The outlook on 2020 marketing turned especially muddy after COVID-19. But you still have calves to sell and plans to put in place. Here's Harlan's thoughts on what we might see.

June 3, 2020

My study herd manager called in mid-April, asking if I would prepare a projection of cattle prices for the rest of 2020. I assured him that I did not have a very clear crystal ball for the rest of this year due to COVID-19.

I was reluctant, but he insisted. “Just share with me what your price projection models are showing, and share with me where this cattle industry might be heading.” This Market Adviser is a summary of what I presented to my study herd manager via email and a telephone call.

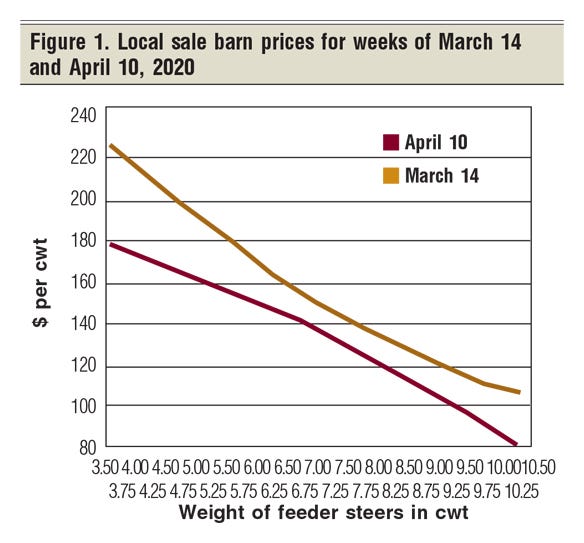

Local mid-April sale barn prices. I always start my outlook discussions by looking at the most recent local sale barn prices. The red line in Figure 1 presents the price line for the week of April 10. The gold March 14 line shows the normal convex curvature as feeder steer weight goes up. This basically represents cattle prices in the early stage of this national economic downturn.

The week of April 10 is represented in Figure 1 by the red line and represents the current downturn. The red line has two important distinctions. First, it is substantially below the gold line, representing the one-month drop in local feeder cattle prices. Second, it has an opposite curvature (concave to the origin), illustrating heavy discount for very light feeders and again for the heavy feeders.

My budgets are suggesting that slaughter cattle harvested in mid-April could be losing in the neighborhood of $180 per head if they were unhedged. This puts considerable pressure on the price of feeder replacements going back into the feedlots.

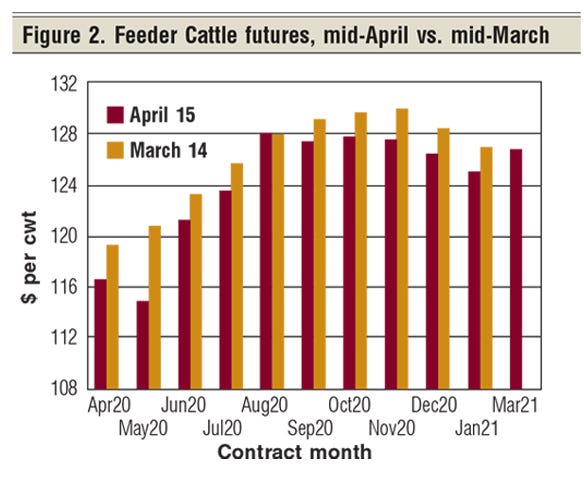

Mid-April feeder cattle futures. Let’s now take a look at the Feeder Cattle futures market for mid-March and mid-April (Figure 2). The gold bars are for mid-March and the red bars are for mid-April.

In all contract months except August, the red bars were below the gold bars. What I think is important to note is that red bars (April 2020 contracts) shows a steady increase from the May low to the October high. I read this as a positive signal for selling October weaned calves — at least relative to current prices as this is being written in late April.

In my mind, the key point in Figure 2 is the general increase in feeder cattle futures contracts going from the May low to the October-November high. While this chart suggests that May prices could even go below April prices, we should see a summer and fall price recovery.

This is assuming that the United States gets the virus situation under control and it stays under control going into the fall — a key assumption as this was being written.

While my October price projection is up from current prices, it is lower than the last three years’ October prices and equals the October price in 2016 — which was not a very favorable year in the last cattle cycle. Fall weaning prices are still going to be a challenge.

Now to ranch planning prices. As we all know, there is a high degree of uncertainty in next year’s feeder cattle prices. We also know that price prospects are also going to change as we progress out of this current price slump and into 2021.

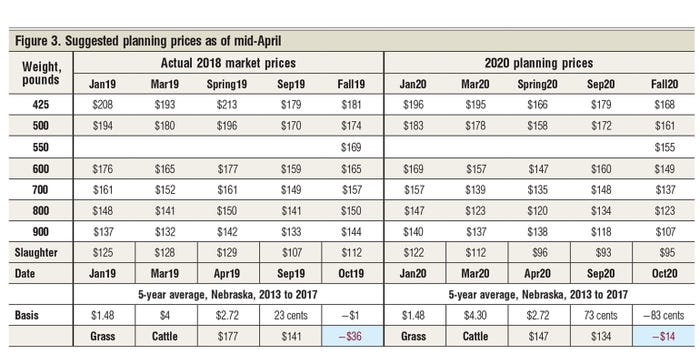

Figure 3 presents my mid-April suggested planning prices for my study herd rancher through fall weaning 2020. The top right-hand two-thirds of the table deals with 2020 feeder cattle planning prices compared to 2019 actual prices on the left.

The Slaughter and Date lines are my planning prices for slaughter cattle. Below that are some Basis data used to convert slaughter cattle futures prices to cash slaughter prices.

The bottom line presents the price going onto grass in the spring and the price coming off grass in the fall. The red numbers shaded in blue (−$13 in 2019 and −$14 in 2020) present the buy/sell marketing loss from going on grass with the price coming off grass.

I find that comparing these two prices are a reasonably good profit indicator for grass cattle. The lower that negative buy/sell marketing loss number, the higher the profit potential for grass cattle. This is because the cost of grass does not vary much from year to year.

My major conclusion from Figure 3 is that the weaning prices for my study herd rancher is going to be lower this fall than it was last fall — my projections are that this fall’s average weaning price ($155 per cwt of steers weaned) for my study rancher will be about 8% lower than his fall 2019 steer weaning price.

One interesting side note pertaining to grass cattle in 2020. My budgets, using these planning prices, suggests that there could still be some profit made in grazing grass cattle in the summer of 2020. This comes from the fact that you would be buying grassers at the low price point in the year. In addition, my budget for finishing these cattle off grass is also projecting a profit.

Stay tuned!

Hughes is a North Dakota State University professor emeritus. He lives in Kuna, Idaho. Reach him at 701-238-9607 or at [email protected].

About the Author(s)

You May Also Like