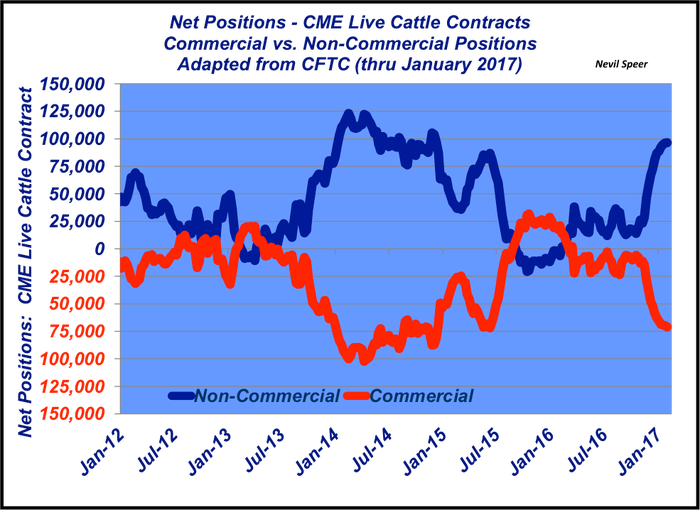

And along the way, it’s been the non-commercial (speculator) positions that have been on the long side of the market during that time. The non-commericals were net long by about 13,000 contracts in mid-October. Since then, they’ve added nearly 83,000 contracts to that position.

Meanwhile, commercial users (hedgers) have been active, too; they’ve laid off their risk taking the opposite side of the market – adding nearly 65,000 contracts to their net short position. In other words, long speculators have systematically purchased contracts while the commercials (short hedgers) have gladly obliged on the other side.

That action is lockstep with futures market theory. The speculator takes a long futures position with expectation that price in the future will exceed current futures price, assuming rational decision making. The hedger on the other side wants to avoid risk; he/she is buying insurance from, and transferring risk to, the speculator.

As such, the short hedger must be willing to sell a futures contract at some level below the expected future price of the commodity. Otherwise the hedger cannot induce the speculator to assume a long position – the discount being what the hedger pays the speculator for assuming risk. In other words, the speculators have provided a great opportunity to get some price protection in recent months. That’s right in line with futures market theory.

With that in mind, have you used the recent run-up to obtain some price protection? Where do you see the market headed in coming months? Will speculators continue to bet on cattle futures, or will they begin to exit their positions in favor of some other asset class? Leave your thoughts in the comments section below.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

About the Author(s)

You May Also Like