It’s situation normal in the beef complex following the major market disruption in August.

December 19, 2019

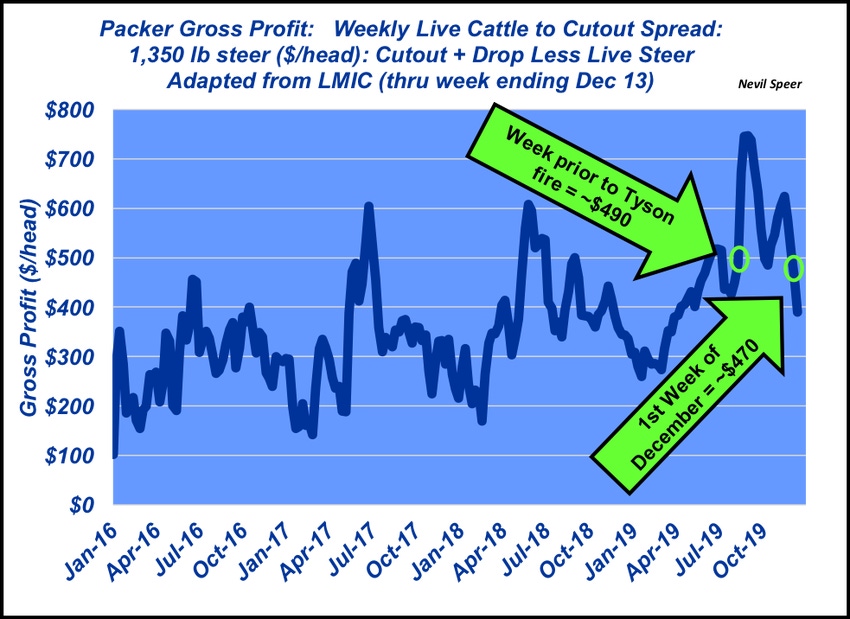

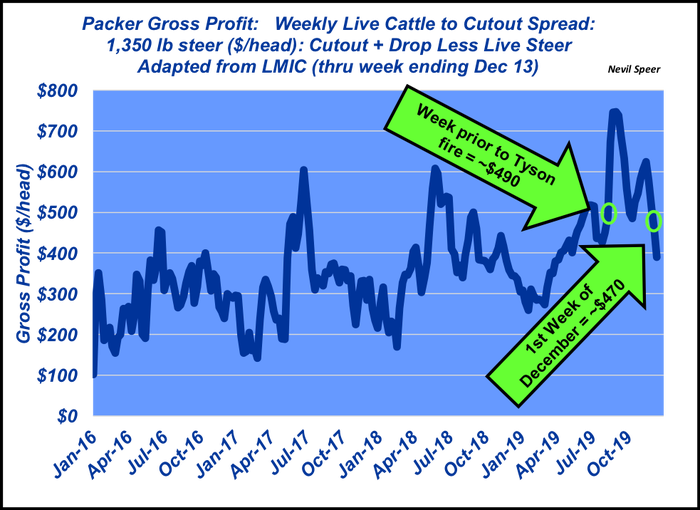

Three months ago, this column provided some coverage on packer gross margins, otherwise known as the live-to-cutout spread. That discussion was spurred by the sharp spike in packer margins following the fire at Tyson’s Holcomb, Kan., beef plant. The purpose was to offer some longer-run context given the large amount of coverage (and rhetoric) that occurred.

As background, the live-to-cutout spread represents the difference between revenue derived from sales of hide and offal plus the wholesale value of beef cuts from a Choice carcass, less the cost of a fed steer. In other words, it represents gross profit: revenue less cost of goods sold.

It does NOT account for operating costs (wages, salaries, administrative expenses, utilities, insurance, depreciation). That said, it is NOT a net profit number, despite often being portrayed that way.

This week’s graph depicts weekly gross profit for a 1,350-pound steer. Just prior to the fire, that number was running right around $490 per head. It subsequently surged sharply higher.

However, in the months that have ensued, it’s since moderated and returned to more typical values the industry has established over the past several years. For the week ending Dec. 13, the spread for a 1,350-pound steer was below $400.

As noted earlier, there was lots of coverage on the heated rhetoric following the fire in August. However, based on these trends, it appears packer gross margins are back in line with the previous two years. And, barring a similar event, there’s no reason they should deviate too far from that trend like the industry witnessed in August.

Nevil Speer serves as an industry consultant and is based in Bowling Green, KY. Contact him at [email protected].

About the Author(s)

You May Also Like