There's certain to be lots of uncertainty ahead for the cattle market in the coming months. As always, the trick is to remain objective and stay informed.

April 5, 2012

Cattle feeders held strong last month. Despite lots of bearish noise surrounding the market, sellers persevered and fended off substantial market damage during March. As such, fed trade remained relatively steady throughout the month. Steers/heifers

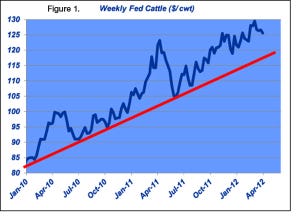

Steers/heifers  were priced mostly $125-$127/cwt. throughout the month with exception of the $129 mark as March opened for business (Figure 1).

were priced mostly $125-$127/cwt. throughout the month with exception of the $129 mark as March opened for business (Figure 1).

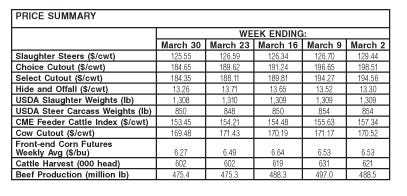

Packers haven’t fared nearly as well. The Choice cutout (Figure 2) is now trading sub-$185. That's the lowest level since January and sharply lower compared to February’s mid-to-upper $190 level. The fed cattle vs. cutout discrepancy highlights challenges to packer profitability as the plague of negative weeks lingers on.

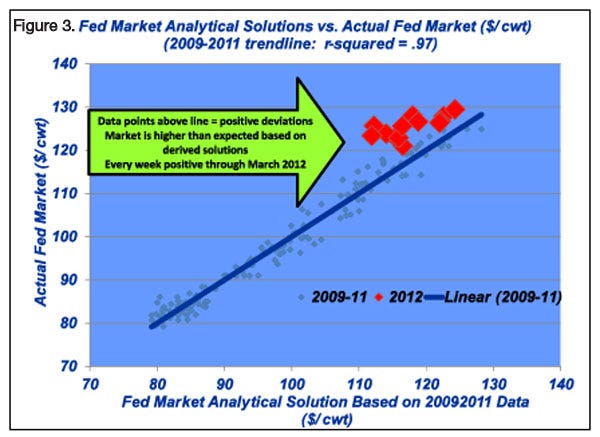

To provide some context around the market, several key illustrations are provided. These graphs are developed from data analysis solutions over the previous three years (2009-2011). The analytical model includes weekly price determinants and explains over 97% of weekly fed price variation. The solutions are then extrapolated to 2012 and represented in two separate manners.

Figure 3 depicts actual vs. predicted fed price action for 2009-2011 and 2012, respectively. It reveals 2012 weekly deviations vs. the previous three years. As alluded above, to date, the fed market in 2012 has outpaced expectation based on the previous three years. F

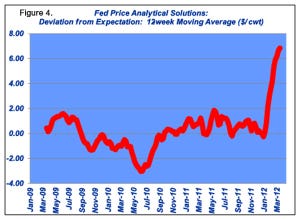

Figure 3 depicts actual vs. predicted fed price action for 2009-2011 and 2012, respectively. It reveals 2012 weekly deviations vs. the previous three years. As alluded above, to date, the fed market in 2012 has outpaced expectation based on the previous three years. F igure 4 represents the data solutions over time (and extrapolated through March 2012) to provide some additional perspective.

igure 4 represents the data solutions over time (and extrapolated through March 2012) to provide some additional perspective.

What about the outlook from here? The futures market pretty well tells that story. Cattle have been pummeled with the June contract now on the cusp of $115 (from $128 just a month ago). Traders are focused on several key factors. Specifically, futures are anticipating trading leverage will rotate from the feeding sector to the packer. Seasonally expanding feedyard supply in the coming weeks will facilitate that shift.

Stated another way, the CME is betting that the trend thus far in 2012 will swing the other way in favor of the packer. Commodity markets are inherently a zero-sum game and therefore typically seek balance over time. The outcome being that relative over-performance to date could translate to relative under-performance in weeks/months to come.

That principle was underscored in my column last month: “…the market is subject to unraveling fairly quickly if: 1) the consumer begins to push back, and/or 2) front-end supply becomes sufficiently large to erode feedyard bargaining leverage. If those factors manifest themselves, the situation could be self-reinforcing.” Unfortunately, they’ve both arrived and the culmination appears to be disruptive for the cash market going forward.

Most troubling of all, consumer pushback did appear but not because of price resistance; rather it resulted from the media’s distortion around lean finely textured beef (LFTB). (Read more on LFTB here.) The firestorm underscores the perpetual need to manage risk – not just financially, but also from an image standpoint. Increasingly, the food business needs to overcome confusion within the general public about the food they eat.

So the market has cattle feeders holed up, trying to fight for another day, but potentially running out of ammunition. They’re facing the reality of softer prices coupled with a sharply volatile grain complex during the summer. In the absence of price protection, that makes for some ugly closeouts.

That influence is quickly translated back upstream into the feeder market. Sure, the feedyard sector is likely to get some relief on the corn side going into the new crop. But that probably won’t be enough to gain back lost margin.

There will be some broader hesitancy to make pricing decisions for fall delivery at these levels – or at least until some of the bearish uncertainty has been removed from the market. CME’s October feeder cattle contract has correspondingly moved lower in the past 30 days.

Lastly, USDA provided the grain markets a couple of good jolts at the end of March. First, corn stocks came in lower than forecasted. But the real story might actually reside within the soybean complex as acreage was pegged under pre-report estimates. The market has work to do and will aggressively try to buy acres away from corn’s huge planting objective.

There's certain to be lots of uncertainty ahead for the coming months – let the volatility begin. As always, remain objective and stay informed!

Nevil Speer is a Western Kentucky University professor of animal science. Contact him at [email protected].

About the Author(s)

You May Also Like