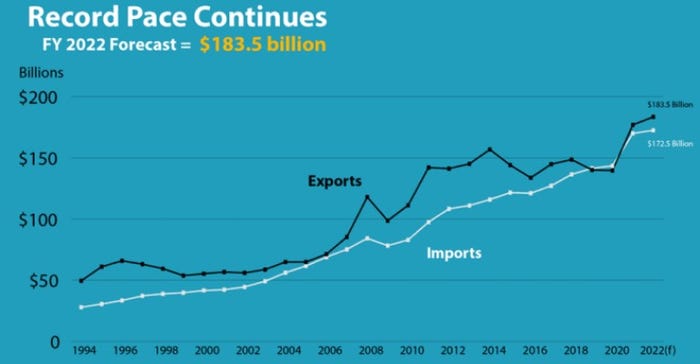

Record $172 billion seen across multiple ag sectors in 2021 and next year projected to reach $183 billion.

The U.S. agricultural sector experienced record ag exports in 2021, 23% above the previous year and 10% over the previous record set in 2014. USDA leaders expect 2022 to be even better, according to insight shared at the USDA Ag Outlook virtual conference held Feb. 24-25.

Secretary of Agriculture Tom Vilsack says the outlook for agriculture is “bright, strong and positive.”

To start off the day, USDA Chief Economist Seth Meyer says increased value, not just volume, contributed to higher ag exports in 2021. Fiscal Year 2021 ended with record exports at $172.2 billion based on very strong commodity prices and record exports supported by the U.S.-China Phase One Agreement. Specifically, oilseeds were a big contributor to the increased U.S. ag exports in 2021, up $5.8 billion, and ethanol also saw a boost of $0.5 billion.

Meyer says while China pork demand has softened on recovering pig herds, the losses are more than made up on extremely strong beef and poultry demand that surged in 2021, which is expected to continue through 2022.

Daniel Whitley, USDA Foreign Agricultural Service administrator, says USDA is excited to see the strong performance across a broad range of U.S. agricultural products including grains, meat, horticultural products and consumer-oriented goods.

“It was just a story of unparalleled demand,” Whitley says. “And it just wasn’t values, it was volumes.”

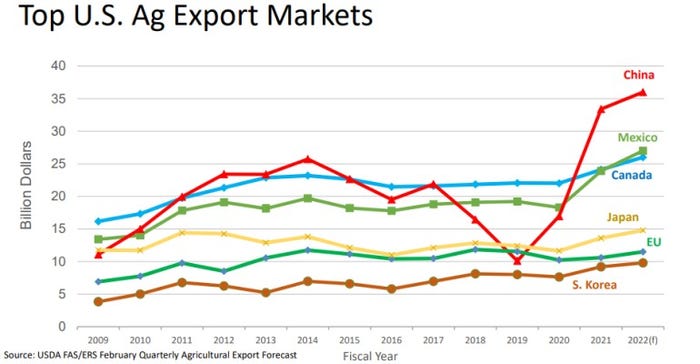

China resurged to the top destination for U.S. agricultural products at $33.4 billion for the year, followed by Canada at $24.1 billion and Mexico at $23.9 billion, each setting new records. South Korea and the Philippines also saw record trade levels and there were 28 markets where U.S. exports exceeded $1 billion, explains Whitley.

The outlook also suggested a FY 2022 forecast of $183.5 billion for U.S. agricultural trade, building on the previous record year. Whitley called the projection “unheard of” and says it speaks to the reputation of American agriculture and the demand for American agricultural products around the world.

Whitley says the race to $200 billion in ag exports is on, and he expects it could be realized in the next few years. “These exports are literally on fire.”

Krysta Harden, CEO and president of the U.S. Dairy Export Council, says dairy products saw an increase of 10% in volume and 18% in value.

