Beef Market Stokes 11% Appreciation In Pasture Value

Pasture appreciation rates outpace cropland for the first time since 2009’s economic downturn.

October 7, 2014

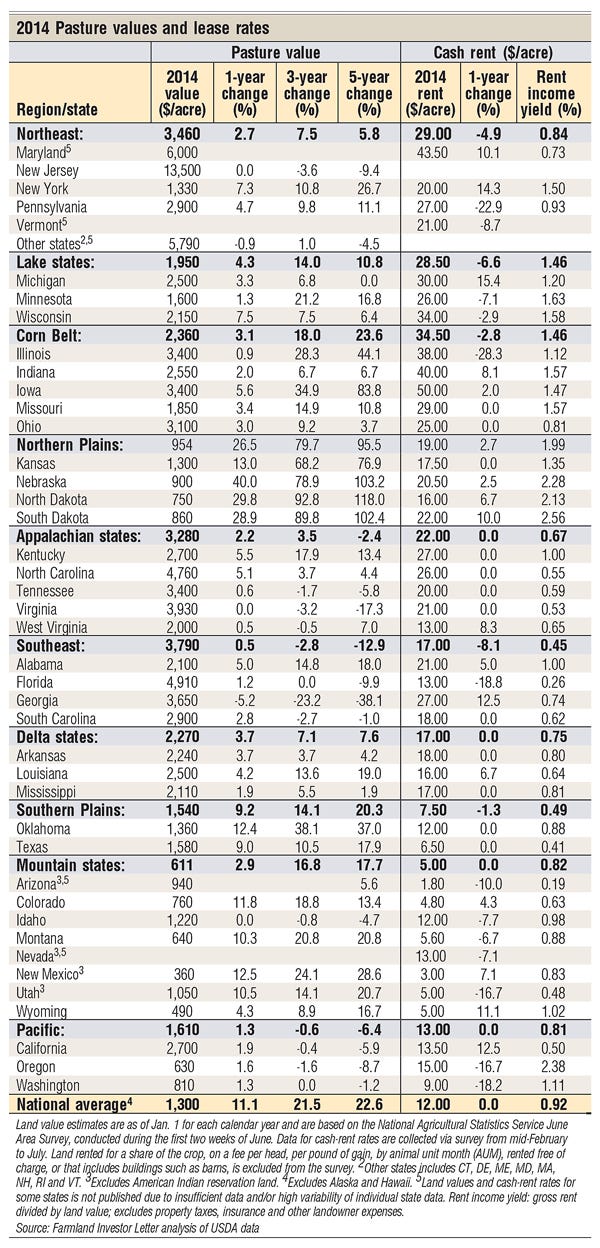

The average value of U.S. pastureland swelled 11% through the start of this year to $1,300/acre, according to USDA. That’s another new nominal high, and well ahead of the formerly blistering cropland market, where values rose 7.6%.

This is the first year that pasture appreciation rates have outpaced cropland since the 2009 economic downturn, when U.S. pasture values fell 2.8%, vs. a 4.3% decline for cropland. Pasture prices are being pulled higher by a combination of record-high cattle prices, low interest rates and continued low returns from competing investments.

Wonderful asset-builder

“Pastureland has been a wonderful asset-builder since it has doubled in the last five years,” notes Richard Griffin, with Griffin Real Estate and Auction Service in Cottonwood Falls, KS. “But leasing it out is still a poor cash flow.”

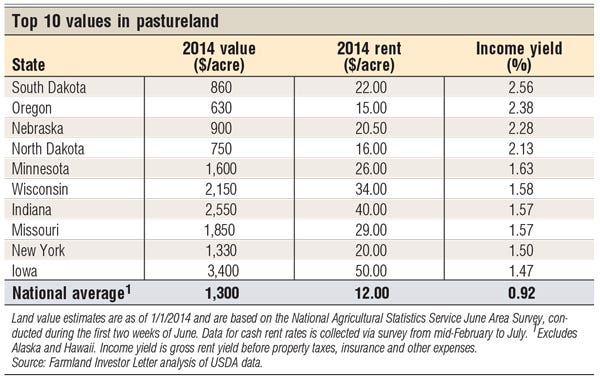

Indeed, with pasture lease rates holding flat, the average rent-to-value yield has dropped to 0.92%, or less than the 1% rate available for a riskless one-year bank certificate of deposit.

With the cattle sector enjoying robust profits — cow-calf producers are likely to clear a record profit of $400-plus/calf this year — market participants expect pasture values to continue to rise as producers seek to gain control of grass to expand their herds.

Regionally, pasture value changes continue to vary widely. The Northern Plains remains the most heated market, where pasture prices soared 27% this year, on top of an 18% gain last year and 22% jump in 2012. Pasture values in this region — which includes the Dakotas, Kansas and Nebraska — continue to be pulled up by the combination of the run-up in cropland values, demand for grass, and North Dakota landowners flush with shale oil lease and royalty payments from the Bakken formation. Collectively, Northern Plains pasture values have soared 96% in the last five years — four times the 24% rise in the Corn Belt, the next highest five-year regional gain.

In North Dakota, pasture values spiked nearly 30% to an average $750/acre. The gain surpassed the 17% rise in North Dakota cropland values. This suggests buyers may have bid up pasture tracts in an arbitrage play to convert pasture parcels to row-crop production, where crop parcels are worth an average $2,050/acre.

In South Dakota, native rangeland values rose nearly 9% to $987/acre for the year through the Feb. 1 period, less than half the prior year’s 23% pace, according to South Dakota State University. Tame pasture values climbed 4% to $1,603/acre — less than one-sixth the prior year’s 27% jump.

