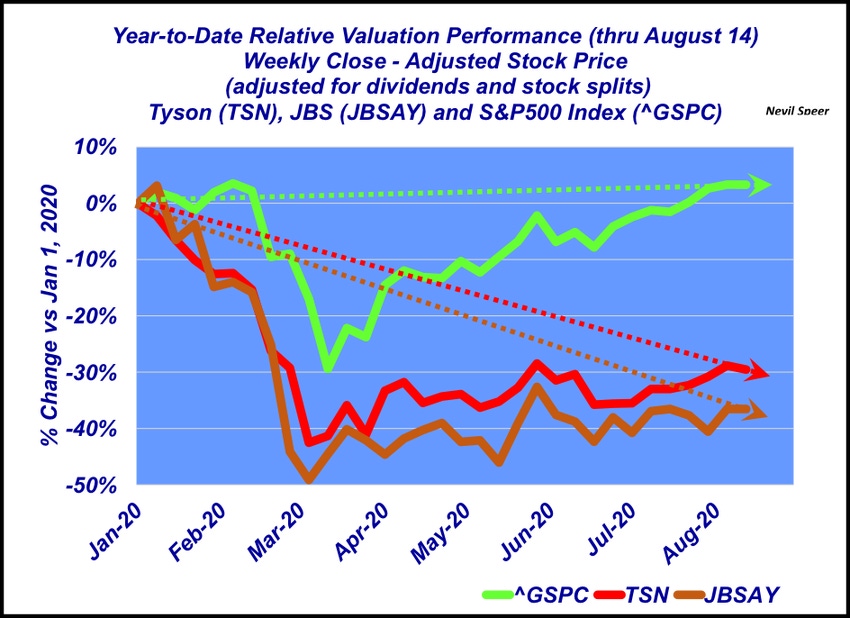

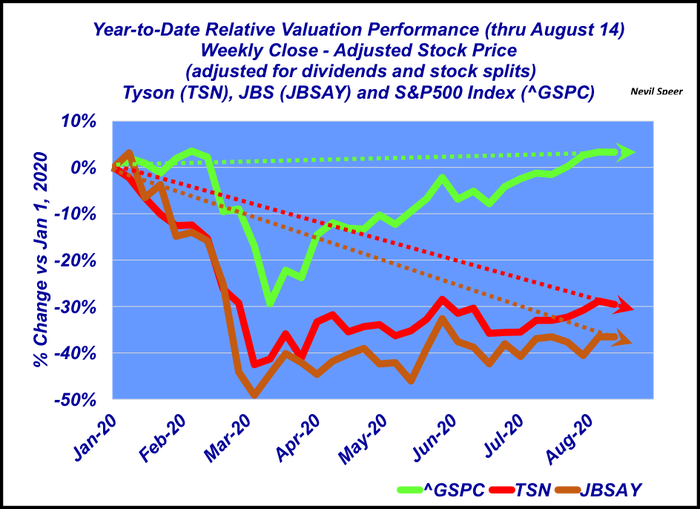

While the S&P has largely recovered, share price of publicly-traded packers has not kept pace.

August 20, 2020

During the past year, there’s been no shortage of intra-industry debate about packer profitability. That’s been primarily driven by sharp spikes in the live-to-cutout spread following the Tyson fire and then during the slowdowns stemming from COVID.

A quick refresher: the live-to-cutout spread represents the difference between revenue derived from sales of hide and offal plus the wholesale value of beef cuts from a Choice carcass, minus the cost of a fed steer. In other words, it represents gross profit: revenue less cost of goods sold. It does NOT account for operating costs (wages, salaries, administrative expenses, utilities, insurance, depreciation). That said, it is NOT an operating, much less a net, profit number.

With that background, Jayson L. Lusk (Purdue University), Glynn T. Tonsor (Kansas State University), and Lee L. Schulz (Iowa State University) recently published an insightful new white paper titled, Beef and Pork Marketing Margins and Price Spreads during COVID-19. There are several key takeaways from the work.

First, with respect to costs (and subsequent profitability), the authors note that, “Operating a packing plant at lower capacity with workers spaced out for social distancing is costly. It is also costly to close down, refrigerate empty buildings, pay sick employees who aren’t at work, pay overtime, install partitions between workers, deal with legal challenges, etc.”

In other words, packer gross margin (live-to-cutout spread) doesn’t account for those sorts of cost considerations –as noted above, it represents nothing more than gross profit.

Second, and most important, the paper provides this all-important observation:

Even though we cannot observe an individual packers’ costs, we can observe the market’s perception of their profitability―at least for publicly traded firms. On balance, changes in the stock prices of companies with significant packing operations do not suggest substantial windfalls corresponding with COVID-19 driven developments, and indeed the performance of publicly traded packing companies has lagged that of the overall market since the first of the year.

To that end, this week’s graph provides some perspective around market performance for both Tyson and JBS – in comparison to the S&P500. As of last week, the broader market completely recovered from March lows and is up ~3% for the year.

Meanwhile, Tyson and JBS are down 30% and 37%, respectively. Clearly, investors have not seen much reason to purchase shares since March despite sharply lower valuations for both companies – despite claims that packer profitability has been exorbitant and/or excessive.

Accordingly, Lusk, Tonsor and Schulz suggest that, “Perhaps [cattle and beef] market developments are rationale responses to massive shocks from a common enemy to society, COVID-19.”

And as such, focusing on a single metric – i.e. packer gross margins – is misleading with respect to company financial performance.

Nevil Speer is based in Bowling Green, Ky. and serves as director of industry relations for Where Food Comes From (WFCF). The views and opinions expressed herein do not necessarily reflect those of WFCF or its shareholders. He can be reached at [email protected]. The opinions of the author are not necessarily those of beefmagazine.com or Farm Progress.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)