In terms of absolute dollars, weekly volatility in fed cattle prices is the same now as it was when cash trade was more than double its current levels.

January 23, 2019

Last week’s Industry At A Glance provided an overview of cash trade trends in the fed cattle market. That’s an important issue right now as the Organization for Competitive Markets previously filed a petition for review of USDA’s order to withdraw implementation of the GIPSA Farmer Fair Practices Rules (otherwise referred to as the GIPSA rule). That petition was recently denied in federal court. Given the history around this issue, it’s likely this isn’t the last we’ll hear of the challenge.

As noted last week, during the past three years, the industry has found an extended equilibrium where cash trade represents roughly one-fourth of all cattle traded on a weekly basis. And some in the industry think that level is insufficient. They voice concerns that low level of price discovery subsequently causes artificial deflation in cash prices and increases price volatility from week to week.

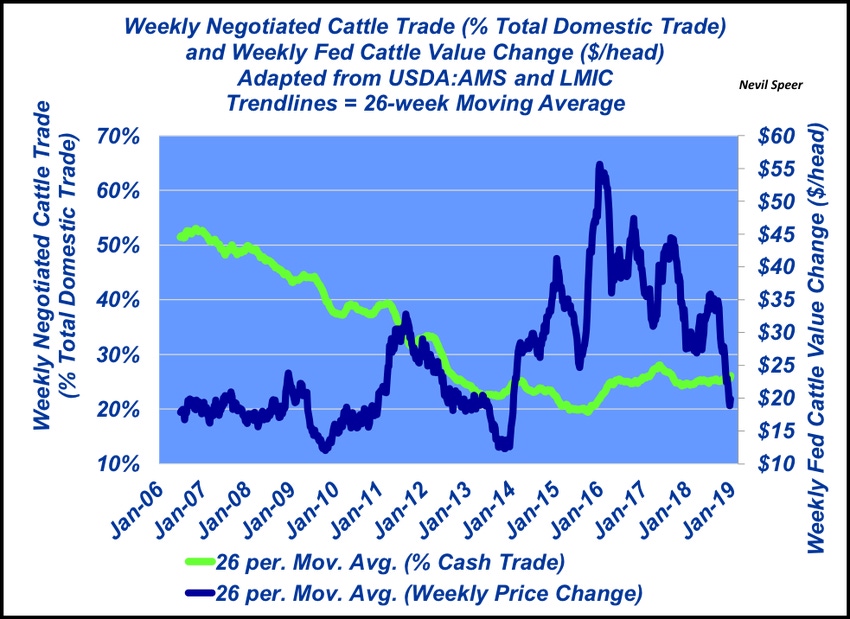

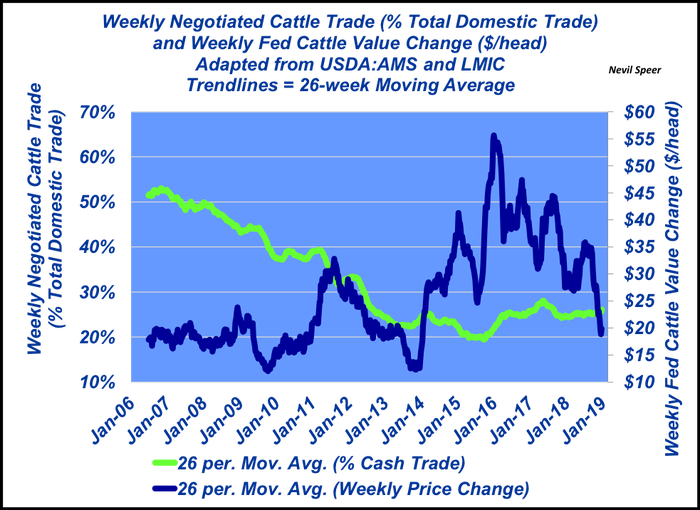

This week’s illustration specifically addresses the second question. The graph highlights the relationship between the level of cash trade and price volatility in more detail. The near-term peak of cash trade was about 53% occurring in November 2006.

At that time, the average weekly price change was $19.75 per head. Fast forward to the end of 2018: cash trade has declined to 26%. Meanwhile, the weekly price change is averaging $19.90. In other words, in terms of absolute dollars, weekly volatility in fed cattle prices is the same now as it was when cash trade was more than double its current levels.

Now consider that same trend as a percentage of fed steer/heifer value. Over time, slaughter weight and market values have increased – therefore, the change in absolute dollars represents an even smaller change over time when expressed in proportion to value.

At peak cash trade in November ’06, the 26-week moving average for fed steer value was $1,075 per head. At the end of 2018, that same value had surged to $1,685. Accordingly, from a percentage of value, volatility has actually declined over time: 1.84% vs 1.18% in ‘06 and ’18, respectively.

Of course, there was an increase in inter-week volatility that began in 2013; much of that was the result of better week-over-week prices. That is, it was volatility to the upside – we don’t typically hear much concern about weekly changes during upward moves. Rather, loss aversion draws attention to it on the way down.

Nevil Speer serves as an industry consultant and is based in Bowling Green, KY. Contact him at [email protected].

About the Author(s)

You May Also Like