BEEF readers hang tough in 2019

Despite myriad challenges inside and outside of the beef business, BEEF’s annual State of the Industry survey shows readers see brighter days ahead.

While the time-honored phrase “Keep a stiff upper lip” from the mother country across the pond certainly applies to ranching, maybe “Keep upturned lips in the face of who knows what’s next” is a better description of how BEEF readers view their situation.

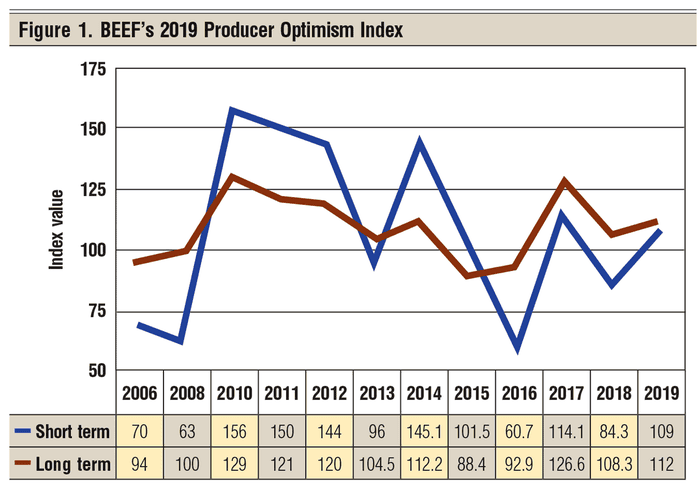

That’s one of many takeaways from BEEF’s annual State of the Industry survey. In spite of what 2018 and so far, 2019, has thrown at them, in the main, BEEF readers see the positive instead of the negative (Figure 1).

Scott Grau, Farm Progress research guru, finds it interesting that producers are still positive given current market conditions. “I think they tend to take a longer-term outlook. This has to be due to the nature of the beef industry as a whole; everything takes time other than dispersal, so they have to be looking beyond today’s prices.” Grau has conducted all BEEF State of the Industry surveys.

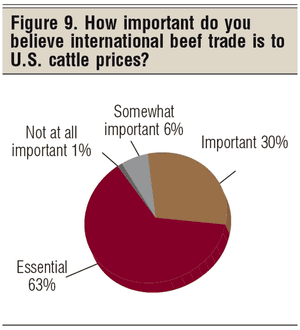

He says respondents who are more optimistic in both the short term and long term see three factors contributing to their positive outlook: international demand, supply and demand fundamentals, and domestic demand.

“The international demand seems to be based two factors: the continued outbreak of African swine fever; and the expansion of the middle class in developing countries who are looking for quality protein sources, so beef can see opportunities,” he says.

“The supply-demand fundamentals may be partially based on how the widespread and severe devastation, with this year’s flooding and blizzards, affects the cow herd and calf production.”

