Ideally, you should buy cows that would calve during the next cycle peak period and sell as culls near the next peak in cull prices. But when exactly? Harlan looks at the data.

June 12, 2019

This question came up again in a recent phone call. A returning military veteran wants to start a new beef cow herd and asked me when he should buy his cows.

I believe there is a profitable time to establish (or expand) a beef cow herd during the beef cattle cycle, and there is a time to not establish (or not expand) a beef cow herd during the cattle cycle. The most difficult problem is identifying the trigger point as one is going through an existing cattle cycle and its resulting beef price cycle.

I also strongly believe that the startup year is all-important to the financial success of establishing a new beef cow herd. I cautioned my caller to not get started in 2019, as I thought he should at least wait until the end of the current cattle cycle before investing.

In this month’s management study, I am going to buy 100 beef cows and run this 100-cow herd for the next seven years. Each year, some of these females will be culled, so the herd gets smaller each year. Finally, at the end of the seventh calf crop, the remaining cows will be sold as cull cows.

This economic analysis will focus on the cash flow generated over the life span of buying the 100-cow herd and running that herd over seven calf crops.

I will duplicate this study four times for the first four years of the current cattle cycle by purchasing 100 cows in four different studies for the years 2009, 2010, 2011 and 2012. This allows me to do all these analyses with historical cattle prices from 2009 through 2018.

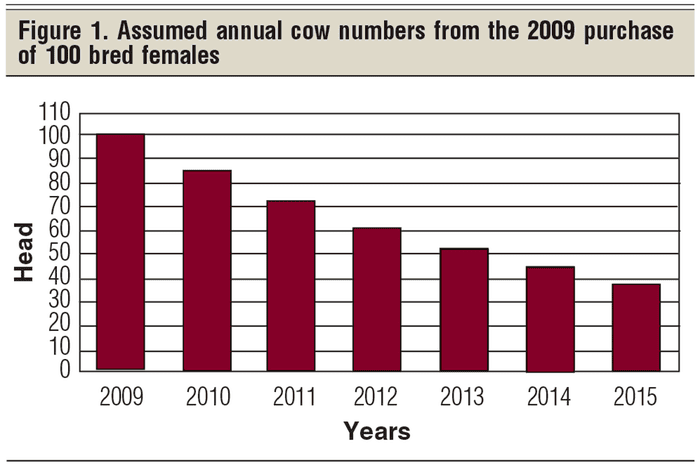

Buying 100 cows in 2009. In 2009, I purchased 100 bred females that will calve in the spring of that year. While I start out with 100 females, each proceeding year there will be some culls for various reasons, so that after seven calf crops, the herd will be reduced to 37 females that are assumed sold as cull cows. In this case, the final cows are sold in 2015 (Figure 1).

I decided to focus on the net cash flow generated from this purchase of these 100 bred females, since I suspect that most ranchers tend to focus on cash flow rather than total economic cost and returns.

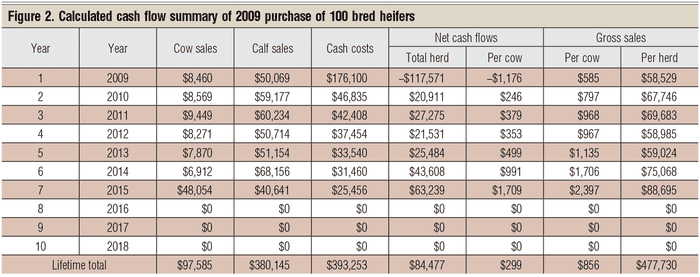

Figure 2 presents my summary cash flow analysis of this 2009 purchase of 100 bred females. The seven-year total for this business adventure is presented in the bottom line of Figure 2. No financing charges for the initial animal purchases are included in this analysis.

Figure 2 illustrates some interesting trends over the projected seven-year life of this study herd. First, remember that cow numbers are going down each year, as open cows are culled and annual death loss is taken into account (Figure 1).

Cull cow sales (Figure 2, third column) changed from year to year based on changing annual cull numbers and changing annual cull cow prices. All live steer calves and heifer calves were weaned and sold annually.

The value of calves sold changed annually, due to fewer calves born each year and changing calf prices. Cash production costs also change due to changes in annual feed prices, including the going v for grassland and changing annual nonfeed production costs.

While one may have a general perception of how costs and returns are changing over time, it is difficult to perceive an accurate account of the interaction of all these items together through time.

A final and critical point: The lifetime cash flow generated with the purchase of a beef cow is based on three price series through time. First is the annual purchase price of the bred heifers. Second is the annual price of the weaned steer or heifer calves sold. Third is the changing annual price of cull cows.

In the current cattle cycle, cull cow prices were the highest in 2014 and 2015. That almost guarantees that the most profitable cows over the cycle had to be calving in 2014 and sold during the high cull cow prices. In this study, the purchase of 100 beef cows in 2010 resulted in selling 37 cull cows in 2015 at relatively high cull cow prices.

Cash flow analysis for purchase of 100 cows in 2010, 2011 and 2012. This same analysis was repeated for the purchase of 100 cows in 2010, repeated again in 2011 and repeated again in 2012. Each year’s herd was assumed to run for seven years, and then all remaining cows in each herd were sold as culls in the seventh year.

Thus, the 2010 herd ran through 2016, the 2011 herd ran through 2017 and the 2012 herd ran through 2018 — the end of my historical prices.

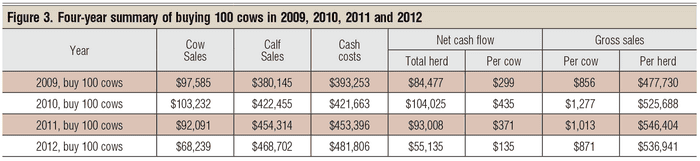

Figure 3 presents a summary by year for the four different purchases of 100 beef cows in the four different consecutive years, 2009-2012. Again, you can see there are considerably different trends in each category in the table.

As expected, the accumulated calf sales went up each year. I would guess this is exactly what my readers would expect. However, cow sales — up and then down, as the years progressed — may not have been anticipated by my readers.

Cash costs of production trended upward, as probably expected. The net cash flow per cow is based on the number of cows in the herd each specific year.

Net cash flow for the herd was highest for cows purchased in 2010. Gross sales per cow were the highest in 2010, but highest for the herd in 2011.

But note that production expenses were higher in 2011 and again in 2012 — maybe not what my readers would have expected. This is why one needs a complete multiyear enterprise cash flow analysis.

Conclusions from this study: The most profitable cows in the current beef cattle cycle (2009 through 2019) were those bred females that had their first calves in spring 2010.

I would further add that logic suggests that the most profitable cows have to be calving during the peak of the beef price cycle (2014 in this cycle). My study supported this. This rules out buying the 100 cows on the downward side of the beef price cycle (years 2015 through 2019).

Let me further generalize by suggesting that the trigger year for the most profitable cows is approximately five years before the cattle cycle price peak. All current projections I am aware of suggest the next cattle cycle is projected to peak around 2026.

So … when should my returning military veteran buy his cows? My answer is, buy the cows to start calving in 2022. These animals would be born in 2020, bred in 2021 and have their first calves in 2022.

These cows should calve during the next cycle peak period and sell as culls near the next peak in cull prices.

Hughes is a North Dakota State University professor emeritus. He lives in Kuna, Idaho. Reach him at 701-238-9607 or [email protected]

About the Author(s)

You May Also Like