What are the marketing analysis for 2019 calves? Harlan breaks down the numbers.

December 26, 2019

The cow herd is home, the calves are weaned and winter work is underway. Now what? My study rancher and I met in mid-October to review that question and discuss how he should market his 2019 calves.

So, he asked me for an economic analysis of marketing alternatives for his 2019 calves.

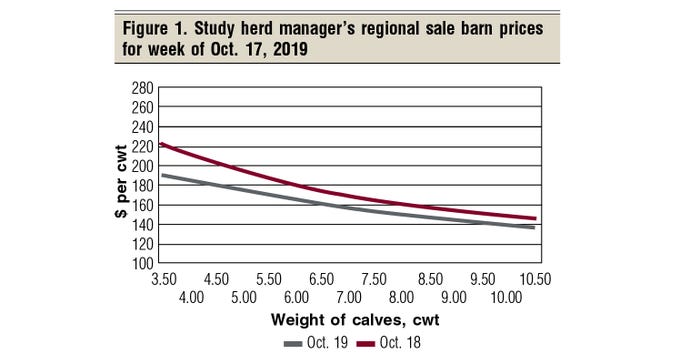

Current local sale barn price analysis: The first thing we looked at was the most recent local sale barn price analysis — see Figure 1. Clearly, October 2019 steer calf prices were all lower than for the same time last year. Selling at weaning, as he normally did, was going to generate less net income for the 2019 calf crop.

My study rancher considers his beef cow business year running from mid-October to the next mid-October. Clearly, net income for his 2019 beef cow herd is going to be lower. His reaction was to ask, “How much lower?”

2019 beef cow economic summary: I suggested it would be useful to compare his beef cow herd’s economic performance in 2019 vs. 2018. We immediately went to the bottom line of each year’s analysis.

The bottom line we used was the returns to unpaid labor, management and equity capital (the dollar return to the total family resources used to run the cow herd).

In 2018, the bottom line was $150 per cow, or $37,492 earned net returns to the family’s resources for the total 250-beef-cow herd. In 2019, the bottom line went down to $57 per cow, or $14,372 for the total 250-cow herd.

These numbers assume calves were sold at weaning both years. My study herd manager said the 2019 bottom line is not acceptable.

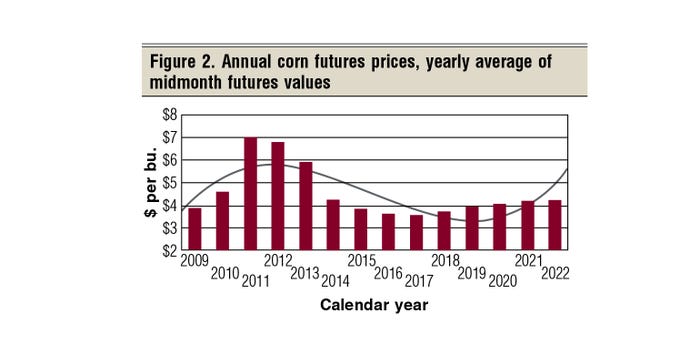

Economic projections for keeping his 2019 calves: A quick review of prices as of mid-October showed corn prices are projected to gradually increase next year (Figure 2). Hay and brewers grain are also showing additional price strength. All these price increases suggest that we can expect the feed cost of gain for backgrounding and/or finishing slaughter cattle to increase slightly over the next year.

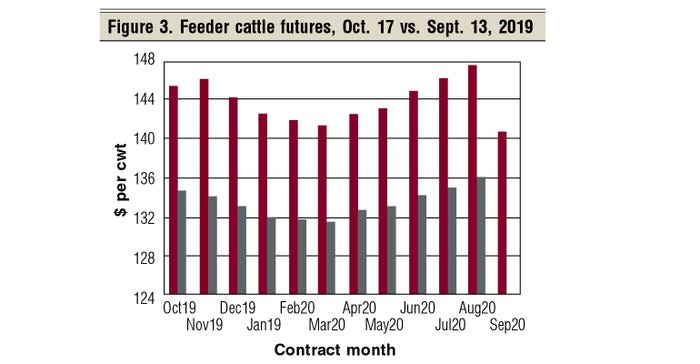

Figure 3 presents my mid-October 2019 price forecasts for feeder cattle going into spring 2020. These prices can be used to evaluate backgrounding and/or finishing of the study rancher’s 2019 calves.