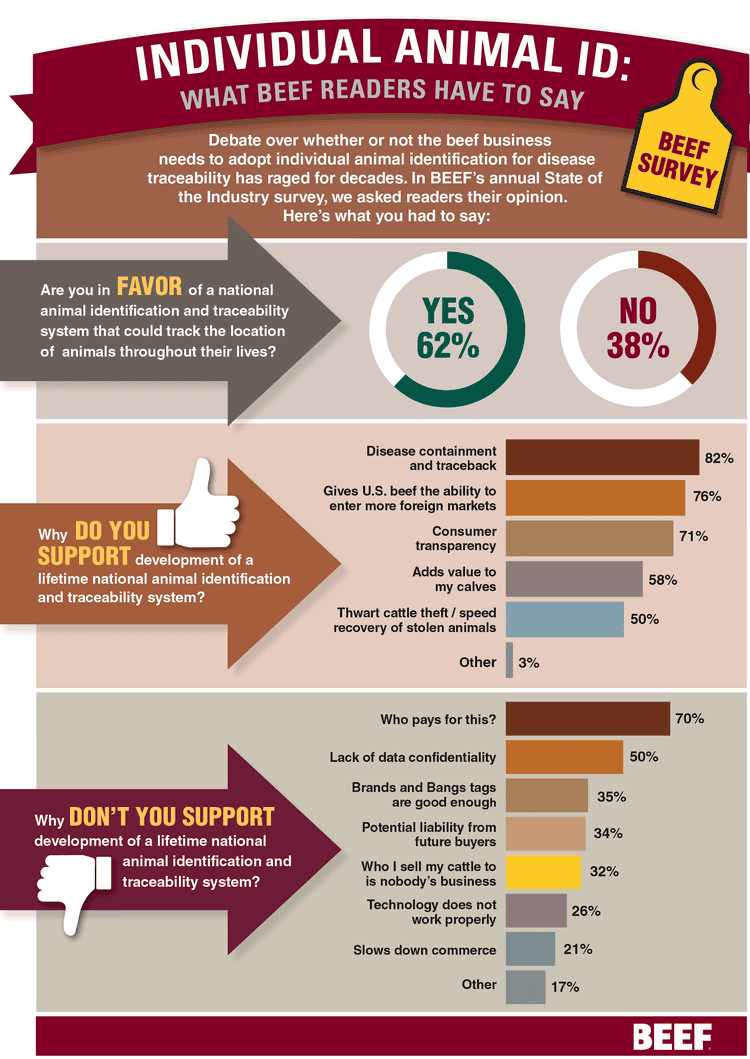

Domestic demand is most likely tied to the fundamentals, he says. “I think the domestic demand may also be tied to talk about any potential traceability program. It seems like many respondents feel if there is a traceability program in place, it is also a COOL [country of origin labeling] program, or it wouldn’t too much of a leap to implement that, too.

“In my 22 years of working with BEEF magazine I’ve very seldom seen a consensus of producers or readers who are real negative about their prospects. Now, this doesn’t mean we always get positive feedback from everyone, but the trends are more positive than not,” Grau summarizes.

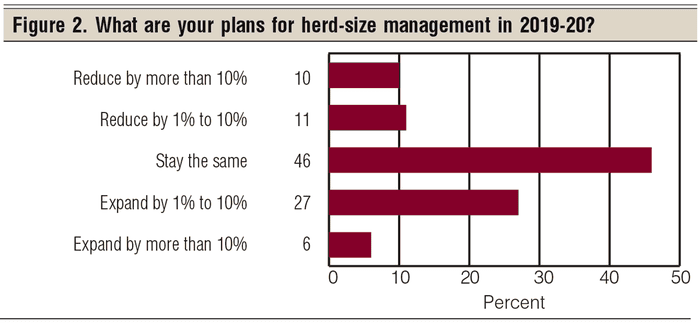

While our Producer Optimism Index shows a positive outlook graphically, based on how readers answered questions in the survey, perhaps the best way readers showed their bright outlook is through their plans for herd-size management (Figure 2).

While 46% say they’re at the numbers they want and plan to stay the same, 27% plan to expand by 1% to 10%, and 6% plan to expand by more than 10%. However, a fair number plan to cut back—11% say they’ll trim numbers by 1% to 10% and 10% say they’ll cull by more than 10%.

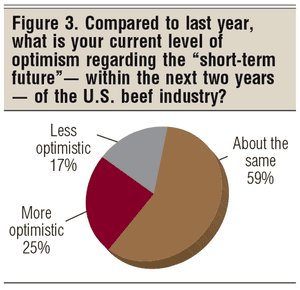

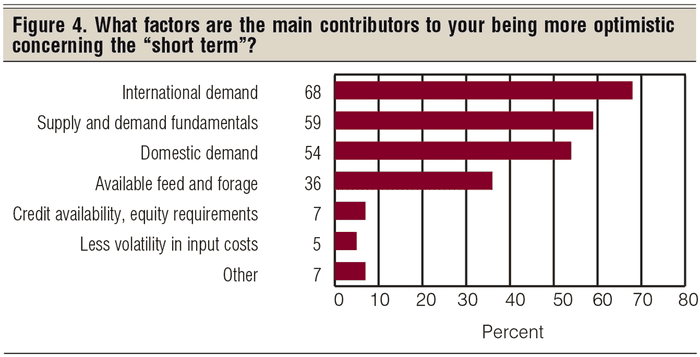

Of those readers who are more optimistic about the next two years, 68% see international demand for beef as the top reason, followed by supply and demand fundamentals at 59%. Domestic demand at 54% rounds out the top reasons for more optimism (Figure 4). All results in the survey where the numbers add up to more than 100% reflect multiple answers.

