BEEF’s 2020 State of the Industry survey shows producers are singing the coronavirus blues.

What a difference a year makes. A year ago, BEEF readers were looking forward to better prices, better times and bigger herds. Just 12 short months and a little bitty virus later, the outlook is decidedly different.

That’s the bottom line from BEEF’s annual State of the Industry survey. In the up and down world of the beef business, 2020 will very likely be remembered as the “COVID Crash.”

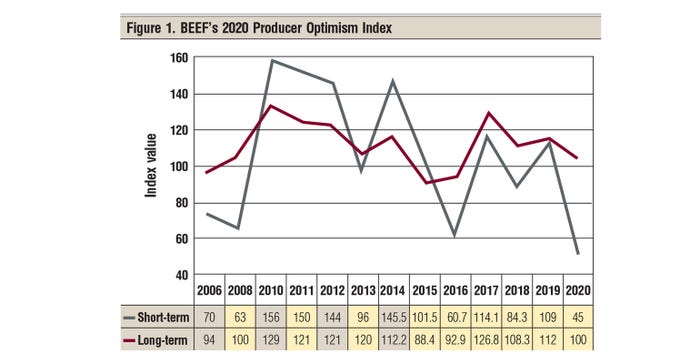

A glance at Figure 1, BEEF’s Producer Optimism Index, tells the tale of woe. Short-term optimism is at its lowest point since the index began in 2006. Long term, however, while still down from last year, BEEF readers show the optimism that is part and parcel of being in the beef business.

Indeed, we’ll get through this, and better days are ahead — even though this rough patch is the roughest beef producers have yet to encounter.

With COVID-19 very much the main topic of conversation, there are many issues swirling around it that have beef producers uncertain and tied in knots. The survey was conducted in late April and early May, so we could discern your latest thoughts on the coronavirus.

COVID-19 effects wide-ranging

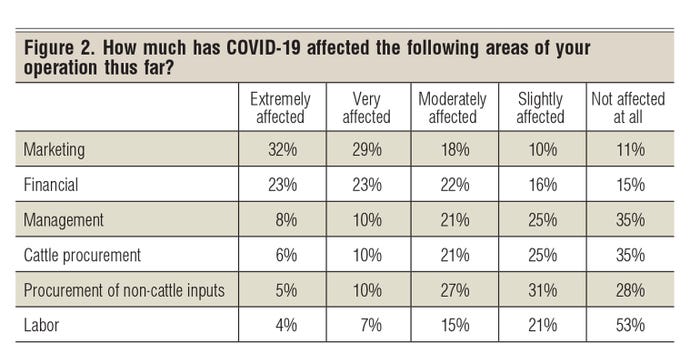

As such, we asked how much COVID-19 had affected you thus far. Given the market gyrations that producers have endured, marketing and financial aspects top the list.

But those who indicate that the marketing and financial aspects of their operation weren’t severely affected still had cause for concern, indicating more difficulty in labor, procuring cattle and non-cattle inputs (Figure 2).

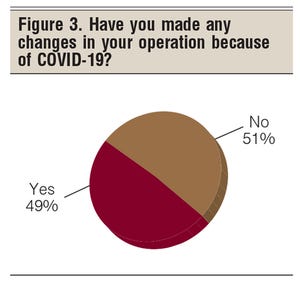

What’s more, when we asked if any management changes were made as a result of the coronavirus, it was almost an even split between beef producers who responded to the survey (Figure 3).

There were ample and wide-ranging comments from those who have made changes in their operation — most having to do with marketing and social distancing.

Another is looking to integrate forward. “Developing a business model for direct-to-consumer meat sales. Started a co-op of diverse parties to study the start of a regional beef processing plant for members of the co-op who seek direct-to-consumer opportunities but lack processing, packaging and freezer assets.”

Comments were equally ample for those who haven’t made any significant changes, mainly revolving around the fact that they haven’t found any need to do so.

“Cows are calving and breeding season is around the corner,” one commenter said. “Due to gestation length and time required to grow calves, there is a long timeline between now and the next calf crop being ready for sale.”

Another is talking about how to ride the storm for the next two years. “Don’t think we know what the longer-term impacts are just yet. One change — ramping up local marketing activities for selling ground beef direct to consumers. Will try to use all our cull cows in this program.”

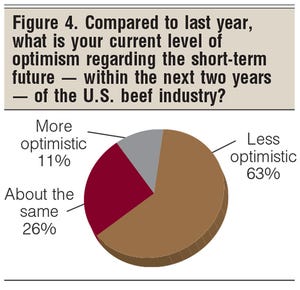

Turning attention back to the general mood in cow country, we asked readers about their short-term optimism for the beef business. As you would expect, the majority — 63% — are less optimistic than a year ago. However, 26% are about the same, and 11% think it will be better (Figure 4).