Two points need to be made relating to Figure 3. First, a substantial price correction occurred over the 35-day period of early- to mid-September to mid-October, represented in Figure 3. The lower September prices (the gray bars) occurred due to the packing plant fire this summer.

Fortunately, there has been a significant price correction since the late-summer low. Second, this chart suggests some potential price strength through the first eight months of 2020.

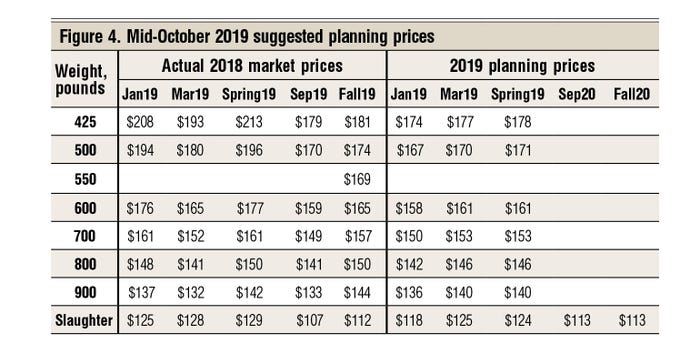

Planning prices for my study herd manager: Figure 4 presents my mid-October 2019 planning prices going into 2020 presented to the study herd manager. The first four actual 2018 market prices are history and the remaining prices are projections. The top section covers feeder cattle planning prices, and the bottom section suggests some slaughter cattle planning prices.

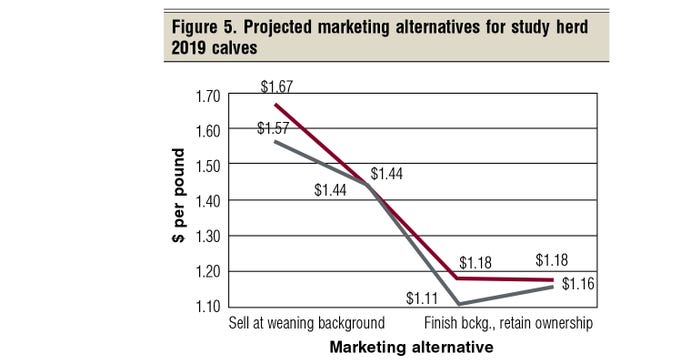

Four marketing alternatives presented to my study rancher: I used the planning prices in Figure 4 to evaluate four marketing alternatives for my study herd rancher for the 2019 calves (Figure 5).

I calculated the added market value for each marketing alternative based on the planning prices. This added value is then compared to the projected breakeven price for each marketing alternative. I like this visual marketing option presentation, as one can quickly see the potential of each marketing alterative.

The only marketing alternative that shows any promise is to finish his backgrounded calves. Interestingly enough, my budgets project that my study rancher can double his herd’s earned net returns by backgrounding his calves at home with a breakeven return, and then finishing them in a commercial feedlot with a mid-June 2020 target harvest date. The downside of this option is that it delays payday from the 2019 calves about eight months.

Another advantage is, he can reevaluate marketing projections in February at the end of the backgrounding phase to see if he still wants to enter the finishing phase.

Additional marketing strategies: A second marketing strategy to increase net income this year is to sell preconditioned calves in the next 30 to 60 days, and then concentrate making adjustments to the beef cow herd by marketing his cull heifer calves as spayed heifers.

I did a statistical study of October 2019 feeder cattle sale barn sales prices that suggests that Nebraska spayed heifers average approximately $8 per cwt more than unspayed heifers.

Additional income might also be generated by selling extra cull cows this year and holding back more replacement heifers in future years. This would shrink the number of productive cows during the low turn-around phase of the beef price cycle (projected low in 2019-20) and allow expansion of the beef cow herd as calf prices turn upward in the 2022-23 years. Stay tuned.

Hughes is a North Dakota State University professor emeritus. He lives in Kuna, Idaho. Reach him at 701-238-9607 or [email protected].

About the Author(s)

You May Also Like