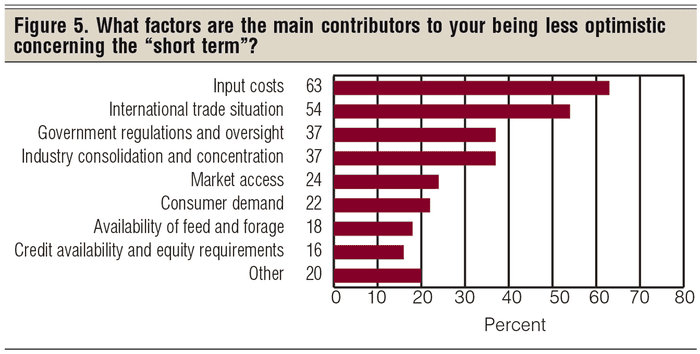

Of the readers who are less optimistic about the short-term future, 63% checked input costs as their greatest concern. That was followed by the international trade situation at 54%; and government regulations and oversight, along with industry consolidation and concentration, at 37% each as the top concerns (Figure 5).

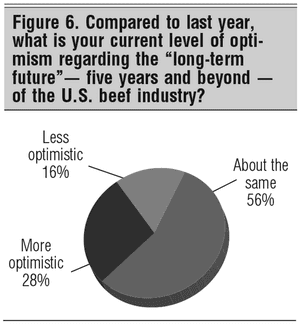

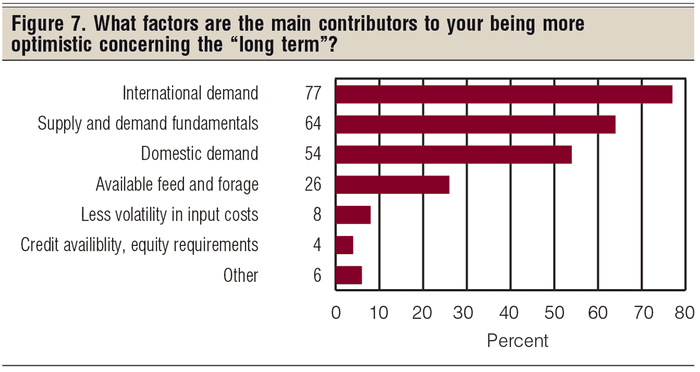

The potential for beef demand is top of mind among those who see a brighter future for beef. Of the readers who are more optimistic than last year for the long-term future of the beef business, the prospects for increased international demand for U.S. beef again ranked first at 77% (Figure 7).

That was followed closely by supply and demand fundamentals at 64% and domestic demand at 54%. Prospects for better availability of feed and forage at 26% rounds out the top reasons for greater optimism.

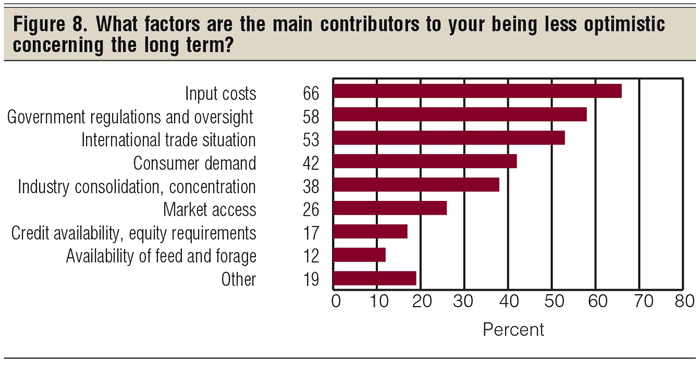

On the flip side, those who are less optimistic about the long term say input costs, at 66%, is their greatest concern. That’s followed by government regulations and oversight at 58%; the international trade situation at 53%; consumer demand at 42%; industry consolidation/concentration at 38% and; market access at 26%, among others (Figure 8).

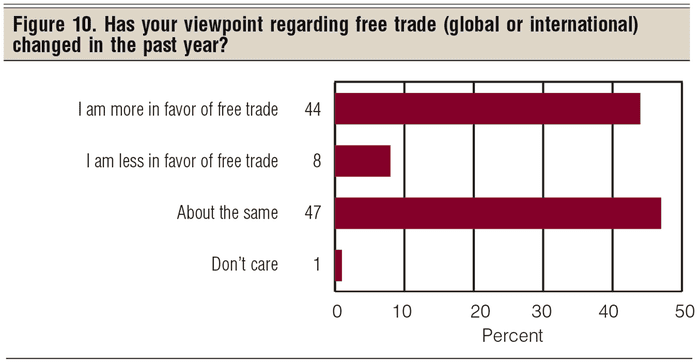

Correspondingly, respondents view international trade in a better light than last year. When asked, “Has your viewpoint regarding free trade changed in the past year?,” 44% say they are more in favor while 47% say about the same. Only 8% are less in favor of free trade. (Figure 10).