That’s a significant change from 2019. A year ago, 25% of respondents were more optimistic for the short term, while 59% were about the same and 17% were less optimistic.

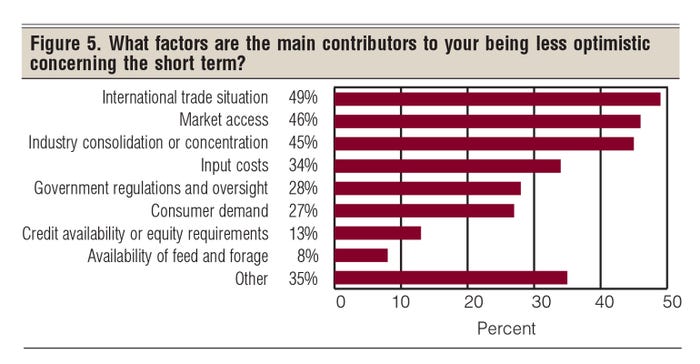

When asked about factors that make them less optimistic, the majority, at 49%, are concerned about the international trade situation. That was followed by market access at 46% and industry consolidation or concentration at 45% (Figure 5). The numbers add up to more than 100% because of multiple answers.

However, 35% indicated other reasons. They were mainly — you guessed it — COVID-19 and the effect it is having on the beef business.

Industry still optimistic

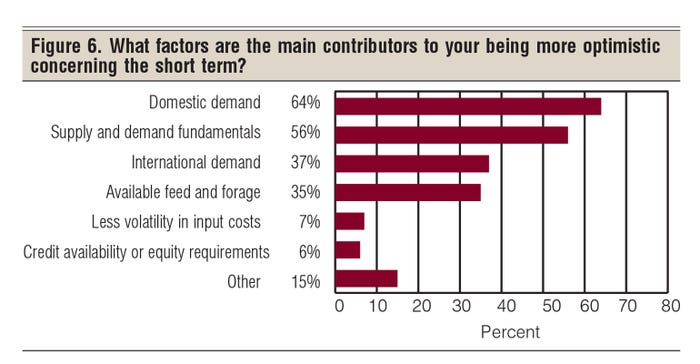

But optimism springs eternal in the beef business, and the 11% who are more optimistic about the short term had their reasons. The two that topped the list both deal with the fact that people have to eat; and given the opportunity, they’ll eat beef. Domestic demand rang in at 64% and supply and demand fundamentals came in 56% (Figure 6).

“Can’t go anywhere but up,” one reader observed. Several others mentioned an ongoing theme during the COVID Crash. “Unique opportunities created by self-isolation during COVID: i.e., direct sales to consumers, consumers seeking to buy from reputable producers.”

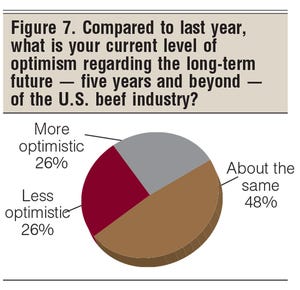

Looking at the long term, BEEF readers see better times ahead, defined as five years or beyond, for the beef business. Of those who responded to the survey, 26% are more optimistic about the long-term future for their business, 48% are about the same and 26% are less optimistic (Figure 7).

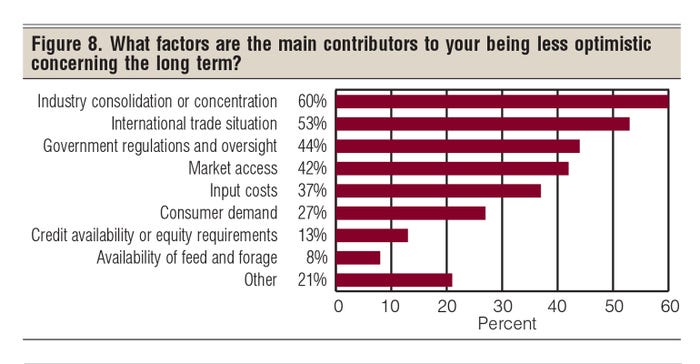

For those in 2020 who are less optimistic about the long-term future of the beef business, 60% cite industry consolidation or concentration as their main worry. After that, 53% see the international trade situation as a concern, followed by government regulations and oversight at 44% and market access at 42% (Figure 8).

Those who are less optimistic about their long-term future mention supply and demand factors, and the need for more packers, and are concerned about how long it will take the economy to recover from COVID-19.

“Beef is a healthy, viable protein for people looking for a better diet,” one reader said. “Virus should be gone or under control,” another offered.

“Perhaps I’m overly focused on the market disruption by COVID-19, but beef has weathered other black swan events,” another wrote. “I believe folks will enjoy the fruits of their hard work through beef again someday.”

About the Author(s)

You May Also Like