New ag market opportunities

The No. 1 target for expanding U.S. agricultural products is in Southeast Asia which includes Vietnam, Thailand, Malaysia, Indonesia and the Philippines with the fastest growth of consumers from low income to middle class, Whitley says. “We’re talking about a series of taste and consumption patterns that are being more westernized each and every single day.”

Harden says the dairy industry also sees promise in expanding exports to Southeast Asia and Japan. “We’re very hopeful for continued growth there certainly in the 16 countries considered Southeast Asia,” Harden says. She says Malaysia and Thailand also have significant opportunities for expanding imports of U.S. dairy goods.

Comments from Vilsack and Whitley shared last week during the trade mission to Dubai reinforced an overwhelming enthusiasm for American agricultural products in the Middle East that Whitley says was “unprecedented.” U.S. agriculture also remains known as a reliable supplier, especially to recognize the record trade levels despite ongoing supply chain constraints.

Whitley says because of that trade mission, he sees the Middle East rising as the No. 2 target market for U.S. agricultural products following the over 300 successful business interactions between state agricultural departments and regional and commodity agricultural groups. “There’s great brand awareness of American agricultural products,” Whitley says, adding the overall respect, appreciation and willingness to want to build a better trade relationship with American agriculture is already there.

Jim Sutter, CEO of the U.S. Soybean Export Council, says it will be important to help foster growing economies’ development in early-stage markets, especially in the key regions of the Middle East and Southeast Asia.

“I think first and foremost the more we can do just to foster this growing economic activity around the world, that’s a real underlying engine of growth for all U.S. agricultural products and certainly for soy because we’re right there as people want to improve their diets,” Sutter says.

Sutter also says engaging in free trade agreements that can be a win for both countries could also build on U.S. agricultural export success. “Even if you don’t all the way get to a free trade agreement, maybe you just have a strong trading relationship,” he says.

Sutter says India and Africa both have offered glimmers of hope in diversifying new markets for U.S. agricultural goods. For the first time this past year, India imported soybean meal for a few months after it realized it wasn’t going to be able to produce enough to feed its poultry, aquaculture and dairy herd.

Ag exports face headwinds

U.S. agricultural exports face some headwinds. For instance, containerized shipping, which makes up more 35% of the value of U.S. agricultural exports, continues to face disruptions in 2022. Meyer says U.S. containerized agricultural exports to Southeast and East Asia (excluding China) markets have been particularly impacted, with containerized shipment volumes down more than 20% over the second half of 2021.

Despite the record trade year for dairy producers, they were hit significantly by the port issues. When asked what ag exports could have been under normal supply chain conditions, Harden says undoubtedly it would have been higher.

Harden says the playing field is not always level for dairy producers. “It's not always fair. It's not always even. Many of our competitors seem to have a little better, a little more sweetheart deals in certain places that we have to work with,” she explains. “They are non-trade barriers that we have to deal with as well. And often in all of agriculture we feel like we're a pawn sometimes in some of these agreements.”

Meyer notes there are other global uncertainties that could affect the U.S. agricultural trade forecast in 2022. For example, Russia’s invasion of Ukraine could have global economic and trade implications. Together the two countries account for almost a quarter of global grain exports.

“Although we may expect global and regional grain markets to reorient to alternative suppliers and markets which may limit direct effects on U.S. agricultural exports, short-term broader macro effects would reverberate through the global economy depending on the severity and duration of the conflict,” Meyer says.

Sutter also suggests the situation in Ukraine, as well as China, reinforces the need to have a wide diversification of markets. “You can never know. The world is filled with uncertainty,” he says.

Whitley says China remains a concern as any day the country could wake up for whatever reason and stop importing U.S. agricultural goods. “We have to identify and build out some of these new markets we’re talking about so we can be better prepared if that were to come to fruition where the relationship with China go frosty, and we saw our exports cut $35 billion to one market,” Whitley says. “It’s nothing to sneeze at, and it’s not easily replaceable so just making sure we’re prepared to do what we need to do and diversifying if we need to do that.”

About the Author(s)

You May Also Like