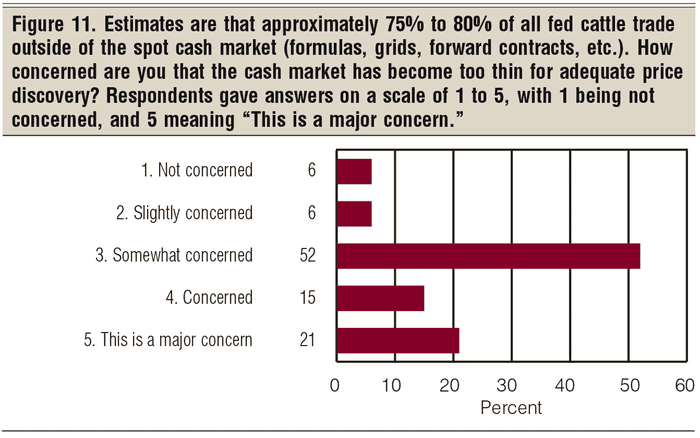

Consolidation and concentration in beef and cattle production is an ongoing trend as well as an ongoing concern. Indeed, a strong majority of survey respondents — 88% — express some degree of concern, ranging from 52% who are somewhat concerned to 21% who say it is a major concern (Figure 11). This is a trend to watch as cattle and price cycles continue to fluctuate.

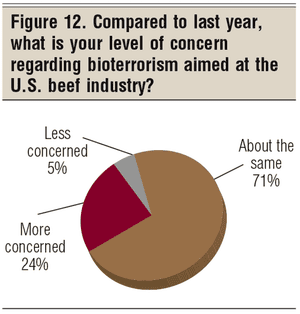

Another industrywide concern are the activities of anti-beef activists and potential terrorism. Indeed, survey results show that BEEF readers are thinking about the possibilities.

When asked “Compared to last year, what is your level of concern regarding terrorism aimed at the U.S. beef industry?,” 24% say they are more concerned, while 71% say their level of concern is about the same. Only 5% are less concerned (Figure 12).

Following up on that question, we asked, “Compared to last year, what is your level of concern regarding domestic terrorism and animal activism?” There, concern is heightened, with 45% saying they are more concerned and 52% saying their concern is about the same. Only 3% are less concerned than last year (Figure 13).

Following up on that question, we asked, “Compared to last year, what is your level of concern regarding domestic terrorism and animal activism?” There, concern is heightened, with 45% saying they are more concerned and 52% saying their concern is about the same. Only 3% are less concerned than last year (Figure 13).

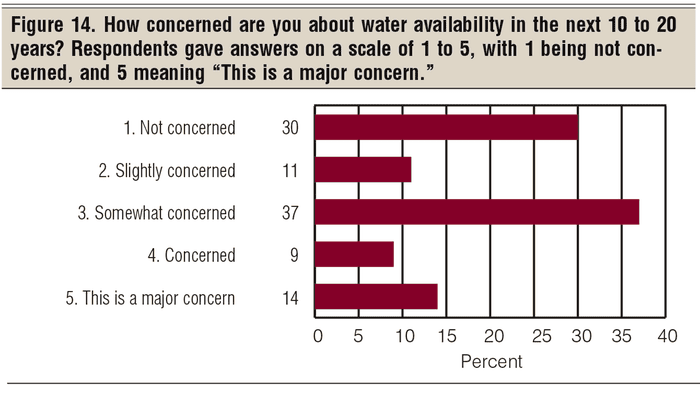

And finally, while 2018-19 might not be the best time to discuss water availability, that issue is still a long-term concern that faces all agricultural producers. We asked, “How concerned are you about water availability in the next 10 to 20 years?” (Figure 14). On a scale of 1 to 5, 60% express some degree of concern, ranging from 37% who are somewhat concerned to 14% who say this is a major concern. However, 41% of respondents show little to no concern with 30% who are not concerned at all and 11% coming in just above that.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)