Class is back in session. Here’s a look at how to use options in your risk management program.

August 1, 2019

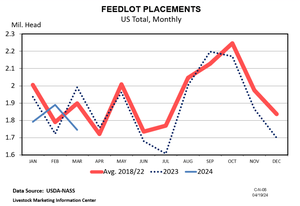

The previous Industry At A Glance highlighted the uncertainty surrounding the corn market in recent months. The result being generally higher prices and increased volatility. Meanwhile, this column has also focused on the mechanics of market risk management during the past several months. However, the series did not include any discussion on the use of call options. Based on those two considerations, it seems timely to feature an example of how call options might be used - with specific application to the grain market.

At this juncture, it’s useful to remind ourselves of some basic fundamental definitions:

Futures contract: standardized contract obligating participants to make (or take) delivery

Options contract: right to buy (call option) or sell (put option) underlying futures contract

Strike price: price of underlying contract at which call or put option would be exercised.

Premium: price of option

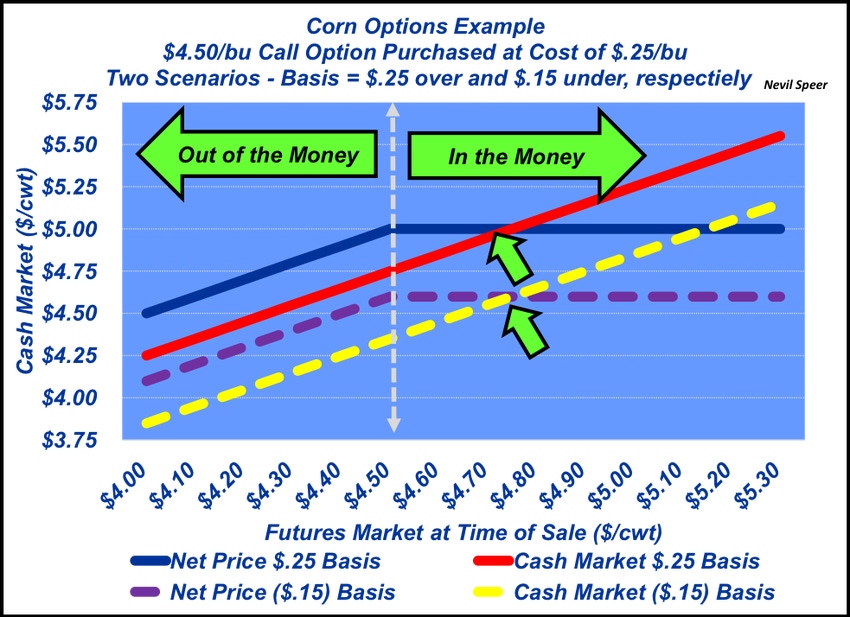

Purchasing a call option provides the buyer the right to purchase a futures contract at the specified strike price (the seller on the other side is obligated to sell a futures contract at the specified strike price). By doing so, the purchaser is facilitating an insurance policy (for a cost – i.e. the premium) to establish a ceiling price on the input cost. This example sets the strike price at $4.50 per bushel at a cost of 25 cents per bushel.

The graph compares utilization of the call option versus the cash market at varying basis levels (25 cents over and 15 cents under). The examples illustrate the concept of establishing a price ceiling in the event the market works higher.

For instance, if December corn futures go to $5.25, the call option would be exercised because the option is “in the money”. If basis is 25 cents over, the net price to the user would be $5.00 per bushel ($4.50/bu futures + $.25/bu premium + $.25/bu basis). If basis is 15 cents under, the net price would be $4.60 per bushel ($4.50/bu futures + $.25/bu premium - $.15/bu basis).

MORE ON HOW FUTURES WORK:

It’s also useful at this juncture to remind ourselves of a couple key principles. First, option values (not the strike price) inherently decline over time as we get closer to expiration.

In other words, time decay matters because uncertainty declines as we get closer to expiration. Stated another way, the further in advance of expiration you purchase an option contract, the more expensive it will be.

Second, increased market volatility increases the cost/value of options. In other words, in a volatile environment, the cost of using options (i.e. purchasing insurance) becomes more expensive.

Speer serves as an industry consultant and is based in Bowling Green, Ky. Contact him at [email protected].

About the Author(s)

You May Also Like