Subscribe now to Cow-Calf Weekly to get the latest industry research and information in your inbox every Friday!

Elsewhere, pasture values rose mostly in the single digits on a year-over-year basis, ranging from 9% in the Southern Plains and 4% in the Lake and Delta states, to 3% in the Corn Belt, Northeast and Mountain regions.

Pasture prices in the Southeast appear to have ended a five-year slide, in which values deflated 25% from $5,040/acre in 2008 to $3,770/acre in 2013. For the 12 months through Jan. 1, 2014, pasture values edged up 0.5% to an average $3,790/acre.

Inflating ranchland values

Surveys of market conditions through this year’s first half indicate that ranchland values are generally continuing to inflate at a high single-digit pace across the Mid-South, Southeast and West-Central Plains.

At the close of June, pasture prices in Alabama, Florida and Georgia were up an average 3% from a year ago, according to Mid-South/Southeast Farmland Market Trends, a quarterly survey.

Midyear Federal Reserve surveys report that pasture values are up 7% to 10% from a year ago across Kansas, western Missouri, Nebraska and Oklahoma.

In Kansas, bluestem pasture is fetching $1,500-$2,000/acre in the Flint Hills, with good grass bringing $2,000-plus/acre, Griffin says. He recently sold two 900-acre tracts in Chase and northern Butler counties via private treaty sales at $2,050/acre.

But Griffin wonders if falling corn prices will pressure grass prices, since many pasture buyers are also farmer-feeders. As corn approaches $3/bu., these farmers may start to pull back from the grass market and simply opt to feed cheap corn, he reasons.

Moving west, ranchland values averaged $520/acre at midyear across Colorado, New Mexico and Wyoming. That’s up 19% from a year ago, according to Federal Reserve data.

In Texas, ranchland values are rising at a 6% pace; buyer demand is strongest in south and central Texas, where values are up 20% and 16%, respectively, year over year, according to the Federal Reserve Bank of Dallas. Central Texas ranchland values continue to be pushed by landowners looking to reinvest energy lease and royalty payments from the Eagle Ford shale play.

In the North Central region, pasture values were up 4% for the 12 months through June, according to the Federal Reserve Bank of Minneapolis. Prices range from an estimated $481/acre in Montana and $633 in North Dakota to $2,083 in Minnesota, $2,197 in South Dakota, and $2,350 in Wisconsin.

Pasture rents hold steady

Pasture rents generally held steady across the U.S. as fewer cattle competed for grass following a string of drought-fueled herd liquidations. Moisture conditions have improved from a year ago — just 20% of pasture in the mainland U.S. was in poor or very poor condition at the end of August. That’s the lowest level in 15 years. But drought still persists across the West and the Central and Southern Plains, home to about 37% of the U.S. beef cowherd.

Texas, the biggest cattle production state, is down 1.2 million head from five years ago, notes Ronald Plain, a University of Missouri Extension economist.

Regionally, pasture lease rates were flat or declined everywhere except the Northern Plains, where rents edged up an average of 2.7% to $19/acre.

With drought receding in the Central Plains and cow-calf producer margins at record highs, rent increases are on the way. In Nebraska, the Board of Educational Lands and Funds, which oversees 982,000 acres of pasture across the state, plans to hike pasture lease rates by 15% to 20% in 2015, up from a 5% to 10% increase this year.

Surveys through this year’s first half indicate that pasture rents are up an average of 10% from a year ago across the West Central Plains, while rates have climbed 11% in the Mountain states of Colorado, New Mexico and Wyoming. Ranchland lease rates range from $73/acre in Nebraska to $56/acre in western Missouri, $24/acre in Kansas and $19/acre in Oklahoma. They average $17/acre across Colorado, northern New Mexico and Wyoming, according to bankers surveyed by the Federal Reserve Bank of Kansas City. Texas ranchland rents averaged $12.20/acre at midyear, up 1.7% from a year ago, according to the Dallas Fed.

In the North Central U.S., pasture lease rates at midyear ranged from up 10% in the northern half of Wisconsin to down 14% in Minnesota, according to the Federal Reserve Bank of Minneapolis. Rents averaged $82/acre in Minnesota, $56/acre in South Dakota, $20/acre in North Dakota, and $65/acre in Wisconsin.

Across the Mid-South and Southeast, pasture rents average $63/acre in Missouri, $61/acre in Florida, $48/acre in Georgia, $42/acre in Tennessee, $35/acre in Alabama, $33/acre in Arkansas and Louisiana, and $27/acre in Mississippi, according to the second-quarter Mid-South/Southeast Farmland Market Trends survey.

In Indiana, pasture lease rates rose 12% in 2014 to an average of $105/acre statewide, ranging from $48/acre in the southeast to $162/acre in west-central Indiana, according to a June survey by Purdue University. Lease rates for established alfalfa/alfalfa-grass hay ground average $194/acre, and range from $102/acre in the southeast to $256/acre in west-central Indiana. Grass hay rents average $150/acre, with a range of $55-$216/acre.

Michael Fritz is editor and publisher of Farmland Investor Letter. Reach him at [email protected] or visit farmlandinvestorcenter.com.

You might also like:

Should You Be Worried About Cattle Ingesting Net Wrap?

15 New Products From John Deere

Are You A Candidate For Cowherd Expansion?

Best Tips For Working Cattle In Cold Weather

Meet A Nebraska Couple That Practices What They Preach At Family Feedlot

Probiotics Vs. Antibiotics? Which One Wins Out For Cattle Health

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)